Cryptocurrency investors face mounting tax complexity as digital assets gain mainstream adoption. The IRS collected $3.7 billion from crypto transactions in 2023, highlighting the need for strategic planning.

Smart crypto portfolio management can significantly reduce your tax burden through proper timing and documentation. We at Bette Hochberger, CPA, CGMA help investors navigate these challenges while maximizing returns.

Tax-Loss Harvesting Strategies for Crypto Portfolios

Tax-loss harvesting transforms crypto volatility into a powerful tax advantage. Unlike traditional securities, cryptocurrencies escape the wash sale rule that prevents investors from immediately repurchasing assets after selling them at a loss. This regulatory gap creates an extraordinary opportunity for crypto investors to harvest losses while maintaining their market positions.

The IRS treats each crypto transaction as a taxable event, meaning you can sell Bitcoin at a loss, claim the deduction, and buy it back the same day without penalty. The IRS allows investors to claim deductions on cryptocurrency losses that can lessen their tax liability or potentially result in a tax refund.

Understanding Wash Sale Rules for Cryptocurrency

Traditional stock investors face the wash sale rule, which disallows loss deductions when you repurchase the same security within 30 days. Crypto investors operate under different rules entirely. The IRS has not applied wash sale restrictions to digital assets, creating a unique advantage for portfolio management.

You can sell your Bitcoin position at a loss on Monday and repurchase the exact same amount on Tuesday without losing your tax deduction. This flexibility allows you to maintain market exposure while capturing tax benefits that stock investors cannot access.

Timing Your Losses to Offset Capital Gains

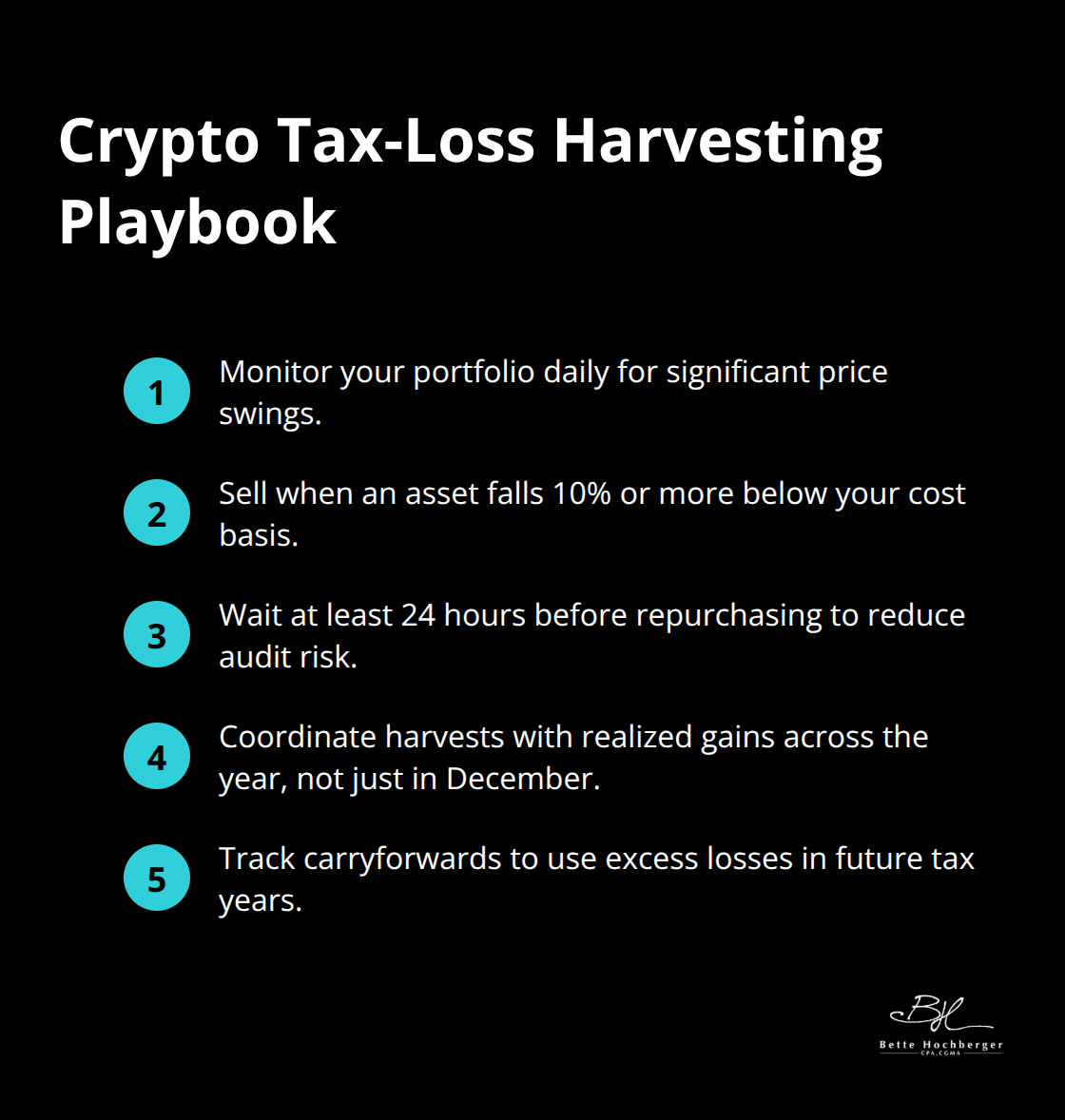

Markets typically experience their highest volatility during the first and last quarters of the year, presenting prime harvesting opportunities. Monitor your portfolio daily and execute sales when assets drop 10% or more below your cost basis.

Wait at least 24 hours before repurchasing to avoid potential IRS scrutiny (though no legal requirement exists). Coordinate your harvesting with other investment gains throughout the year rather than waiting until December.

This proactive method allows you to offset up to $3,000 in ordinary income annually, with excess losses carrying forward indefinitely.

Maximizing Tax Benefits Through Strategic Selling

Execute harvesting across multiple crypto assets simultaneously to maximize benefits. When Bitcoin drops, Ethereum often follows, creating opportunities to harvest losses on correlated assets while maintaining diversified exposure. Focus on assets with the highest unrealized losses first, as these provide the greatest immediate tax benefit.

Document every transaction with timestamps and prices, as the burden of proof lies entirely with you during audits. Professional crypto tax software like CoinTracker or Koinly automates this process and prevents costly documentation errors that could trigger penalties.

These harvesting strategies work best when combined with thoughtful asset allocation decisions that consider how different holding periods affect your overall tax liability.

Asset Allocation and Holding Period Considerations

Crypto investors who hold assets for 366 days or longer benefit from long-term capital gains treatment. Short-term gains face ordinary income tax rates up to 37%, while long-term rates cap at 20% for high earners. This 17-percentage-point difference means a $100,000 Bitcoin gain costs $37,000 in taxes if held short-term versus $20,000 long-term. The one-day difference between 365 and 366 days saves $17,000 on this transaction alone.

Long-Term vs Short-Term Capital Gains Tax Rates

The IRS applies ordinary income tax rates to crypto assets held for one year or less. High earners face rates up to 37% on short-term gains, while middle-income investors pay 22% to 24%. Long-term capital gains receive preferential treatment with rates of 0%, 15%, or 20% based on income levels.

The number 0% seems to be not appropriate for this chart. Please use a different chart type.

Investors with taxable income below $44,625 (single filers) or $89,250 (married filing jointly) pay zero tax on long-term crypto gains in 2023. This creates powerful opportunities for tax-free wealth accumulation through strategic timing of asset sales.

Strategic Asset Allocation Across Crypto Classes

Allocate your highest-conviction positions to assets you plan to hold long-term, such as Bitcoin and Ethereum for core holdings. Reserve speculative altcoins and DeFi tokens for short-term trades where you expect quick profits that justify higher tax rates.

Large-cap cryptocurrencies like Bitcoin show 60% correlation with traditional markets during crises, while smaller altcoins maintain lower correlations and provide better portfolio diversification. Position 70% of your portfolio in established cryptocurrencies for long-term holdings and limit speculative positions to 30% for active trades.

Tax-Advantaged Account Benefits for Crypto

Crypto IRAs are self-directed Individual Retirement Accounts that include digital currencies, with providers like BitcoinIRA and iTrustCapital offering direct cryptocurrency investments within retirement accounts. Traditional IRA contributions reduce current taxable income while Roth IRAs provide tax-free withdrawals in retirement.

The annual contribution limit of $6,500 for 2023 ($7,500 if over 50) represents significant tax savings when invested in high-growth crypto assets. Self-directed IRAs expand options further and allow investments in crypto operations that traditional IRAs cannot access.

Proper documentation becomes essential when you combine these allocation strategies with tax-advantaged accounts, as the IRS requires detailed records for all crypto transactions regardless of account type.

Record-Keeping and Documentation Requirements

Crypto investors face the burden of proof during IRS audits, which makes meticulous record-keeping your primary defense against penalties and additional taxes. Starting in 2025, Form 1099-DA will require crypto brokers to report extensive transaction information, underscoring the need for thorough documentation. The IRS requires documentation of every transaction including purchase date, sale date, cost basis, fair market value at time of transaction, and the purpose of each trade. Missing records can result in the IRS assuming zero cost basis, which means you pay taxes on 100% of proceeds rather than just gains. Professional crypto tax software like Koinly tracks over 350 exchanges and automatically calculates gains, losses, and tax liability across multiple wallets and platforms.

Essential Transaction Data Points

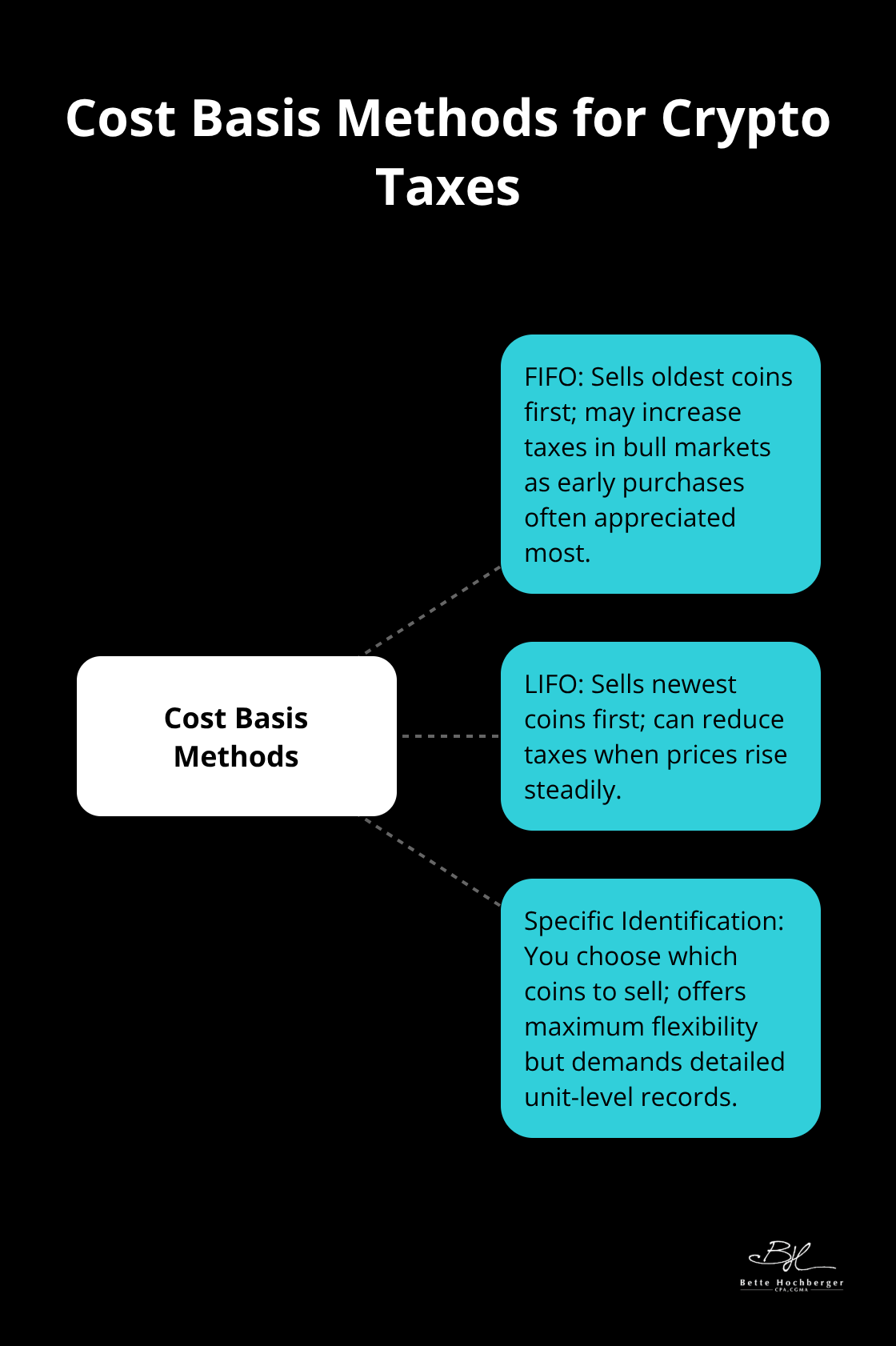

Document the exact timestamp, exchange used, transaction fees, wallet addresses, and counterparty information for every crypto transaction. Cost basis calculations become complex when you purchase the same cryptocurrency multiple times at different prices, which requires FIFO (first-in-first-out), LIFO (last-in-first-out), or HIFO (highest-in-first-out) accounting methods for tax reporting. The IRS defaults to FIFO unless you elect otherwise, and this often results in higher taxes during bull markets when early purchases appreciate most. Maintain separate records for mining rewards, staking income, airdrops, and DeFi transactions as each category faces different tax treatment and documentation requirements.

Professional Software Solutions

CoinTracker integrates with over 300 exchanges and generates IRS Form 8949 automatically, while TaxBit offers enterprise-grade solutions for high-volume traders with advanced portfolio analytics. These platforms cost $50 to $500 annually but save thousands in accounting fees and prevent costly errors that trigger audits. Manual spreadsheet tracking becomes impossible beyond 100 transactions and creates significant audit risk due to human error in complex calculations. Choose software that supports your specific exchanges, DeFi protocols, and NFT marketplaces to maintain complete transaction history across all platforms you use.

Cost Basis Calculation Methods

The IRS allows three methods for calculating cost basis: First-In-First-Out (FIFO), Last-In-First-Out (LIFO), and Specific Identification. FIFO assumes you sell your oldest holdings first, which typically results in higher taxes during bull markets. LIFO treats your newest purchases as the first sold, often reducing tax liability when prices rise consistently.

Specific Identification lets you choose exactly which coins to sell, providing maximum tax optimization flexibility (though it requires detailed records for each individual unit).

Final Thoughts

Effective crypto portfolio management combines tax-loss harvesting with strategic hold periods and meticulous documentation. The absence of wash sale rules for cryptocurrencies creates unique opportunities to harvest losses while you maintain market exposure, potentially saving thousands in taxes annually. Long-term hold strategies reduce tax rates from 37% to 20% for high earners, while proper cost basis tracking prevents the IRS from assuming zero basis during audits.

Professional crypto tax software automates complex calculations and maintains audit-ready records across multiple exchanges and wallets. The IRS collected $3.7 billion from crypto transactions in 2023, which signals increased enforcement that makes professional guidance essential. We at Bette Hochberger, CPA, CGMA help crypto investors minimize tax liabilities while maximizing returns through personalized financial services.

Start implementation of these strategies immediately rather than wait until year-end. Review your portfolio monthly for harvest opportunities, maintain detailed transaction records, and consult with tax professionals who understand cryptocurrency regulations. Proactive planning today prevents costly mistakes tomorrow.