Cryptocurrency has become a major part of the investment landscape, and with it comes a complex web of tax implications. At Bette Hochberger, CPA, CGMA, we’ve seen firsthand how crypto taxes can catch investors off guard.

As we enter 2025, understanding the latest regulations and reporting requirements is essential for anyone involved in digital assets. This guide will walk you through the key aspects of crypto taxes, helping you navigate this evolving financial terrain with confidence.

How Has Crypto Taxation Changed in 2025?

New Reporting Forms and Requirements

The cryptocurrency taxation landscape has transformed significantly as we enter 2025. The IRS has implemented more stringent reporting requirements and clearer guidelines for investors. As of June 20, 2025, you may have to report transactions with digital assets such as cryptocurrency and non-fungible tokens (NFTs) on your tax return. This change standardizes crypto tax reporting and requires investors to adopt a wallet-by-wallet accounting method to calculate their cost basis (replacing the previously used universal accounting method).

Taxation of Different Crypto Transactions

The IRS continues to categorize cryptocurrencies like Bitcoin and Ethereum as property, making every transaction potentially taxable. Here’s how different crypto activities are taxed in 2025:

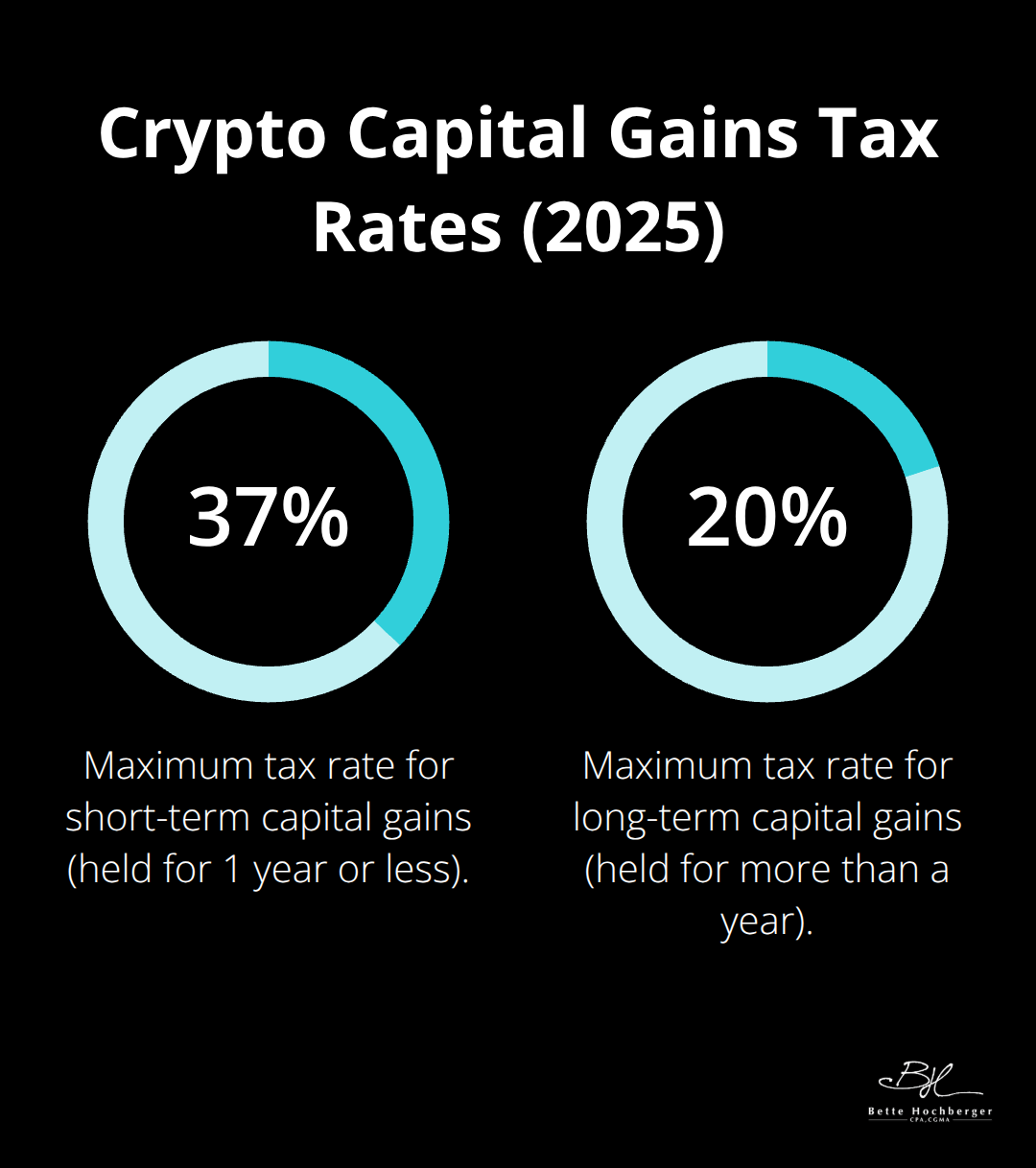

- Trading and Selling: Capital gains tax applies when you sell or trade cryptocurrency. Short-term gains (assets held for 1 year or less) are taxed at ordinary income rates (10% to 37%), while long-term gains (assets held for more than a year) are taxed at more favorable rates of 0%, 15%, or 20% (depending on your total income).

- Mining and Staking: The IRS taxes rewards from mining or staking as ordinary income based on the fair market value of the crypto at the time of receipt. If you run a mining business, you may deduct related expenses.

- DeFi Activities: Decentralized finance transactions (such as providing liquidity or earning governance tokens) typically trigger taxable events. For example, swapping one cryptocurrency for another on DeFi platforms incurs a capital gain or loss.

Increased Scrutiny and Compliance Measures

The IRS has intensified its efforts to ensure crypto tax compliance. This increased scrutiny makes accurate reporting more critical than ever. The surge in IRS audits related to cryptocurrency transactions underscores the importance of maintaining detailed records and seeking professional guidance.

As crypto taxation becomes more complex, working with experienced professionals who understand these nuanced regulations is vital. Cryptocurrency tax regulations are complex and evolving. A licensed tax professional stays updated on these changes and can provide tailored advice, ensuring compliance while optimizing tax strategies in this evolving digital asset landscape.

The next chapter will explore how to report these various crypto transactions on your tax return, including the required forms and common pitfalls to avoid.

How to Report Crypto on Your Tax Return in 2025

New Forms for Crypto Reporting

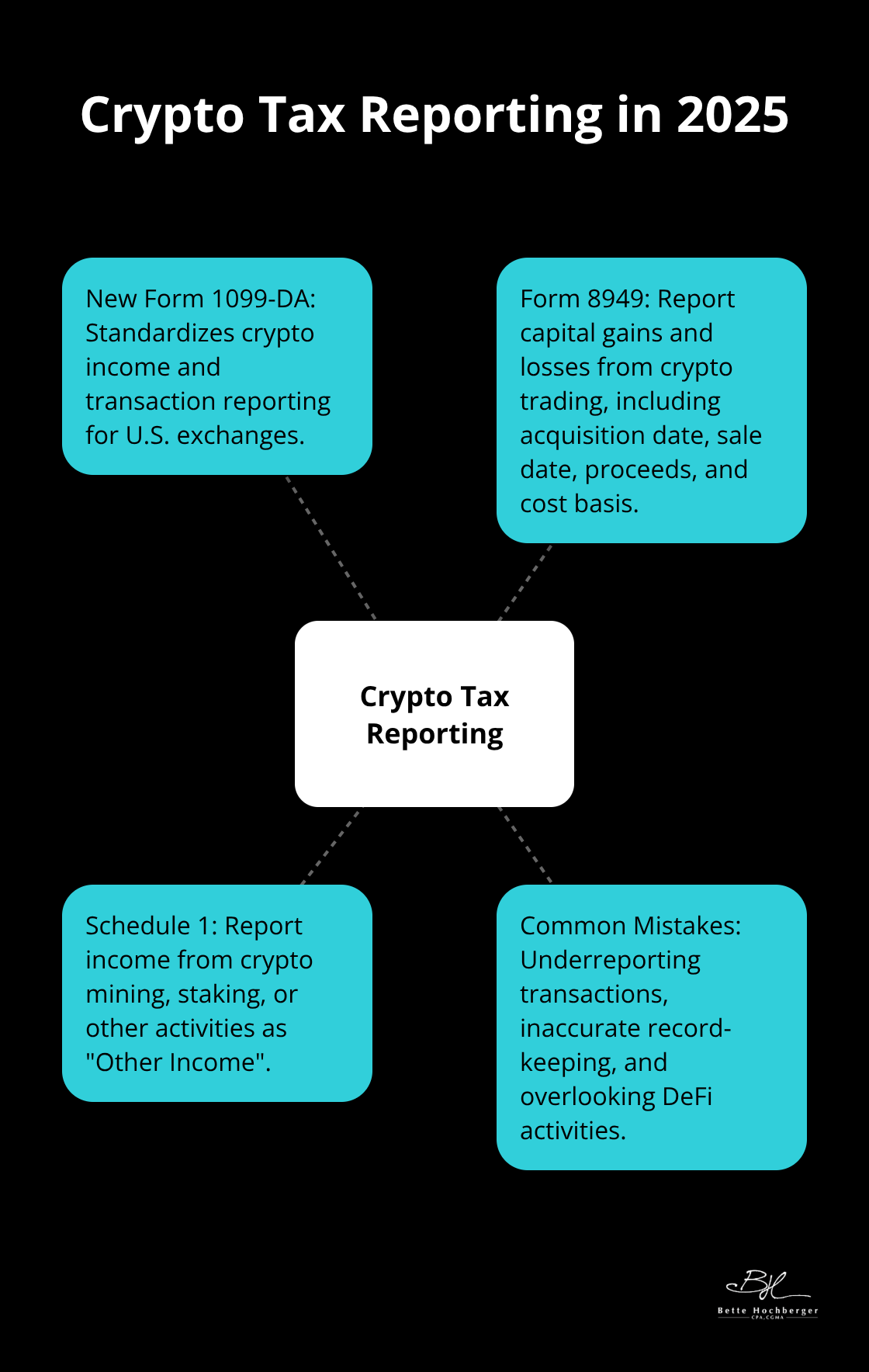

The IRS has introduced Form 1099-DA for all U.S. crypto exchanges to report transactions starting January 1, 2025. This form standardizes crypto income and transaction reporting. For each digital asset sale that a broker has effected for a customer in 2025, the broker must complete Form 1099-DA. However, you must report all crypto activities, even without receiving a 1099-DA.

For capital gains and losses from crypto trading, use Form 8949. Report each sale or exchange of cryptocurrency on this form, including acquisition date, sale date, proceeds, and cost basis. Transfer the totals from Form 8949 to Schedule D of your Form 1040.

Report income from crypto mining, staking, or other activities on Schedule 1 as “Other Income.” If you run a crypto-related business, you may need to use Schedule C to report profit or loss.

Calculating Gains and Losses

The IRS now requires a wallet-by-wallet accounting method to calculate cost basis. Beginning Jan. 1, 2025, investors must track the purchase price and date for each crypto asset in each wallet separately.

To calculate your gain or loss, subtract your cost basis (the original purchase price plus any fees) from the sale price. The holding period determines whether it’s a long-term (more than a year) or short-term (less than a year) capital gain or loss.

Common Reporting Mistakes to Avoid

Many investors underreport crypto transactions, believing only profitable sales need reporting. In reality, all dispositions of cryptocurrency (including trades, purchases made with crypto, and some wallet transfers) may require reporting.

Inaccurate record-keeping is another frequent error. The new wallet-by-wallet accounting method makes detailed logs of all crypto activities essential. Include dates, amounts, and the fair market value of the crypto at the time of each transaction.

Don’t overlook DeFi transactions. Activities like providing liquidity to pools or earning governance tokens often trigger taxable events that require reporting.

Importance of Professional Guidance

The complexity of crypto tax reporting in 2025 highlights the value of professional assistance. A qualified tax professional can help navigate these intricate regulations, ensure compliance, and optimize your tax strategy. They can also assist with the nuances of DeFi transactions and the new wallet-by-wallet accounting method.

As we move forward, let’s explore some effective tax-saving strategies that crypto investors can employ to minimize their tax burden while staying compliant with the latest regulations.

How Can Crypto Investors Minimize Their Tax Burden?

The crypto market’s volatility presents unique opportunities for tax optimization. Several strategies can help investors reduce their tax liabilities while staying compliant with the latest regulations.

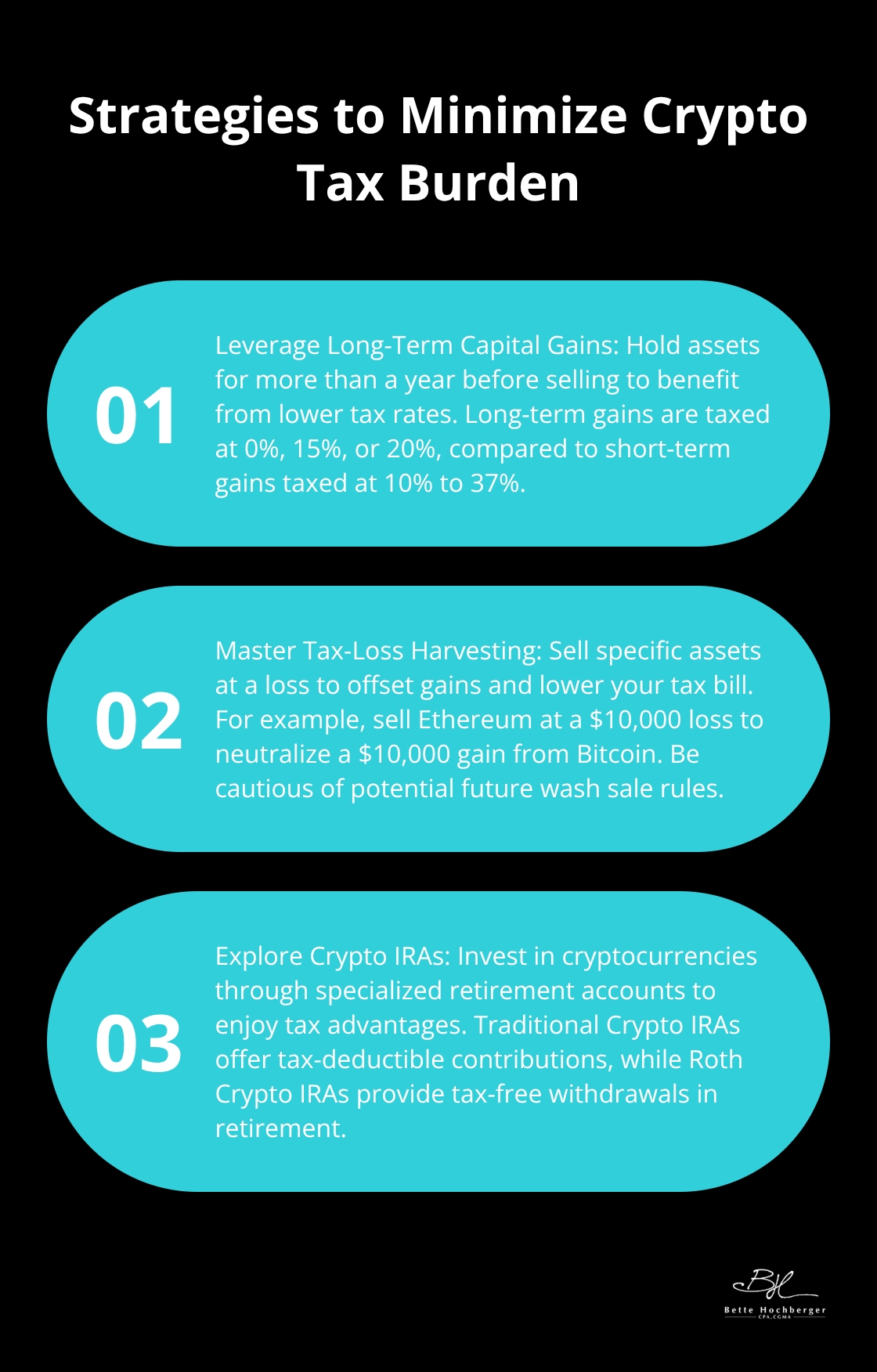

Leverage Long-Term Capital Gains

One of the most effective ways to minimize your crypto tax burden is to hold your assets for more than a year before selling. Long-term capital gains are taxed at significantly lower rates compared to short-term gains. If you’re in the 22% tax bracket, your long-term capital gains rate could be as low as 15%, potentially saving you thousands in taxes.

Long-term capital gains tax rates are treated the same as ordinary income and can range from 10% – 37% depending on your income level.

Master Tax-Loss Harvesting

Tax-loss harvesting in cryptocurrency markets involves selling specific assets at a loss in order to lower your tax bill. This strategy brings multiple advantages when applied to crypto investments. With the high volatility in crypto markets, opportunities for tax-loss harvesting are abundant. For example, if you’ve realized $10,000 in gains from Bitcoin, you could sell Ethereum at a $10,000 loss to neutralize your tax liability.

However, be cautious of the wash sale rule. While it doesn’t currently apply to cryptocurrencies, there’s speculation that it might extend to digital assets in the future. To be safe, wait at least 30 days before repurchasing the same or substantially similar crypto after selling at a loss.

Explore Crypto IRAs

Crypto IRAs are gaining popularity as a tax-advantaged investment vehicle. These specialized retirement accounts allow you to invest in cryptocurrencies while enjoying the tax benefits of traditional or Roth IRAs. With a traditional Crypto IRA, your contributions are tax-deductible, and you only pay taxes when you withdraw funds in retirement. Roth Crypto IRAs are funded with after-tax dollars, but your withdrawals in retirement are tax-free.

For instance, if you invest $6,000 in a Roth Crypto IRA and it grows to $60,000 over time, you won’t owe any taxes on that $54,000 gain when you withdraw it in retirement. This can result in substantial tax savings, especially if you expect cryptocurrency values to appreciate significantly over the long term.

The annual contribution limits for IRAs apply to Crypto IRAs as well. In 2025, the limit is $7,000 for individuals under 50 and $8,000 for those 50 and older (these limits are subject to change).

Seek Professional Guidance

The implementation of these strategies requires careful planning and execution. The crypto tax landscape is complex and ever-changing, making professional guidance invaluable. A qualified tax professional can help you navigate these waters and optimize your tax positions. They can provide tailored advice to suit your unique financial situation and stay abreast of the latest regulations.

Final Thoughts

The crypto tax landscape in 2025 presents new challenges and opportunities for investors. Form 1099-DA, wallet-by-wallet accounting, and increased IRS scrutiny reshape cryptocurrency taxation. Accurate record-keeping and understanding of DeFi activities become essential for compliance in this evolving environment.

Investors can minimize their tax burden through long-term capital gains, tax-loss harvesting, and Crypto IRAs. These strategies offer powerful tools but require careful planning and execution. Professional guidance proves invaluable in navigating the complex world of crypto taxes.

We at Bette Hochberger, CPA, CGMA specialize in helping investors tackle the intricacies of cryptocurrency taxation. Our team offers personalized strategies to minimize tax liabilities while ensuring full compliance. We provide comprehensive support tailored to your unique financial situation, from strategic tax planning to Fractional CFO services.