The average investor loses 2-3% annually to taxes on their investment returns. Tax-efficient investing can save you thousands of dollars over time through strategic planning.

We at Bette Hochberger, CPA, CGMA see clients miss these opportunities daily. This guide shows you how to build a portfolio that minimizes your tax burden while maximizing growth potential.

How Do You Choose the Right Tax-Advantaged Account

Tax-Deferred vs Tax-Free Account Selection

Tax-deferred accounts like traditional 401(k)s and IRAs let you deduct contributions now and pay taxes later when you retire. For 2025, you can contribute up to $23,500 to a 401(k), with the limit rising to $31,000 if you’re 50 or older. These accounts work best when you expect lower tax rates in retirement.

Tax-exempt accounts like Roth IRAs and Roth 401(k)s take after-tax dollars but provide completely tax-free growth and withdrawals. The IRS recently raised the required minimum distribution age from 72 to 73, which gives you more time to let tax-deferred accounts grow.

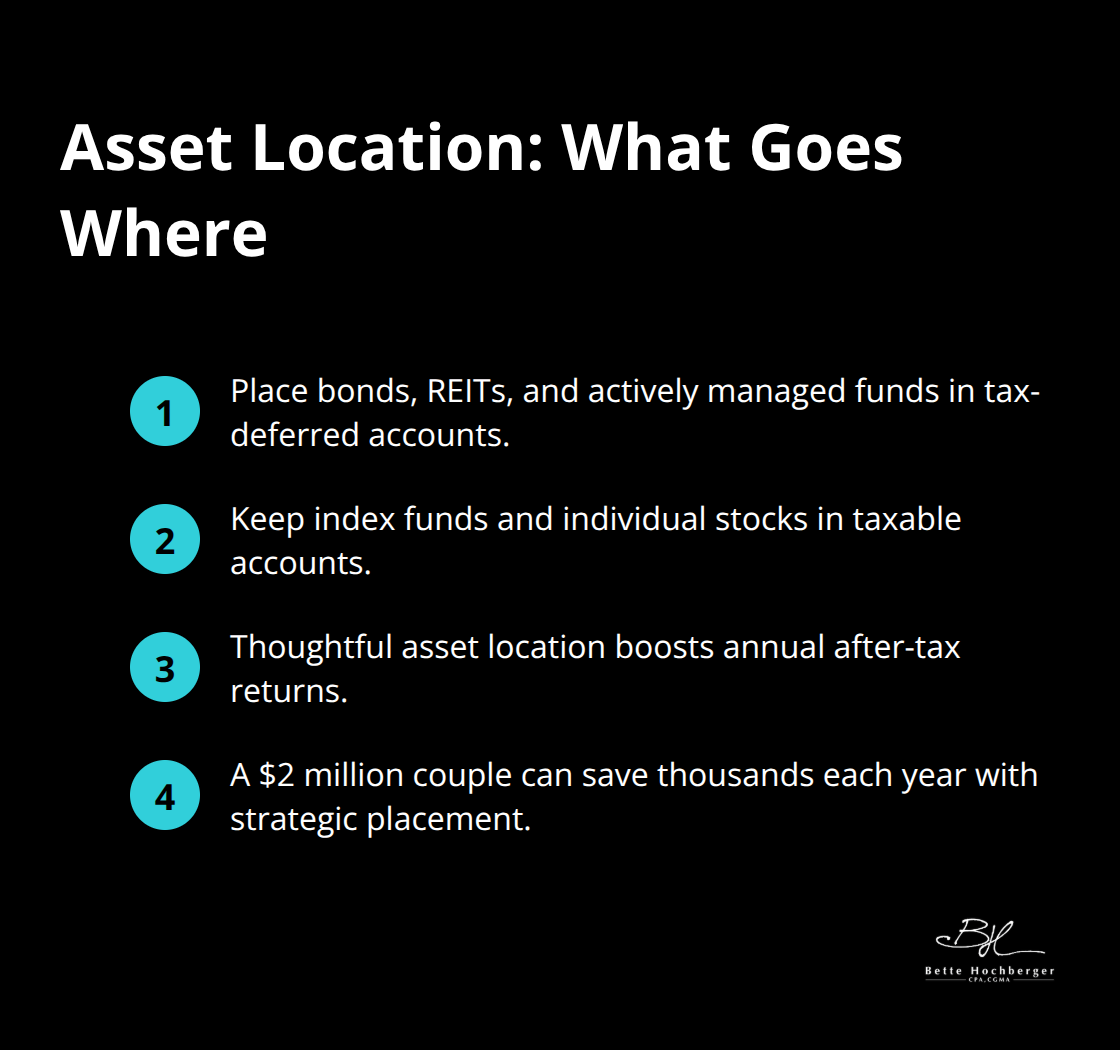

Asset Location Maximizes Tax Efficiency

Asset location means you place the right investments in the right account types. Tax-inefficient investments like bonds, REITs, and actively managed funds belong in tax-deferred accounts where their high turnover won’t generate immediate tax bills.

Tax-efficient investments like index funds and individual stocks work better in taxable accounts where you control when to realize gains. The Schwab Center for Financial Research found that proper asset location can boost annual after-tax returns. A couple with a $2 million portfolio could save thousands yearly through strategic asset placement.

Tax-Loss Harvesting Reduces Your Tax Bill

Tax-loss harvesting lets you sell losing investments to offset gains from winning positions. You can deduct up to $3,000 in net capital losses against ordinary income each year (with unused losses carrying forward indefinitely). The wash sale rule prevents you from buying the same security within 30 days before or after you sell it for a loss.

Smart investors harvest losses throughout the year, not just in December. This strategy works particularly well in taxable accounts where you have full control over timing. Once you master these foundational strategies, you can focus on selecting the specific investment vehicles that will maximize your tax efficiency.

Which Investment Vehicles Cut Your Tax Bill Most

Index Funds Beat Actively Managed Funds Every Time

Index funds are far more tax efficient than actively managed funds because of lower turnover. The average index fund has a turnover rate below 5%, while actively managed funds often exceed 100% annually. This means index funds create fewer capital gains distributions that hit your tax bill each year.

Vanguard’s S&P 500 index fund distributed just 0.02% in capital gains in 2023, while the average actively managed large-cap fund distributed 4.8% according to Morningstar data. This difference compounds over decades of investment growth.

The number 0% seems to be not appropriate for this chart. Please use a different chart type.

Exchange-traded funds work even better than mutual funds for tax efficiency. ETFs use an in-kind redemption process that eliminates most capital gains distributions entirely. When you hold ETFs in taxable accounts, you only pay taxes when you sell your shares (which gives you complete control over timing).

Municipal Bonds Generate Tax-Free Income Now

Municipal bonds pay interest exempt from federal taxes and often state taxes too if you buy bonds from your home state. A 5% municipal bond has a 6.41% tax equivalent yield when exempt from both federal and state income taxes.

High-income investors in states like California or New York can see even bigger advantages when they avoid state taxes. Target AAA-rated municipal bonds from stable issuers to minimize default risk.

Revenue bonds from essential services like water and sewer systems offer higher yields than general obligation bonds while maintaining strong credit quality. The recent Infrastructure Investment and Jobs Act increased funding for municipal projects, creating more high-quality bond options for investors.

Treasury Securities Offer State Tax Exemption Benefits

Treasury bonds, bills, and notes provide interest income exempt from state and local taxes while remaining subject to federal taxation. Series I savings bonds add inflation protection with tax-deferred growth until you cash them out.

These securities work particularly well for investors in high-tax states where state income tax avoidance creates meaningful savings over time. The combination of federal backing and state tax benefits makes Treasury securities a cornerstone of tax-efficient fixed income allocation.

Now that you understand which specific investment vehicles minimize your tax burden, you can implement advanced strategies that take your tax efficiency to an even higher level.

How Do Advanced Tax Strategies Maximize Your Investment Returns

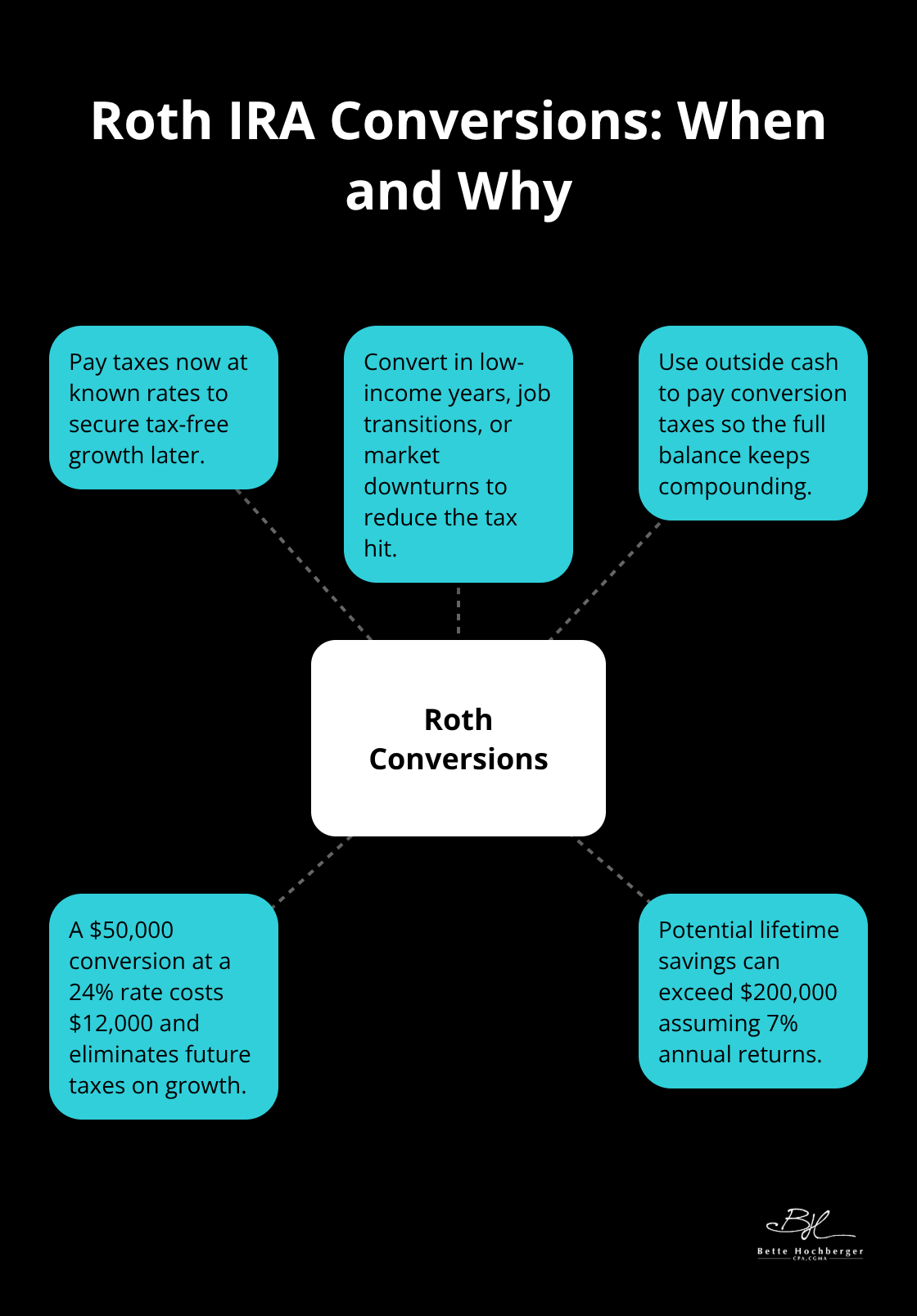

Roth IRA Conversions Generate Long-Term Tax Savings

Roth IRA conversions allow you to pay taxes now at known rates instead of risking future tax policy changes. You convert traditional IRA funds to a Roth IRA, pay ordinary income tax on the converted amount, then enjoy tax-free growth forever. The optimal conversion amount depends on your current tax bracket and available cash to pay the conversion taxes without touching retirement funds.

Target conversions during low-income years like early retirement, job transitions, or market downturns when your account values drop temporarily. Converting $50,000 from a traditional IRA to a Roth IRA costs $12,000 in taxes at a 24% rate but eliminates all future taxes on growth. A 30-year-old who converts this amount could save over $200,000 in lifetime taxes according to Fidelity research (assuming 7% annual returns).

Charitable Securities Donations Eliminate Capital Gains Taxes

You can donate appreciated stocks, bonds, or mutual funds directly to charity to avoid capital gains taxes entirely while claiming a full fair market value tax deduction. This strategy works best with securities held longer than one year that have significant unrealized gains. The IRS allows you to deduct up to 30% of your adjusted gross income for appreciated securities donations.

A $10,000 stock purchase that grows to $50,000 creates a $40,000 capital gain. Selling generates an $8,000 tax bill at 20% long-term rates, leaving $42,000 for charity. Direct stock donation gives the charity the full $50,000 while you claim a $50,000 deduction worth $12,000 in tax savings at a 24% rate. Donor-advised funds let you accelerate charitable contributions in high-income years while distributing grants to charities over time.

Estate Tax Integration Reduces Multigenerational Tax Burden

Strategic estate planning moves appreciating assets out of your taxable estate while preserving income streams. Grantor retained annuity trusts work particularly well for volatile growth investments where you transfer future appreciation to beneficiaries while retaining income. The 2025 federal estate tax exemption of $13.61 million per person creates opportunities for significant wealth transfers without estate taxes.

Annual gifts remove assets from your estate while funding beneficiary investment accounts. Gift appreciated securities rather than cash to transfer future growth potential. Qualified personal residence trusts let you transfer your home’s future appreciation while continuing to live there (creating substantial estate tax savings for high-net-worth families).

Final Thoughts

Tax-efficient investing saves you thousands of dollars annually through strategic account selection, smart asset placement, and advanced planning techniques. The data shows that proper implementation of these strategies adds 0.14 to 0.41 percentage points to your annual returns while reducing your overall tax burden. You should start with maximum contributions to tax-advantaged accounts like 401(k)s and IRAs.

Place tax-inefficient investments in these accounts while you keep index funds and individual stocks in taxable accounts where you control the timing of gains. Implement tax-loss harvesting throughout the year to offset gains with losses. Complex strategies like Roth conversions, charitable securities donations, and estate planning integration require professional guidance to avoid costly mistakes (since tax laws change frequently and individual circumstances vary significantly).

We at Bette Hochberger, CPA, CGMA help clients minimize tax liabilities while maximizing investment returns through personalized financial strategies. Take action now and review your current account allocations and contribution limits for 2025. The sooner you implement these tax-efficient investing principles, the more you’ll save over your investment lifetime.

![Building a Tax-Efficient Investment Portfolio [Guide]](https://bettehochberger.com/wp-content/uploads/emplibot/Building-a-Tax-Efficient-Investment-Portfolio-_Guide__1762776533.jpeg)