Hi everyone! I’m Bette Hochberger, CPA, CGMA. I know that understanding big tax deductions for businesses is essential for maximizing your company’s financial health. Smart tax planning can significantly reduce your tax burden and boost your bottom line.

This guide will walk you through the most impactful deductions available to businesses, including some lesser-known write-offs you might be missing. I’ll also share strategies to help you make the most of these deductions and optimize your tax position.

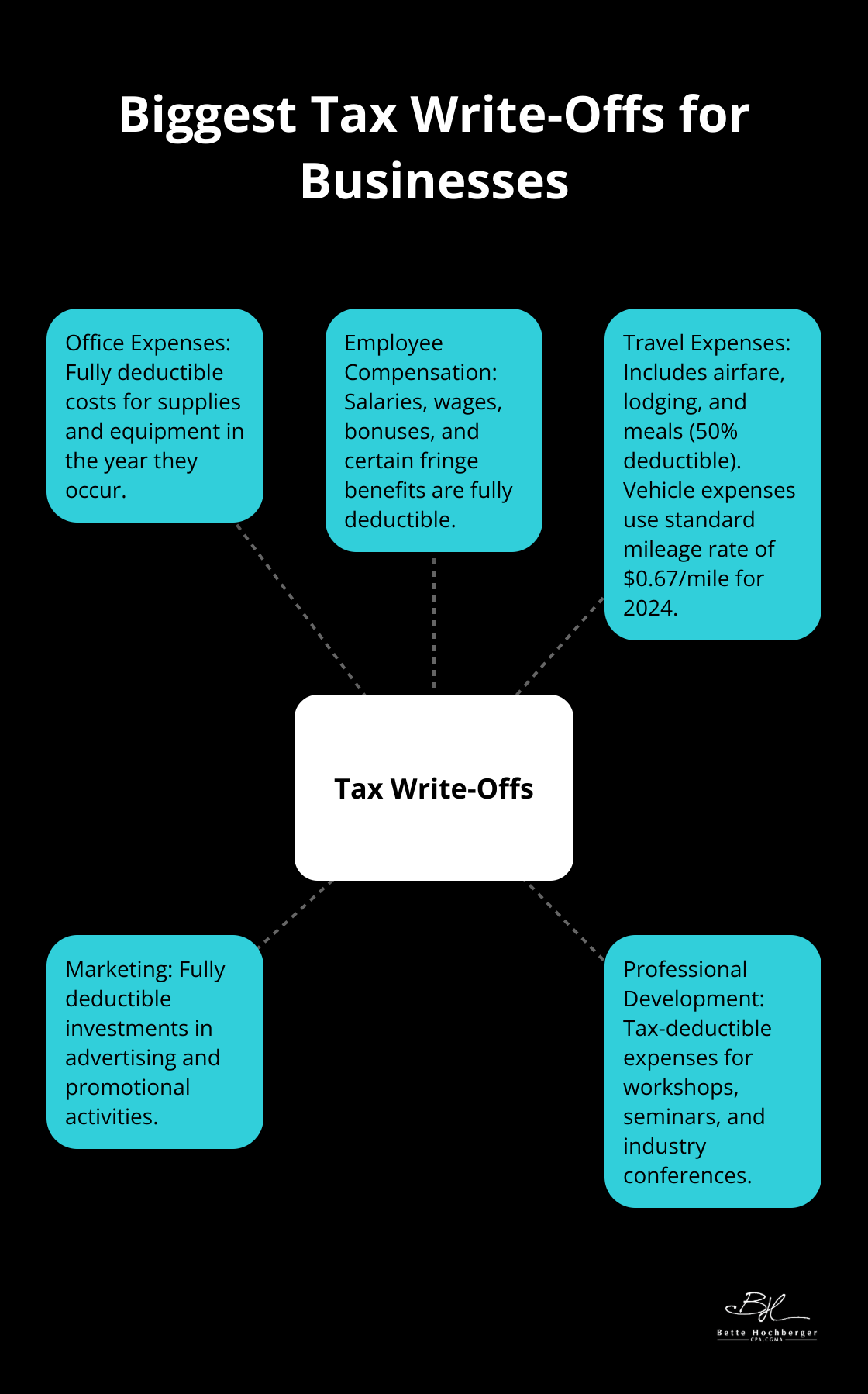

What Are the Biggest Tax Write-Offs for Businesses?

Businesses can significantly reduce their tax burden through strategic deductions. Let’s explore some of the most substantial write-offs available to companies.

Office Expenses and Supplies

Office expenses and supplies often go unnoticed, but they can amount to a significant deduction. This category encompasses everything from basic stationery to high-tech equipment. These costs are fully deductible in the year they occur, offering immediate tax relief.

Employee Compensation and Benefits

Salaries, wages, and benefits for employees typically represent one of the largest expenses for businesses-and they’re also fully deductible. This includes regular pay, bonuses, commissions, and certain fringe benefits. Total employer compensation costs for private industry workers were $32.97 at the 50th (median) wage percentile. Offering comprehensive benefits packages can attract and retain talent while providing substantial tax savings.

Travel and Vehicle Expenses

Business travel expenses offer another area for significant deductions. This includes airfare, lodging, meals (generally 50% deductible), and incidental expenses. For vehicle expenses, businesses can choose between deducting actual expenses or using the standard mileage rate ($0.67 per mile for 2024). Detailed records of all travel and vehicle use are essential to maximize these deductions.

Marketing and Advertising

Investments in marketing and advertising are fully deductible and essential for business growth. This covers a wide range of activities, from digital advertising and social media campaigns to traditional print ads and promotional events. Businesses typically dedicate a portion of their total (gross) revenue to marketing initiatives, which can translate into significant tax savings.

Professional Development and Education

Expenses related to professional development and education for you and your employees are tax-deductible. This includes costs for workshops, seminars, online courses, and industry conferences. These deductions not only reduce your tax liability but also invest in your team’s skills and knowledge.

While these deductions can substantially lower your tax liability, working with a qualified tax professional (like those at Bette Hochberger, CPA, CGMA) ensures you claim them correctly and maximize your benefits. The next section will uncover some lesser-known tax deductions that businesses often overlook but can provide additional savings.

Hidden Tax Deductions That Could Save Your Business Money

Many businesses overlook several tax deductions that could significantly reduce their tax burden. These often-missed write-offs can make a substantial difference in your bottom line. Let’s explore some of these hidden opportunities for tax savings.

Professional Development: A Business Investment

Investing in your team’s skills benefits business growth and offers tax advantages. Expenses for workshops, online courses, and industry conferences qualify for deductions. For example, a $2,000 leadership seminar for an employee becomes fully deductible from your taxable income. This deduction applies to both you and your employees, creating a dual benefit of skill enhancement and tax savings.

Financial Fees: Small Deductions Add Up

Every deductible expense counts, including fees associated with running your business finances. Bank fees, credit card processing charges, and even ATM fees qualify for deductions. Additionally, you can write off interest paid on business loans and credit lines. A small business with a $50,000 loan at 6% interest could deduct $3,000. These seemingly minor deductions accumulate to create significant savings throughout the year.

Depreciation: Maximizing Asset Value

Depreciation allows you to deduct the cost of business assets over time, but many businesses underutilize this deduction. Section 179 of the tax code permits you to deduct the full purchase price of qualifying equipment or software bought or financed during the tax year. In 2024, businesses can deduct up to $1,220,000 under Section 179. This means a $50,000 machinery purchase could potentially result in a full deduction in the year of purchase, rather than spreading it across several years.

Home Office: Beyond Just Square Footage

If you use part of your home exclusively for business, you might qualify for the home office deduction. This deduction extends beyond just the office space-it can include a portion of your mortgage interest, property taxes, utilities, and home insurance. The IRS offers a simplified option of $5 per square foot (up to 300 square feet, maxing out at $1,500). However, the regular method could yield a larger deduction, especially for larger spaces or higher home-related expenses.

These lesser-known deductions can significantly reduce your business’s tax liability. However, tax laws change frequently and can be complex. Working with a qualified tax professional ensures you don’t miss out on potential savings and helps you navigate these deductions effectively. A skilled accountant can help you optimize your tax strategy and potentially save your business thousands of dollars each year.

How to Maximize Your Business Tax Deductions

Keep Meticulous Records

Accurate and detailed record-keeping forms the backbone of maximizing tax deductions. Track every business expense, no matter how small. A survey by the National Small Business Association reveals that 40% of small business owners dedicate over 80 hours annually to tax preparation. Invest in quality bookkeeping software or hire a professional to save time and capture all valuable deductions.

Strategically Time Income and Expenses

The timing of your income and expenses can significantly impact your tax liability. Cash-basis taxpayers can lower their current year’s tax bill by delaying income or accelerating deductible expenses near the end of the tax year. If you expect to be in a lower tax bracket next year, consider deferring income. Alternatively, if you anticipate a higher bracket, accelerate income into the current year.

Utilize Section 179 for Immediate Deductions

Section 179 of the Internal Revenue Code allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. For 2024, the deduction limit stands at $1,220,000, with a phase-out limit set at $3,050,000. This provision enables you to deduct the full purchase price of qualifying equipment from your gross income, reducing your tax liability and improving cash flow.

Understand Current vs. Capital Expenses

Differentiate between current and capital expenses to optimize your deductions. Current expenses (like office supplies) are fully deductible in the year they occur. Capital expenses (such as equipment purchases) typically must be depreciated over time. However, Section 179 and bonus depreciation rules often allow for immediate deduction of certain capital expenses.

Seek Professional Tax Advice

Hiring a professional tax advisor offers numerous benefits, from maximizing deductions to providing personalized strategies tailored to your unique situation. A skilled accountant (like those at Bette Hochberger, CPA, CGMA) can help you optimize your tax position and potentially save your business thousands of dollars each year.

Final Thoughts

Big tax deductions for businesses offer powerful ways to boost financial health. From office expenses to marketing investments, these deductions can significantly reduce tax burdens. Meticulous record-keeping and strategic timing of income and expenses optimize tax positions, while understanding current versus capital expenses further enhances savings.

Professional tax advice becomes invaluable when navigating complex and ever-changing tax laws. Bette Hochberger, CPA, CGMA specializes in personalized financial services for businesses and professionals. Our team uses advanced cloud technology to provide strategic tax planning, Fractional CFO services, and tax preparation.

We help clients minimize tax liabilities, manage cash flow, and ensure profitability across diverse industries. Our expert guidance tailors to unique business needs, identifies applicable deductions, develops comprehensive tax strategies, and ensures compliance with current regulations. Contact us today to turn tax season into an opportunity for financial growth and stability.