Cryptocurrency mining has exploded in popularity, but many entrepreneurs struggle with the complex tax implications. The IRS treats mining rewards as taxable income from the moment you receive them.

We at Bette Hochberger, CPA, CGMA see mining operators making costly mistakes with crypto mining taxation every tax season. Understanding proper reporting requirements and available deductions can save thousands in penalties and missed opportunities.

How the IRS Taxes Your Mining Rewards

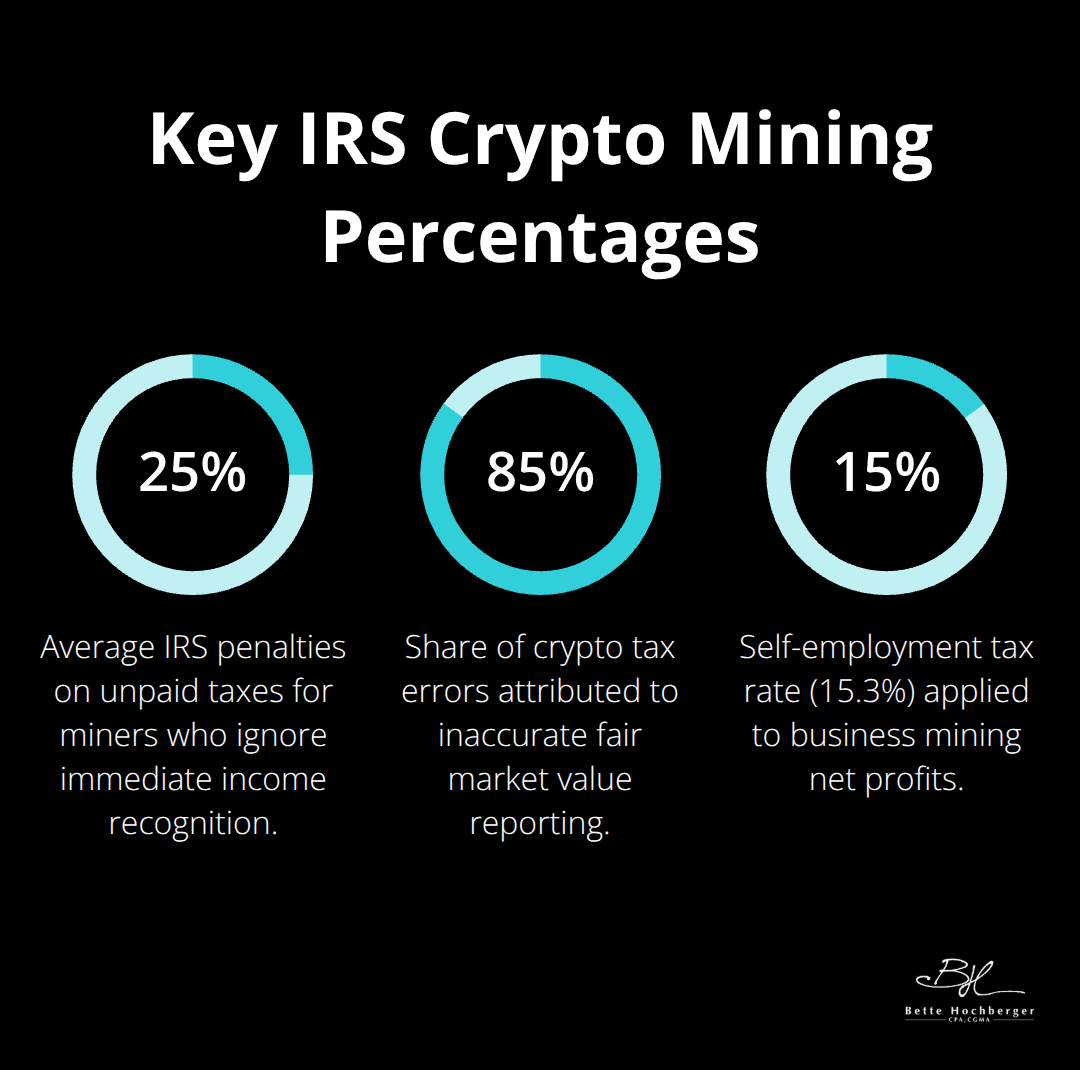

The IRS classifies cryptocurrency mining rewards as ordinary income the moment they hit your wallet, not when you sell them. This means if you mine 0.1 Bitcoin worth $4,200 on January 15th, you owe taxes on that $4,200 as regular income for that tax year. Federal income tax rates range from 10% to 37% based on your bracket, which makes timing absolutely critical for tax planning. Mining operators who ignore this immediate tax obligation face penalties that average 25% of unpaid taxes plus interest that compounds monthly.

Fair Market Value Documentation Standards

The IRS requires precise fair market value calculations that use reputable exchanges at the exact time you receive mining rewards. CoinGecko and CoinMarketCap provide acceptable pricing data, but you must document the specific timestamp and exchange rate used. Mining pools that distribute rewards throughout the day create multiple taxable events, each one requiring separate valuation. Smart miners use automated tracking software like Koinly or CoinTracker to capture real-time pricing data, as manual calculations become impossible with frequent payouts. The Treasury Department estimates that 85% of crypto tax errors stem from inaccurate fair market value reporting.

Mining Activity Record Requirements

Detailed mining records protect you from IRS audits and maximize available deductions. Document every reward received with date stamps, coin quantities, USD values, and the mining pool or solo mining details. Track all mining-related expenses including electricity bills, equipment purchases, repairs, and dedicated internet costs. The IRS treats cryptocurrencies as property, meaning that any gains or losses from trading or selling them are subject to capital gains taxes. Mining businesses must also track equipment depreciation using Modified Accelerated Cost Recovery System schedules, with most hardware qualifying for 5-year depreciation periods under current tax law.

Business vs. Hobby Classification Impact

The IRS distinguishes between hobby miners and business miners, which dramatically affects your tax obligations and deduction opportunities. Business miners report income on Schedule C and can deduct all ordinary and necessary expenses, while hobby miners report income as “Other Income” with limited deduction options. The IRS considers factors like profit motive, time spent, and expertise level when making this determination. Business classification also subjects you to self-employment taxes (15.3% on net profits), but the additional deductions often offset this burden for serious operations.

These classification rules directly impact how you report crypto income to the IRS and which forms you must file.

Tax Deductions and Business Expenses for Mining Operations

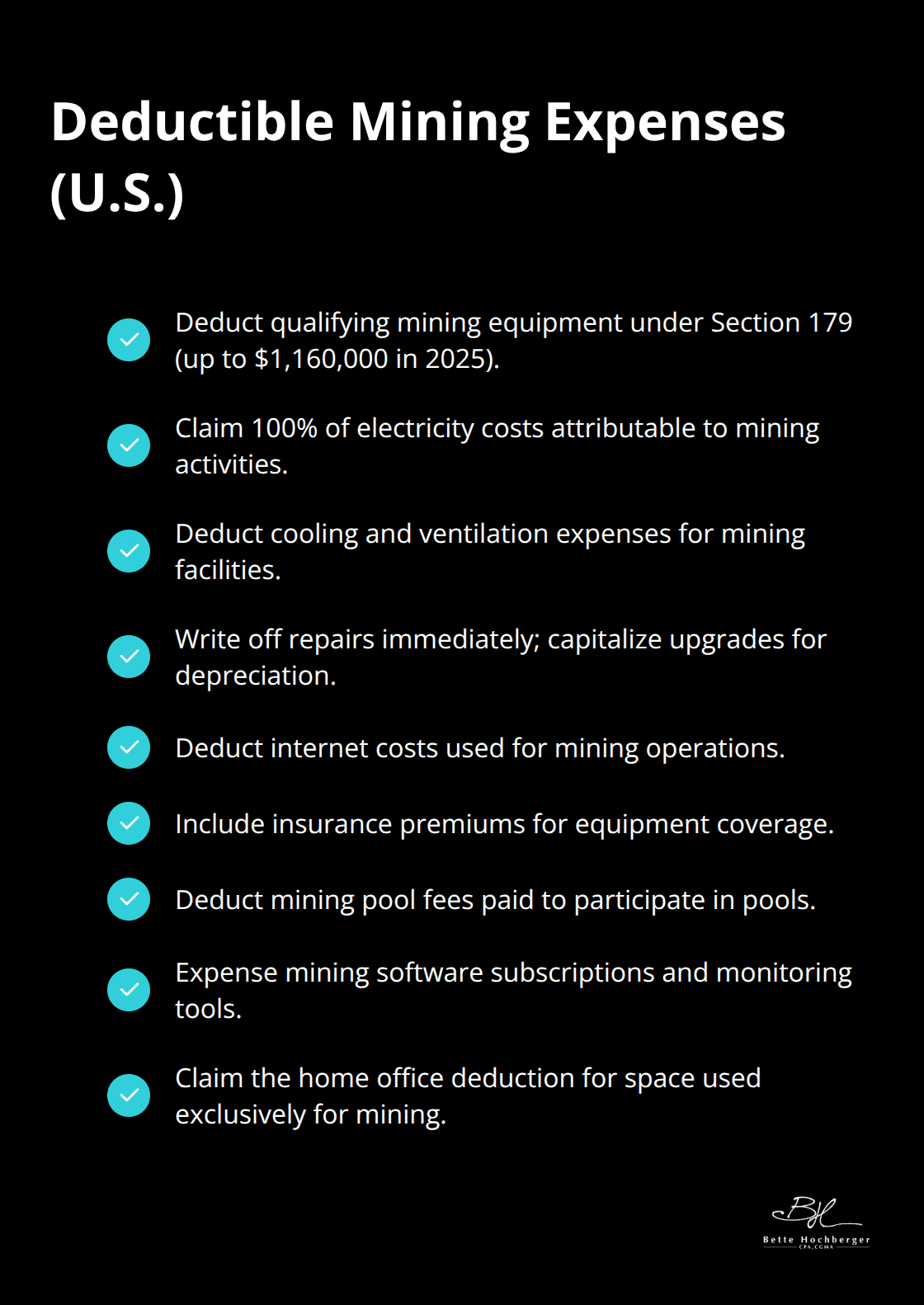

Mining operations generate substantial business expenses that dramatically reduce your tax liability when you properly document and claim them. Section 179 expensing allows miners to deduct up to $1,160,000 for qualifying mining equipment in 2025, which includes ASIC miners, GPUs, cooling systems, and supporting infrastructure. Mining hardware typically qualifies for 5-year depreciation under MACRS, but Section 179 lets you expense the entire cost immediately rather than spread it over five years. Electricity costs represent the largest ongoing expense for most operations, with commercial miners averaging $0.13 per kWh according to recent market data.

Equipment Purchase and Depreciation Options

Mining equipment loses value rapidly due to technological advancement and network difficulty increases. ASIC miners typically become unprofitable within 2-3 years, which makes immediate expensing under Section 179 more advantageous than traditional depreciation schedules. GPU miners benefit from equipment flexibility since graphics cards retain resale value for gaming and other applications. Repair costs qualify as immediate deductions while equipment upgrades must be capitalized and depreciated. Mining facilities also qualify for depreciation including electrical infrastructure, ventilation systems, and dedicated mining spaces.

Electricity and Utility Expense Claims

Mining businesses can deduct 100% of electricity costs directly attributable to mining activities, but mixed-use situations require careful allocation between personal and business usage. Smart miners install separate electrical meters for mining operations to simplify expense tracking and strengthen audit defense. Commercial electricity rates often provide better per-kWh pricing than residential rates, making dedicated mining facilities more tax-efficient. Cooling costs during summer months can double electricity expenses, but these additional costs remain fully deductible for business operations.

Home Office and Operational Deductions

Home-based mining operations can claim home office deductions using either the simplified method at $5 per square foot up to 300 square feet, or actual expense method based on percentage of home used exclusively for mining. Internet costs, insurance premiums for equipment coverage, and mining pool fees all qualify as deductible business expenses. Professional miners often overlook smaller deductions like mining software subscriptions, hardware monitoring tools, and educational resources that total several thousand dollars annually.

These deduction strategies directly impact how you report your mining income and which tax forms you must file with the IRS.

Reporting Mining Income on Tax Returns

Mining entrepreneurs face critical decisions that directly impact their tax liability and audit risk. Business miners must file Schedule C to report income and expenses, while hobby miners report income on Schedule 1 Form 1040 as other income with severely limited deduction opportunities. The IRS classification determines whether you pay self-employment taxes at 15.3% on net profits, which applies only to business operations. Schedule C filers can deduct all ordinary business expenses (equipment costs, electricity, repairs, and home office expenses), while hobby miners face the harsh reality of taxes on gross income with minimal expense offsets.

Business vs. Hobby Classification Impact

The difference between Schedule C and Schedule 1 creates massive tax variations that can cost miners thousands annually. Business miners report gross income but subtract all legitimate business expenses to arrive at net profit subject to both income tax and self-employment tax. Hobby miners face a devastating tax scenario where they report full income on Schedule 1 without meaningful expense deductions, effectively paying taxes on 100% of rewards regardless of operational costs. The IRS applies strict profit motive tests to determine classification, examining factors like time investment, expertise, and profit history over multiple years.

Self-Employment Tax Obligations

Mining businesses must pay self-employment taxes at 15.3% on net profits, covering Social Security at 12.4% up to $160,200 in 2023 and Medicare at 2.9% on all income. High-income miners face an additional 0.9% Medicare surtax on earnings exceeding $200,000 for single filers. Operations that generate $50,000 in net profit pay approximately $7,650 in self-employment taxes plus regular income taxes based on their bracket. Smart miners reduce self-employment tax burden through equipment purchases, operational expense maximization, and strategic business structure planning.

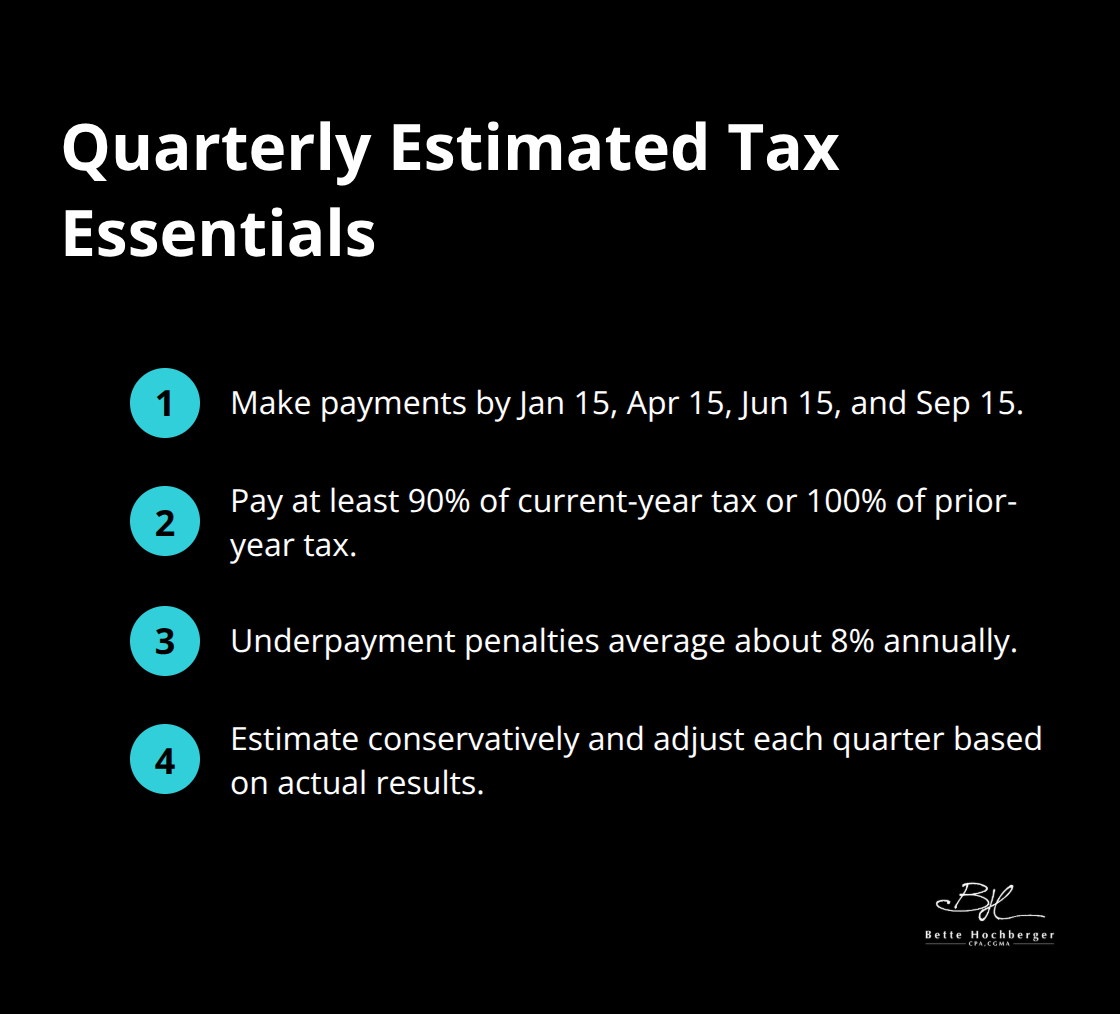

Quarterly Estimated Tax Requirements

Miners who expect to owe at least $1,000 or more in taxes must make quarterly estimated payments by January 15, April 15, June 15, and September 15 to avoid underpayment penalties that average 8% annually. The IRS requires payments equal to 90% of current year liability or 100% of prior year taxes (whichever is lower). Income volatility makes quarterly estimates challenging, but underpayment penalties accumulate monthly and compound rapidly.

Successful miners calculate estimated taxes based on conservative income projections and adjust payments quarterly based on actual results rather than hope for year-end windfalls.

Final Thoughts

Crypto mining taxation requires immediate action the moment rewards hit your wallet. The IRS treats mining income as ordinary income at fair market value, which creates tax obligations that many entrepreneurs underestimate. Business classification opens substantial deduction opportunities through Schedule C filing, while hobby miners face harsh tax realities with limited expense offsets.

Quarterly estimated payments prevent costly underpayment penalties that compound monthly. Section 179 expensing allows immediate deduction of up to $1,160,000 in mining equipment for 2025 (making strategic equipment purchases powerful tax planning tools). Self-employment taxes at 15.3% apply to business mining profits, but proper expense documentation often reduces overall tax burden significantly.

Mining operations generate complex tax scenarios that require professional guidance to navigate successfully. We at Bette Hochberger, CPA, CGMA help crypto mining entrepreneurs minimize tax liabilities while maintaining compliance. Our team provides ongoing support for cash flow management and profitability optimization in this rapidly evolving industry.