Starting a business comes with countless expenses, but many entrepreneurs miss valuable tax deductions. The IRS allows significant write-offs for startup expenses that can reduce your tax burden substantially.

We at Bette Hochberger, CPA, CGMA see business owners leave thousands of dollars on the table each year. Understanding which costs qualify for deductions can transform your tax strategy and boost your bottom line.

What Startup Costs Can You Actually Deduct

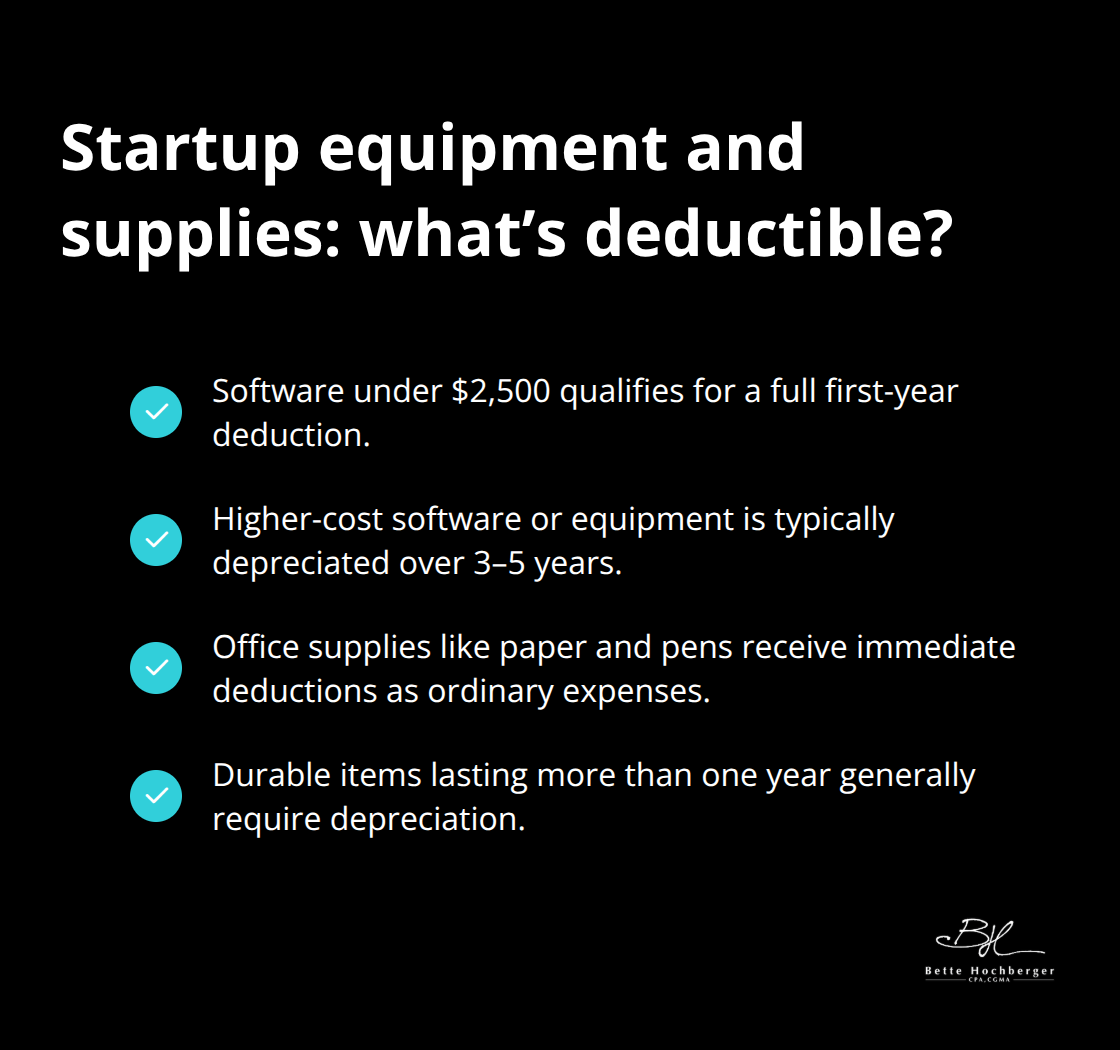

Equipment and Office Setup Write-Offs

Your office furniture, computers, and equipment purchases qualify for immediate deduction or depreciation based on their cost. Software purchases under $2,500 receive full deduction in the first year, while more expensive items require depreciation over three to five years. Office supplies like paper, pens, and basic materials qualify for immediate deduction as ordinary business expenses. The key difference lies in durability – items that last more than one year typically require depreciation, while consumable supplies receive immediate write-offs.

Professional Service Fees That Count

Legal fees for business formation, contract reviews, and regulatory compliance qualify as fully deductible startup expenses. Accounting services for book setup, initial tax planning, and business structure advice qualify for the Section 195 startup cost deduction of up to $5,000 in year one. Consulting fees for market analysis, business plan development, and operational setup also fall under deductible startup costs. The IRS requires these services relate directly to investigation or creation of your specific business venture to qualify for deductions.

Marketing Investments With Tax Benefits

Initial advertising campaigns, website development, and branding expenses qualify as deductible startup costs when you incur them before business operations begin. Social media advertising, print materials, and promotional events qualify for immediate deduction if they occur after your business launches. Market research expenses (including surveys and demographic studies) count as startup costs eligible for the $5,000 first-year deduction. Trade show participation, networking events, and initial customer outreach efforts also provide valuable deductions that reduce your tax liability while you build your customer base.

Research and Development Costs

Market research expenses for customer analysis and competitive studies qualify as startup deductions when conducted before operations begin. Product development costs, prototype creation, and testing expenses fall under the startup cost category (up to the $5,000 limit). Patent applications and intellectual property research also qualify for deduction as startup expenses. These research investments often represent significant upfront costs that many business owners overlook when calculating their tax benefits.

Many entrepreneurs miss additional deductible expenses that extend beyond these obvious categories.

Which Hidden Deductions Are You Missing

Home Office Deductions Most Entrepreneurs Ignore

Your home office qualifies for substantial deductions that most entrepreneurs completely overlook. The simplified method allows $5 per square foot for up to 300 square feet of dedicated business space, which provides up to $1,500 in annual deductions. The actual expense method often yields higher deductions when you claim proportional home expenses that include mortgage interest, property taxes, utilities, insurance, and maintenance costs. Your internet bill, phone service, and utility expenses become partially deductible when you maintain a dedicated workspace that serves exclusively business purposes.

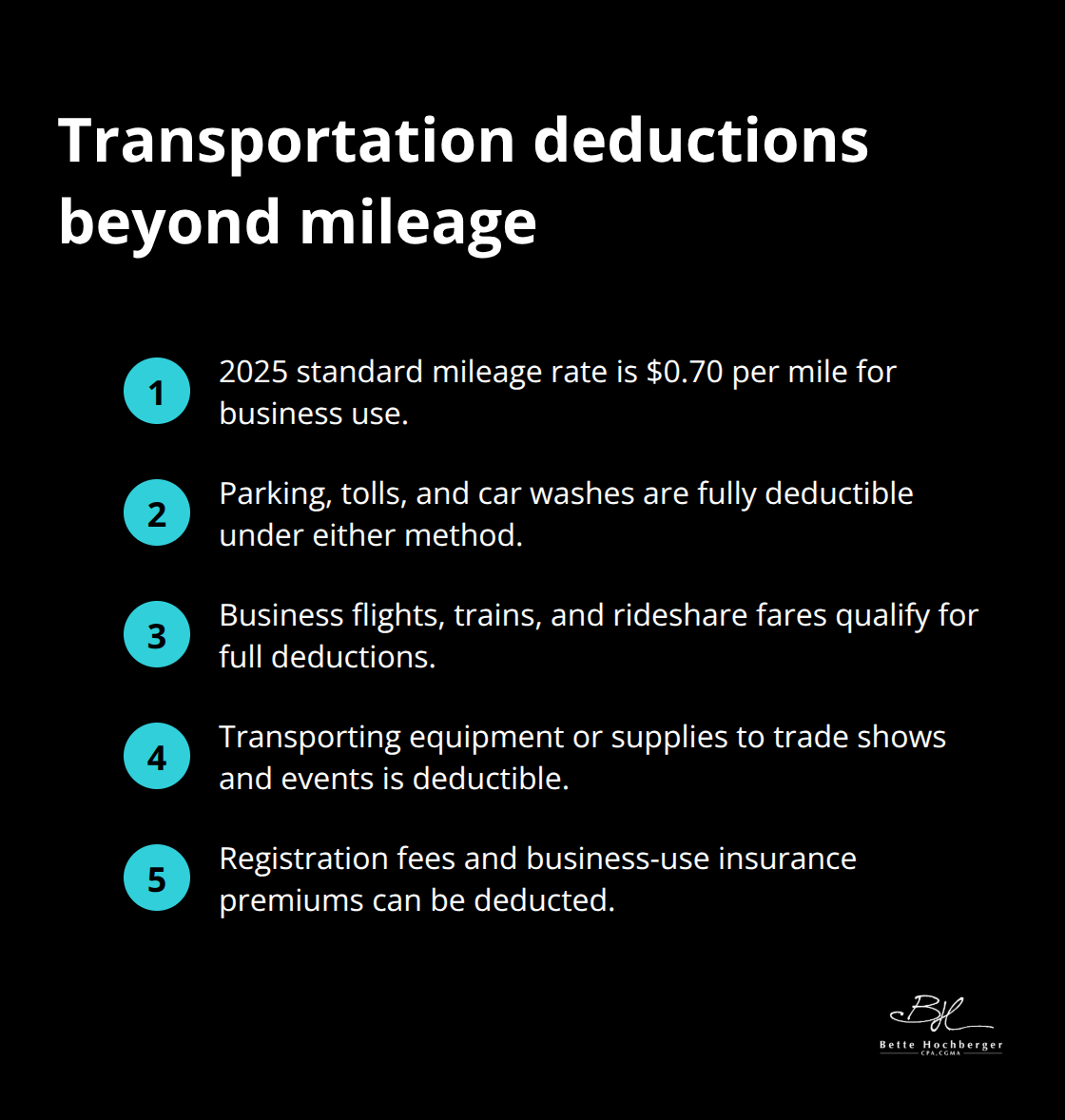

Transportation Costs Beyond Basic Mileage

Vehicle expenses extend far beyond the standard 70 cents per mile rate for 2025. Parking fees, tolls, and car washes for business trips qualify for full deduction regardless of which method you choose. Public transportation costs that include flights, trains, and rideshare services for business purposes receive complete tax benefits. Many entrepreneurs miss equipment transportation costs when they move office supplies or attend trade shows.

Vehicle registration fees and business-related insurance premiums also provide deductible expenses that reduce your overall tax burden substantially.

Development Expenses That Qualify

Patent research, prototype tests, and product development costs qualify as startup expenses eligible for the $5,000 first-year deduction limit. Software development tools, code platforms, and technical consultation fees fall under research and development categories. Industry conference attendance, professional development courses, and certification programs provide immediate deductions when they relate directly to your business operations. Laboratory fees, test services, and quality assurance expenses also qualify for deduction as ordinary business expenses rather than capital investments that require depreciation.

The IRS has specific rules and limits that govern how you can claim these startup expense deductions. Understanding these business deductions helps you maximize your tax savings while staying compliant.

What Rules Govern Your Startup Deductions

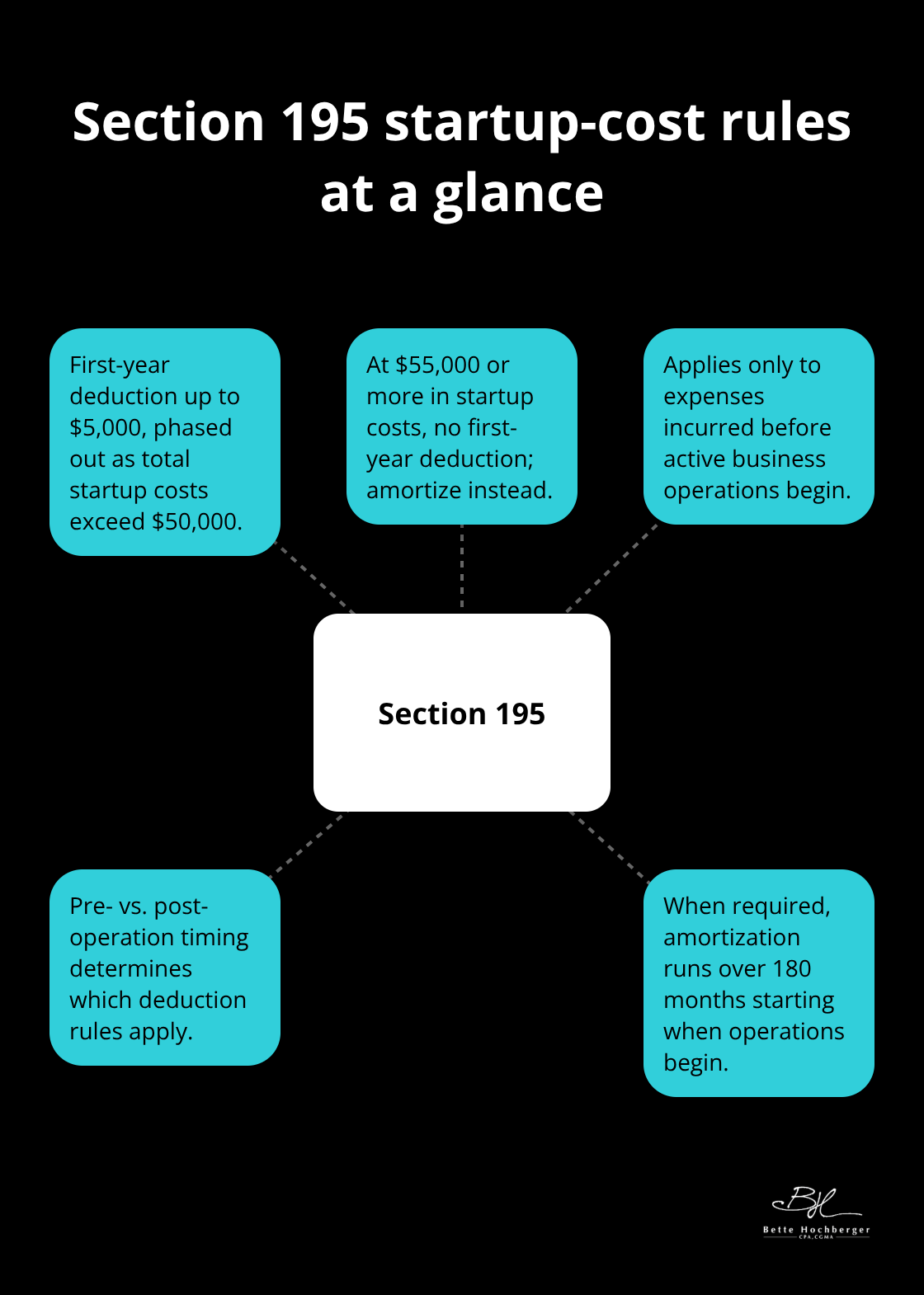

Section 195 Startup Cost Regulations

Section 195 of the Internal Revenue Code establishes strict parameters for startup cost deductions that many entrepreneurs misunderstand completely. The IRS permits you to deduct up to $5,000 in startup expenses during your first year of business operations, but this amount decreases dollar-for-dollar once your total startup costs exceed $50,000. If your startup expenses reach $55,000 or more, you forfeit the entire first-year deduction and must amortize all costs over 180 months instead.

This regulation applies specifically to expenses you incur before your business begins active operations. The IRS defines this moment as when you start to generate revenue or provide services to customers. The distinction between pre-operational and operational expenses determines which deduction rules apply to your business costs.

Timing Requirements for Deduction Claims

The IRS requires that startup expenses occur before you begin business operations to qualify for Section 195 treatment. Costs you incur after your first sale, service delivery, or revenue generation become ordinary business expenses subject to different deduction rules. You must elect to deduct startup costs on your first tax return that includes business income (missing this election means you lose the opportunity permanently).

The amortization period begins in the month your business starts operations, not when you incur the expenses. Documentation must clearly establish dates for each expense to prove they occurred during the qualifying pre-operational period. This timing requirement affects thousands of dollars in potential deductions for most startups.

Documentation Standards That Satisfy IRS Requirements

The IRS demands detailed documentation for every startup expense you claim, including receipts, invoices, contracts, and bank statements that show payment dates and business purposes. Your records must demonstrate that each expense directly relates to investigation, creation, or acquisition of your specific business rather than general business exploration.

Maintain separate files for startup costs versus regular business expenses, as mixing these categories during an audit creates compliance problems that cost time and money. Digital storage systems work effectively, but you need backup copies of all critical documents stored in multiple locations to prevent data loss that could invalidate your deductions. The IRS typically allows three years to audit returns, so maintain records for at least this period.

Final Thoughts

Startup expenses represent one of the most significant tax-saving opportunities for new business owners, yet most entrepreneurs fail to capture these deductions effectively. The combination of immediate write-offs and long-term amortization benefits can reduce your tax liability by thousands of dollars when you understand and apply the rules correctly. Professional guidance becomes invaluable when you navigate the complex requirements of Section 195 regulations and documentation standards.

We at Bette Hochberger, CPA, CGMA help businesses minimize tax liabilities through comprehensive deduction strategies. Our team works with startups to prevent costly mistakes while maximizing available deductions. Tax compliance requires expertise that protects your business from IRS penalties and audit complications.

Future tax years require systematic expense tracking and strategic timing of business investments (start this process immediately). Document every business-related expense from day one, maintain organized records throughout the year, and review your deduction opportunities quarterly rather than scramble during tax season. This proactive approach transforms tax preparation from a stressful obligation into a strategic advantage that supports your business growth and profitability.