Small business owners juggling work and family responsibilities often overlook valuable tax benefits. The Child Care Tax Credit is one such opportunity that can significantly reduce your tax burden.

At Bette Hochberger, CPA, CGMA, we understand the importance of maximizing every available tax advantage for our clients. This blog post will guide you through the essentials of the Child Care Tax Credit, helping you make informed decisions for your business and family.

What Is the Child Care Tax Credit?

Definition and Purpose

The Child Care Tax Credit serves as a financial tool for small business owners with children. This credit reduces the costs of child care, enabling entrepreneurs to concentrate on business growth while ensuring quality care for their children.

Credit Mechanics

The Child Care Tax Credit allows claims up to 35% of your employment-related expenses for child care. The credit percentage varies based on your adjusted gross income (AGI). For instance, with one child and qualification for the full 35% credit, you could receive a significant saving off your tax bill.

Eligibility Criteria

Small business owners qualify for this credit if they pay for child care to work or seek work. Your child must be under 13 years old (or a dependent physically or mentally incapable of self-care). You must have earned income to qualify, which includes profits from your business.

Income Limitations

The credit’s value decreases as income increases. Families with an AGI under $15,000 qualify for the maximum 35% rate. This percentage gradually drops to 20% for those with a higher AGI. Interestingly, there’s no upper income limit for claiming the Child Care Tax Credit. However, the credit is non-refundable, meaning it can’t reduce your tax liability below zero.

Strategic Tax Planning

Understanding these details helps you plan your finances more effectively. Many small business owners overlook this credit, potentially missing out on valuable savings. By incorporating this credit into your tax strategy, you can reinvest the savings back into your business or cover other family expenses.

As we move forward, let’s explore how to calculate this credit and maximize its benefits for your small business.

How to Calculate Your Child Care Tax Credit

Identifying Qualified Expenses

The IRS sets clear guidelines for qualified child care expenses. These include payments to daycare centers, nursery schools, and licensed babysitters. Some summer camp costs qualify if they enable you to work. Expenses for schooling (kindergarten or higher), food, lodging, clothing, or education don’t count.

Small business owners should track costs for child care during work hours, networking events, or business trips. Maintain detailed records of these expenses, including receipts and provider information.

Applying the Credit Percentage

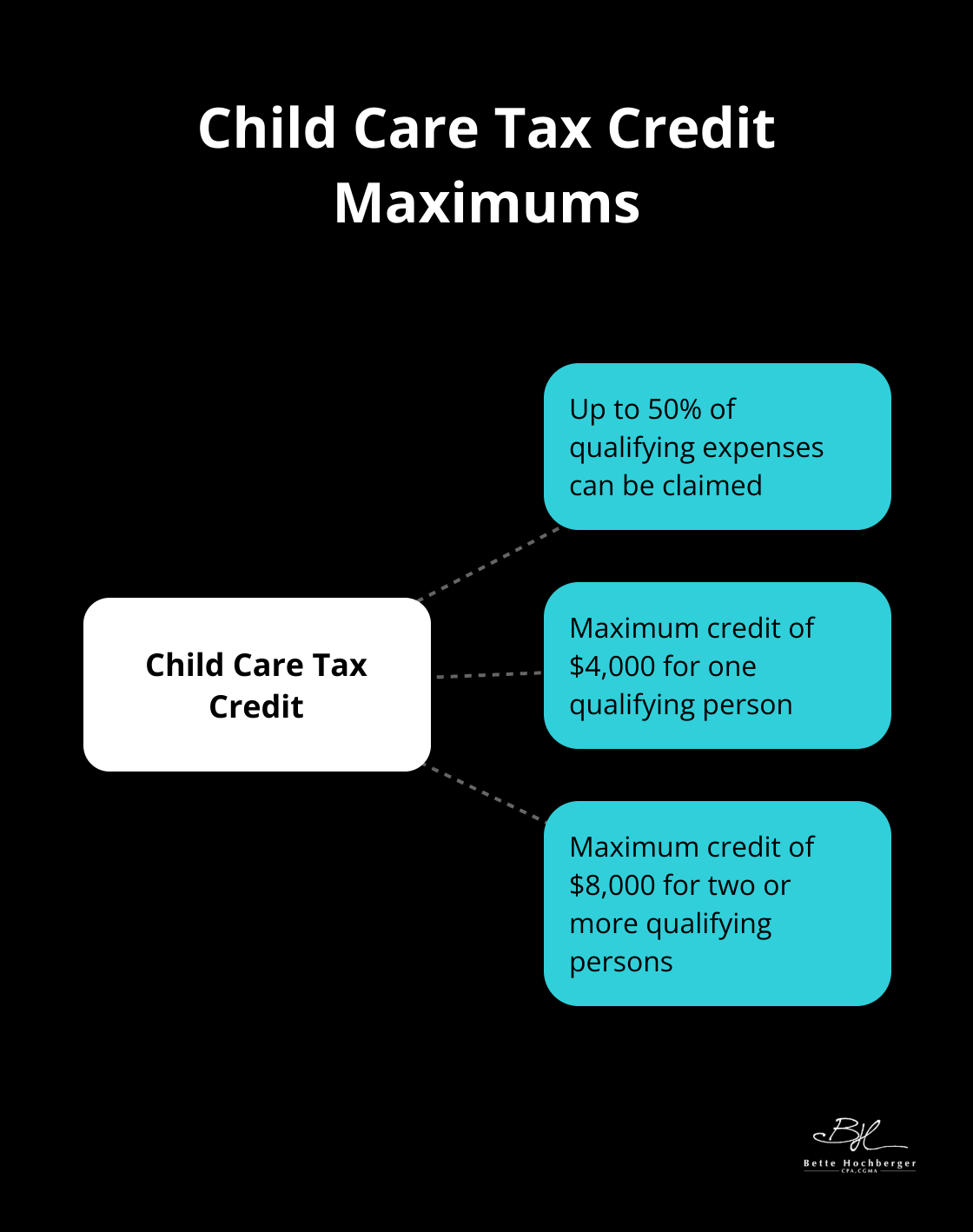

Your adjusted gross income (AGI) determines the percentage of expenses you can claim. The Child Care Tax Credit percentage can be up to 50% of your qualifying expenses, with a maximum total credit of $4,000 for one qualifying person or $8,000 for two or more qualifying persons.

Examples of Credit Calculations

Let’s examine two scenarios:

- A small business owner with $3,000 in qualifying child care expenses for one child can claim up to 50% of these expenses, resulting in a maximum tax credit of $1,500.

- A business owner with $6,000 in expenses for two children could receive a maximum credit of $3,000, which is 50% of the qualifying expenses.

Strategies to Maximize Your Credit

To optimize your Child Care Tax Credit, consider these strategies:

- Time your child care expenses strategically. If possible, concentrate expenses into a single tax year to potentially claim a higher credit.

- Evaluate your business structure’s impact on your AGI, as this directly affects your credit percentage.

- Maintain a separate account for child care expenses. This practice simplifies tracking and ensures you capture all eligible costs at tax time.

This credit can significantly reduce your tax bill. However, you can combine it with other credits and deductions to optimize your overall tax strategy.

Understanding these calculations sets the foundation for effective tax planning. The next step involves exploring strategies to maximize this credit for your small business.

How Small Business Owners Can Maximize the Child Care Tax Credit

Small business owners can reduce their tax burden by strategically using the Child Care Tax Credit. This section explores practical ways to optimize child care expenses, ensure proper documentation, and avoid common filing mistakes.

Optimize Child Care Expenses

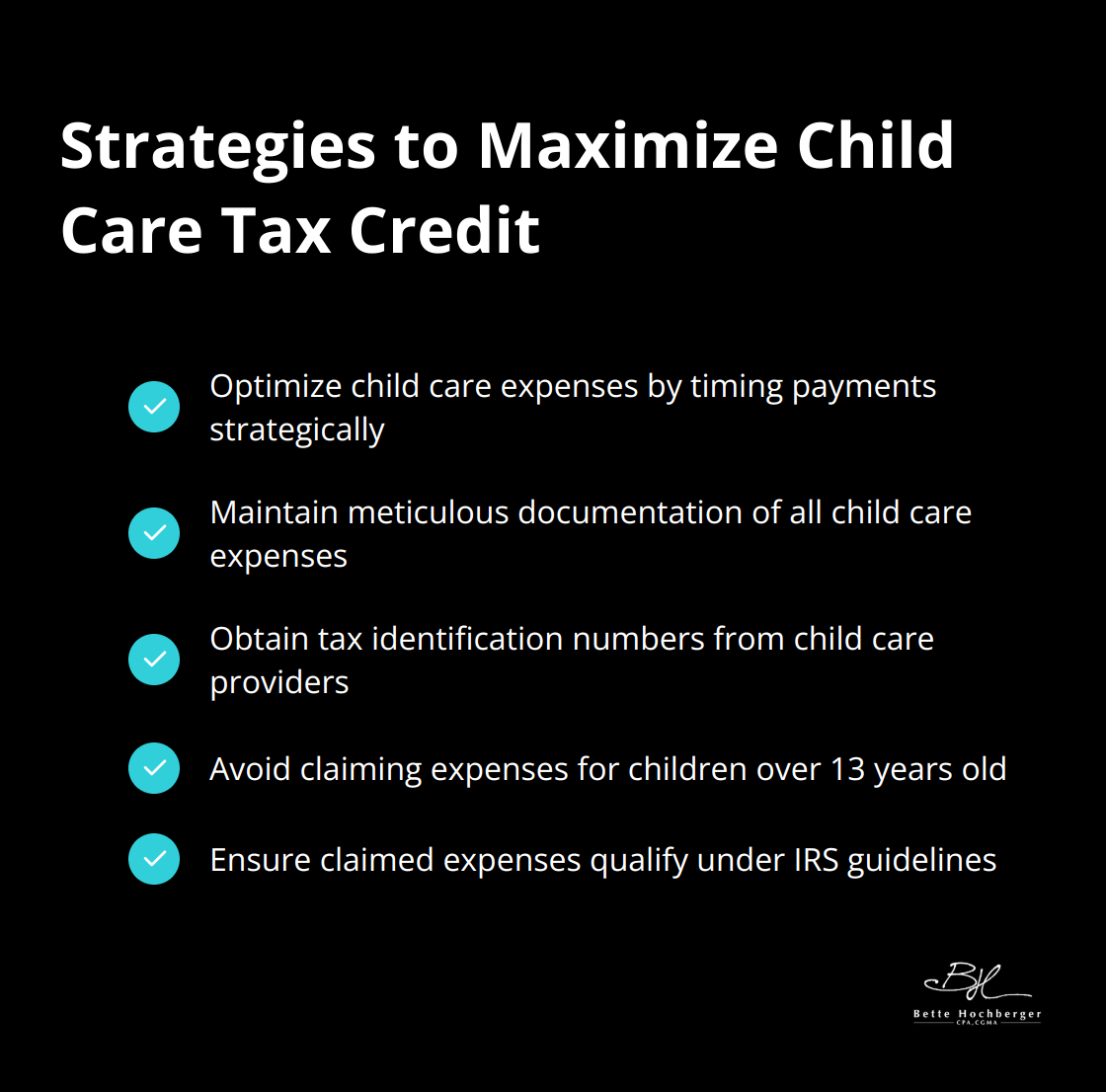

Timing plays a key role in maximizing your Child Care Tax Credit. You can front-load your child care expenses into a single tax year to potentially claim a higher credit. For example, if you plan to enroll your child in a summer camp, pay for it in December rather than January to boost your credit for the current tax year.

Reassess your business structure as well. Your adjusted gross income (AGI) directly impacts the percentage of expenses you can claim. S-corporations and partnerships may offer advantages in managing your AGI compared to sole proprietorships. (However, changing your business structure is a significant decision that requires careful consideration of various factors beyond just the Child Care Tax Credit.)

Document Meticulously

The IRS scrutinizes Child Care Tax Credit claims closely, making thorough documentation essential. Keep detailed records of all child care expenses, including receipts, canceled checks, and provider information. Create a dedicated spreadsheet or use accounting software to track these expenses throughout the year.

Obtain the tax identification number (TIN) or social security number of your child care provider. You need this information on Form 2441 when you file your taxes. If your provider hesitates to share this information, explain that it’s necessary for you to claim the credit and that the IRS requires it.

Avoid Common Filing Mistakes

One frequent error involves claiming expenses for children who don’t meet the age requirement. The child must be under 13 years old at the time the care was provided (not just at the end of the tax year).

Another mistake is claiming expenses that don’t qualify. While daycare and babysitting costs typically qualify, expenses for schooling (kindergarten and above), food, or clothing generally don’t. Summer camps can be tricky – day camps often qualify, but overnight camps don’t.

Don’t forget to factor in employer-provided dependent care benefits. These benefits reduce your eligible expenses dollar-for-dollar. For example, if you have $5,000 in child care expenses and receive $3,000 in dependent care benefits from your employer, you can only claim the remaining $2,000 for the Child Care Tax Credit.

Seek Professional Guidance

Tax laws can be complex and change frequently. (A professional tax advisor can help you navigate these complexities and ensure you maximize your Child Care Tax Credit.) At Bette Hochberger, CPA, CGMA, we specialize in helping small business owners optimize their tax strategies, including the Child Care Tax Credit. Our team stays up-to-date with the latest tax laws and can provide personalized advice tailored to your specific situation.

Final Thoughts

The Child Care Tax Credit provides small business owners a significant opportunity to reduce their tax burden while managing work and family responsibilities. Small business owners who understand the eligibility criteria, calculate the credit accurately, and implement strategic planning can maximize this benefit. Tax planning plays a vital role for small business owners, and the Child Care Tax Credit forms just one part of a comprehensive tax strategy.

Tax law complexities often challenge busy entrepreneurs. A tax professional can offer personalized advice tailored to specific situations. Bette Hochberger, CPA, CGMA specializes in helping small business owners develop comprehensive tax strategies that minimize liabilities and maximize profitability. Our team of experts stays current with the latest tax laws and regulations (ensuring accurate and timely advice).

We can help you navigate the intricacies of the Child Care Tax Credit and other relevant tax benefits. Contact us for personalized guidance on the Child Care Tax Credit and comprehensive tax planning tailored to your small business needs. With our expertise, you can navigate the tax landscape confidently and position your business for long-term success.