Cash flow management is evolving rapidly, and 2025 promises groundbreaking changes. At Bette Hochberger, CPA, CGMA, we’ve analyzed the latest financial news stories about cash flow management for 2025.

Our research reveals exciting technological advancements, innovative strategies, and significant regulatory shifts that will reshape how businesses handle their finances. This blog post will explore these trends and their potential impact on your company’s cash flow management practices.

How AI Will Transform Cash Flow Management in 2025

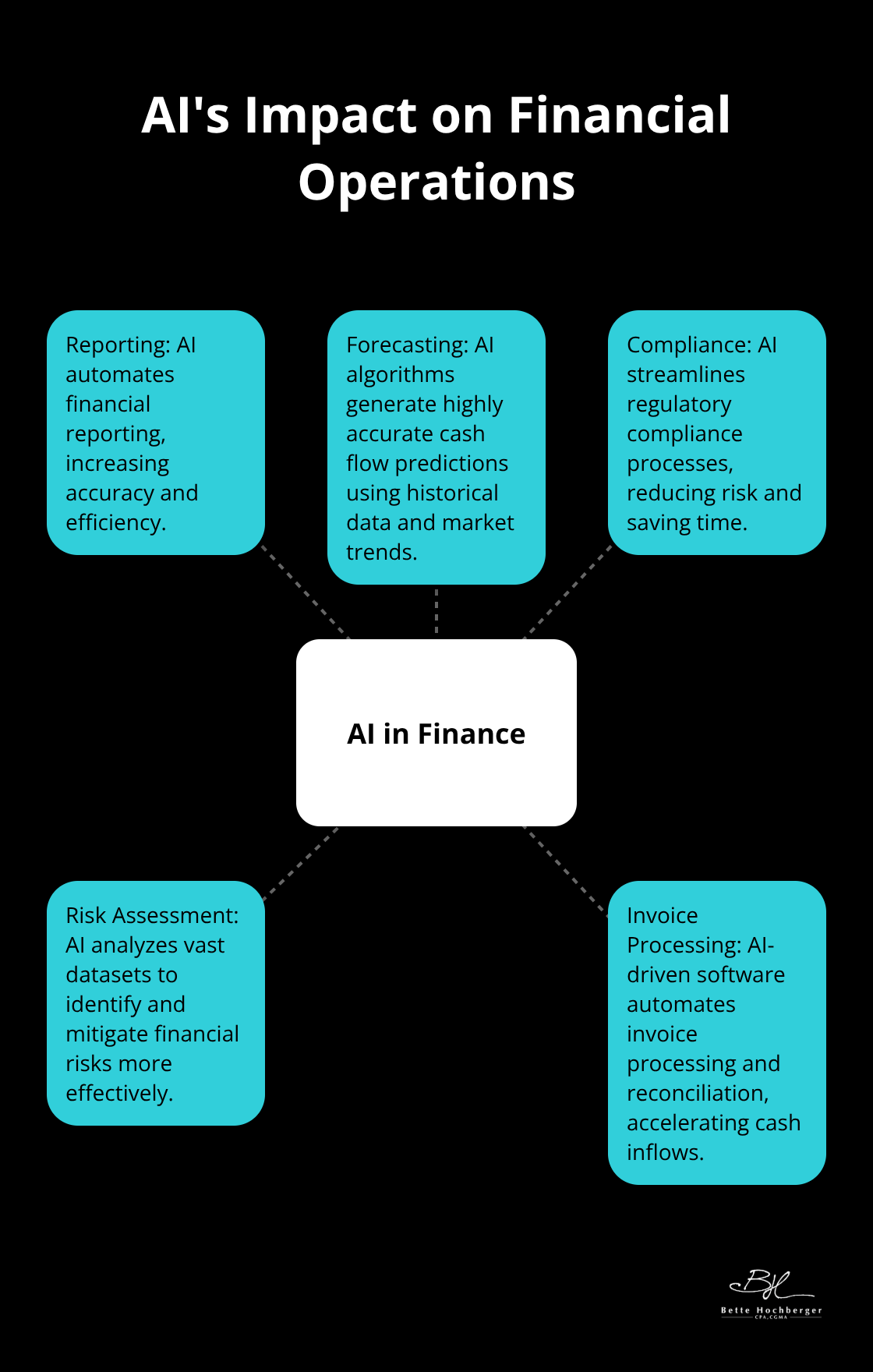

Artificial intelligence (AI) will revolutionize cash flow management in 2025, offering unprecedented accuracy and efficiency. AI is transforming financial operations by automating tasks such as reporting, forecasting, compliance, and risk assessment, thereby freeing up resources for more strategic activities.

Predictive Analytics Enhances Cash Flow Forecasting

AI algorithms will use historical data, market trends, and economic indicators to generate highly accurate cash flow predictions. These forecasts will allow businesses to anticipate cash shortages or surpluses weeks or even months in advance. According to Gartner’s AI Hype Cycle, which represents the maturity, adoption metrics, and business impact of AI technologies, including GenAI, companies are increasingly adopting AI for various financial operations.

Blockchain Technology Secures Transactions

Blockchain-based payment systems will transform supplier relationships and cash flow management. These systems will offer enhanced security, transparency, and speed in financial transactions.

AI Streamlines Invoice Processing and Reconciliation

AI-driven software will automate invoice processing and reconciliation, reducing manual errors and accelerating cash inflows. Machine learning algorithms will automatically categorize expenses, match invoices with purchase orders, and flag discrepancies for review.

The Human Touch Remains Essential

While AI and blockchain offer powerful tools for cash flow management, human expertise remains critical. Financial professionals must interpret AI-generated insights, make strategic decisions, and maintain relationships with clients and suppliers. The most successful businesses in 2025 will strike a balance between technological innovation and human judgment.

As we move towards these technological advancements, businesses must prepare for a new era of financial management. The next section will explore emerging cash flow strategies that complement these technological innovations, ensuring companies can maximize the benefits of AI and blockchain in their financial operations.

How Cash Flow Strategies Will Evolve in 2025

Real-Time Cash Flow Monitoring Becomes Standard

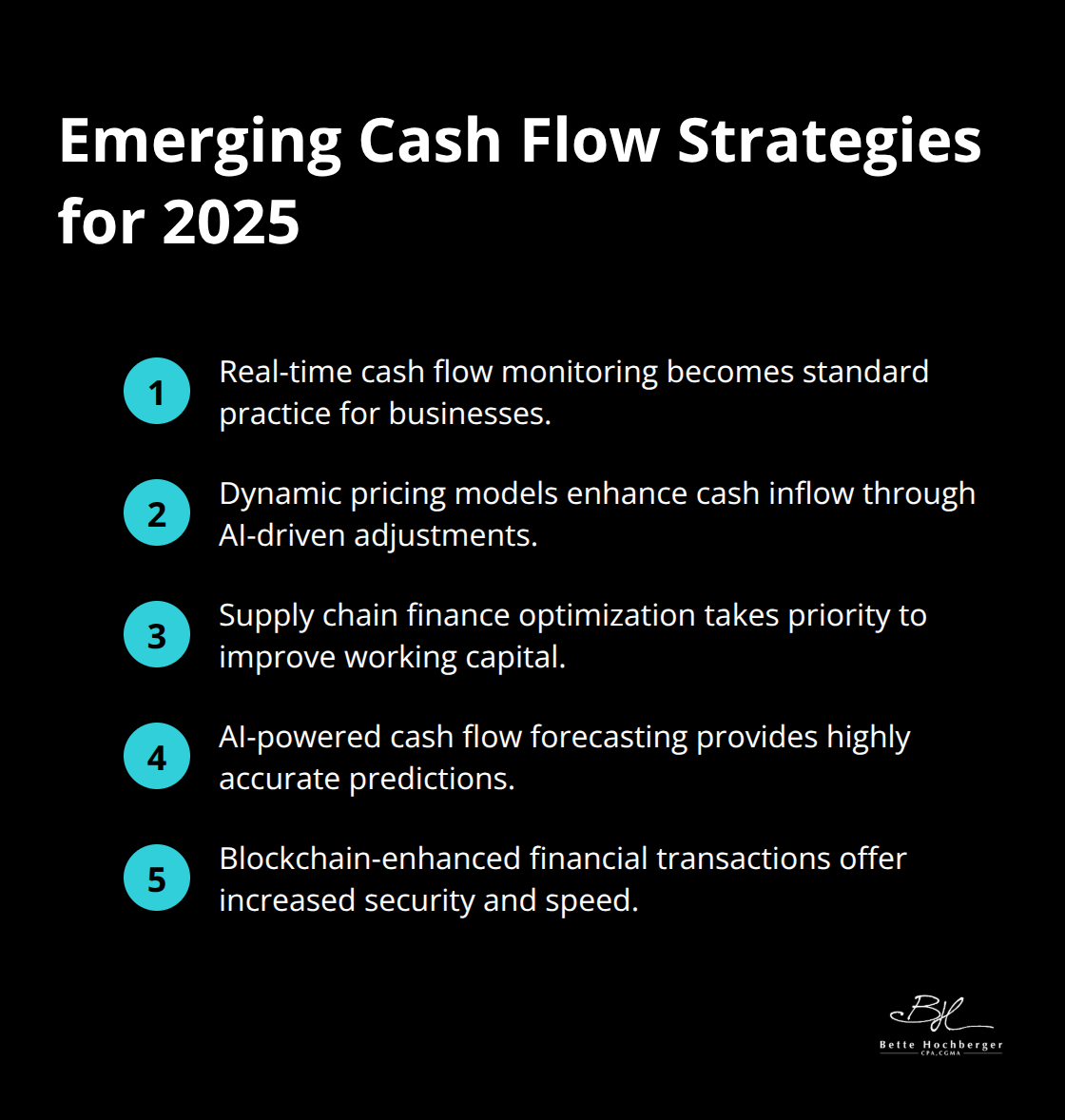

In 2025, real-time payments adoption will accelerate rapidly, with large companies leading the charge while small and medium enterprises follow suit. Advanced financial management platforms will provide instant visibility into cash positions, allowing companies to make informed decisions quickly.

Dynamic Pricing Models Enhance Cash Inflow

Dynamic pricing strategies will play a key role in optimizing cash inflow for businesses in 2025. Companies will use AI and machine learning algorithms to adjust their prices in real-time based on market demand, competitor pricing, and other relevant factors. Utilizing AI for pricing boosts operating margins and revenues, while enabling accurate data-driven decision-making.

Supply Chain Finance Optimization Takes Priority

Supply chain finance optimization will become a top priority for businesses looking to improve their cash flow management in 2025. Companies will increasingly turn to innovative financing solutions (such as reverse factoring and dynamic discounting) to optimize working capital and strengthen supplier relationships.

AI-Powered Cash Flow Forecasting

Artificial Intelligence will revolutionize cash flow forecasting in 2025. AI algorithms will analyze historical data, market trends, and economic indicators to generate highly accurate cash flow predictions. These forecasts will enable businesses to anticipate cash shortages or surpluses weeks (or even months) in advance, allowing for proactive financial management.

Blockchain-Enhanced Financial Transactions

Blockchain technology will transform supplier relationships and cash flow management in 2025. Blockchain-based payment systems will offer enhanced security, transparency, and speed in financial transactions. This technology will reduce the risk of fraud, minimize transaction costs, and accelerate the flow of funds between businesses and their partners.

As these emerging strategies take hold, businesses must prepare for a new regulatory landscape that will shape cash flow management practices. The next section will explore the regulatory changes that will impact financial operations in 2025, providing a comprehensive view of the evolving financial ecosystem.

How 2025 Regulatory Changes Will Impact Cash Flow

New International Financial Reporting Standards

The International Accounting Standards Board (IASB) plans to introduce updated financial reporting standards in 2025. These changes will affect how companies report cash flow and liquidity. The new standards may require more detailed disclosure of cash flow components, including a breakdown of operating, investing, and financing activities.

Companies should review their current reporting processes and identify areas that need adjustment. Consulting with financial experts will ensure a smooth transition to the new reporting requirements.

Tax Regulations and Cash Flow Planning

Tax regulations in 2025 will significantly impact cash flow planning. The U.S. government considers implementing a global minimum tax rate, which could affect multinational corporations’ cash flow strategies. Changes to depreciation rules and R&D tax credits may also alter the timing of tax deductions and credits.

Companies should assess how these potential tax changes might affect their cash flow. This may involve adjusting investment strategies, reconsidering the timing of major purchases, or restructuring international operations. Working with tax professionals who stay informed about these changes will be essential for effective cash flow management.

Government Incentives and Grants

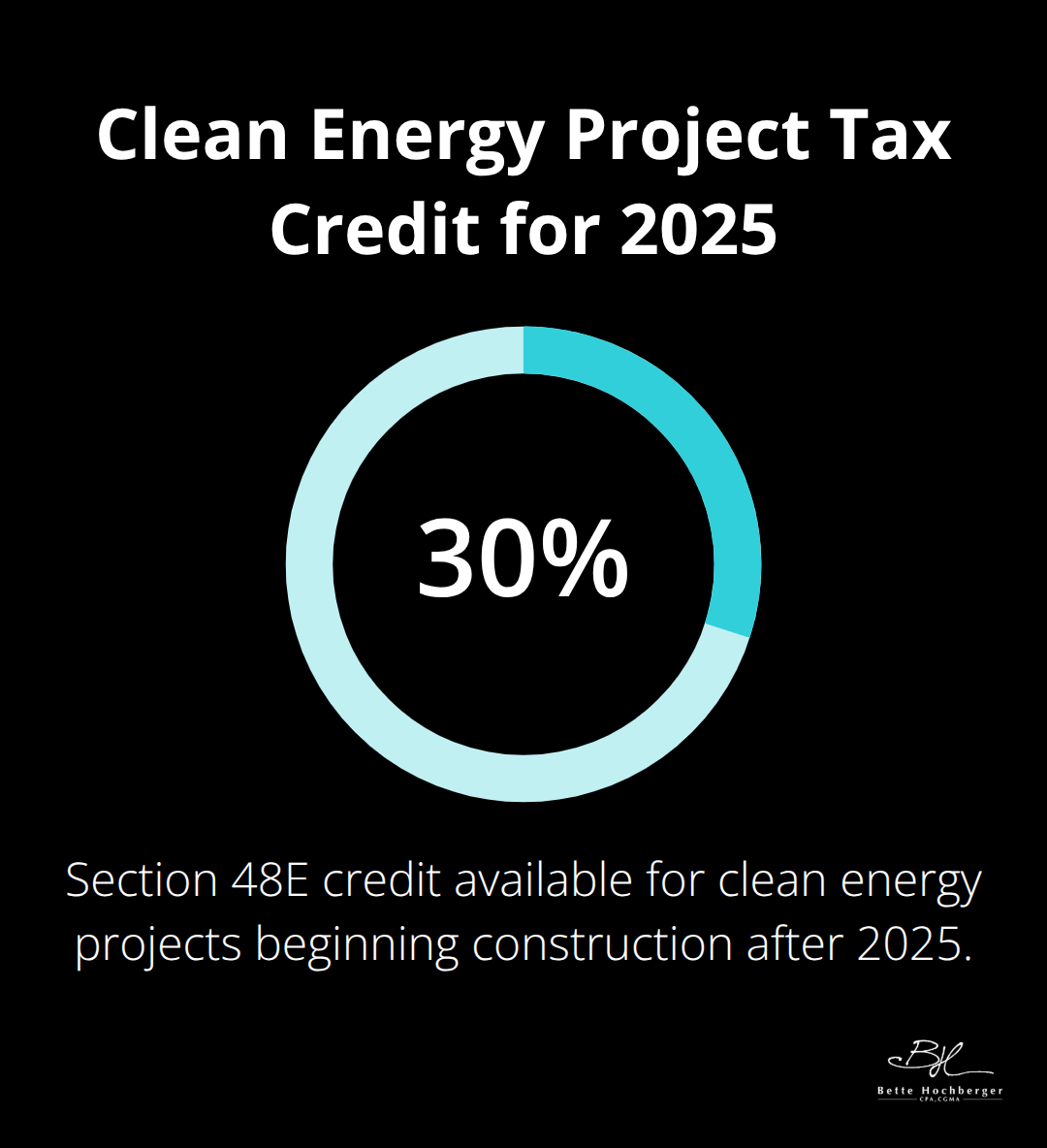

In 2025, we expect a shift in government incentives and grants, particularly those related to sustainable business practices and technology innovation. The U.S. Department of Energy has announced plans for clean energy projects to be eligible for a 30% Section 48E credit beginning construction after 2025.

Businesses should monitor these developments and consider how they can align their operations with areas eligible for government support. This might involve investing in green technologies, developing sustainable products, or participating in research initiatives that qualify for grants.

Companies that successfully leverage these incentives can significantly improve their cash flow position. However, navigating the application process and compliance requirements for government programs can be complex. Seeking guidance from financial advisors (such as Bette Hochberger, CPA, CGMA) with experience in this area can help businesses maximize their chances of securing these valuable resources.

Cybersecurity and Data Protection Regulations

New cybersecurity and data protection regulations will likely come into effect in 2025, impacting how businesses handle financial data and transactions. These regulations may require companies to invest in enhanced security measures and data management systems.

While these investments may initially impact cash flow, they will ultimately protect businesses from costly data breaches and ensure compliance with regulatory requirements. Companies should proactively assess their current cybersecurity measures and plan for necessary upgrades.

International Trade and Tariff Changes

Changes in international trade agreements and tariff structures expected in 2025 will affect businesses engaged in global commerce. These changes may impact the cost of imported goods and materials, as well as the competitiveness of exported products.

Companies should closely monitor developments in international trade policy and assess how potential changes might affect their supply chains and pricing strategies. Developing contingency plans for various trade scenarios will help businesses maintain stable cash flow in the face of changing global economic conditions.

Final Thoughts

The financial news stories about cash flow management in 2025 reveal a future of technological innovation and strategic evolution. AI will revolutionize forecasting, while blockchain will enhance transaction security. Real-time monitoring and dynamic pricing models will become standard practices for businesses aiming to optimize their cash flow.

Regulatory changes will reshape financial reporting standards and tax regulations. Companies must adapt their strategies to comply with new cybersecurity requirements and navigate shifting international trade policies. These changes will present both challenges and opportunities for businesses in managing their cash flow effectively.

Bette Hochberger, CPA, CGMA offers expert guidance to help businesses thrive in this evolving landscape. Our boutique accounting firm provides personalized financial services, including strategic tax planning and Fractional CFO services. We use advanced cloud technology to serve diverse industries, helping clients grow their wealth and navigate the complexities of modern financial management.