Tax preparation can be a complex process for small business owners. Many wonder if the fees associated with this essential task are tax-deductible.

At Bette Hochberger, CPA, CGMA, we often field questions about the deductibility of tax preparation expenses. This post will clarify the rules and provide valuable insights for small business owners looking to maximize their deductions.

What Are Tax Preparation Fees?

Tax preparation fees encompass the costs associated with professional tax services. These fees cover a range of activities that help small business owners navigate the complex world of tax regulations and ensure compliance with IRS requirements.

Types of Tax Preparation Services

Tax preparation services typically include:

- Gathering financial information

- Analyzing tax documents

- Preparing tax returns

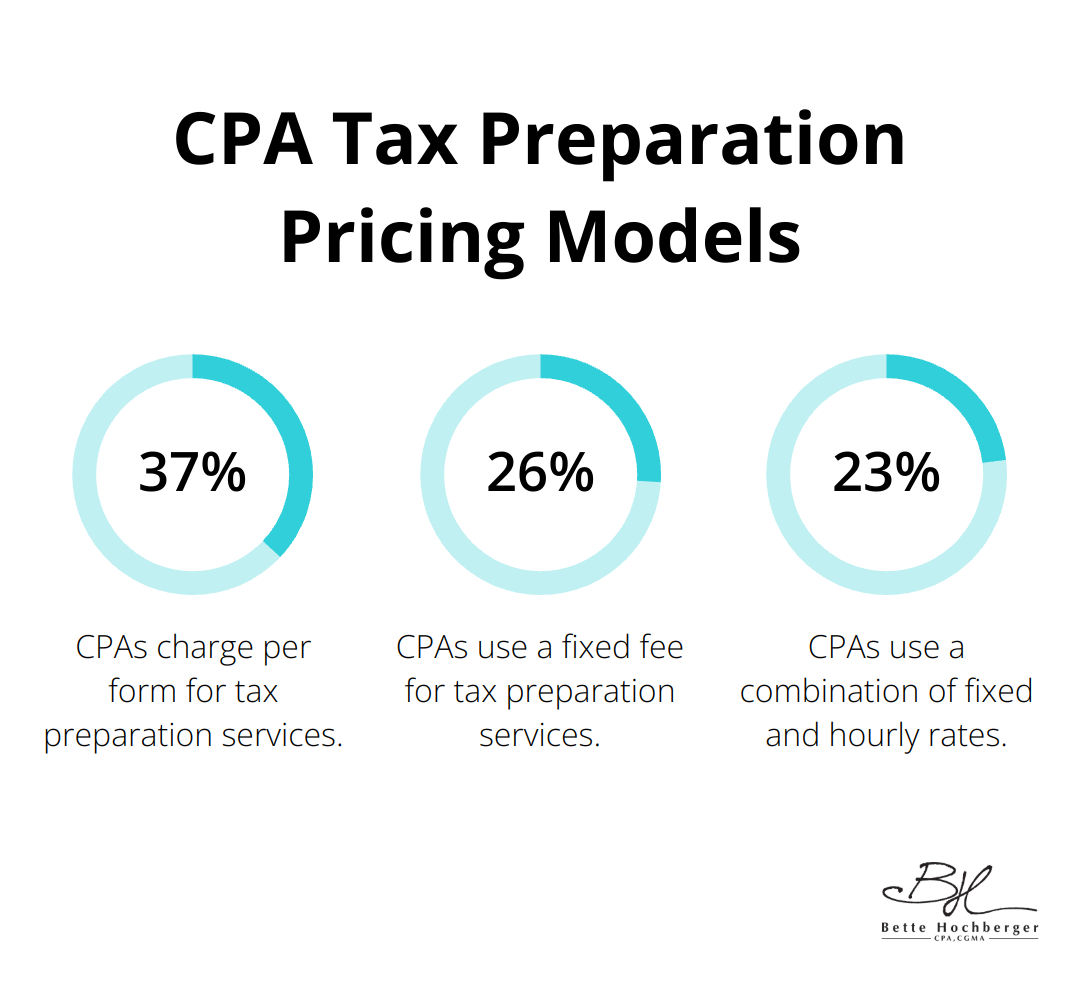

For small businesses, this might involve organizing receipts, reviewing profit and loss statements, and identifying potential deductions. According to Carson Thorn CPA, the pricing models for tax preparation services vary, with 37.8% of CPAs charging per form, 26.8% using a fixed fee, and 23.6% using a combination of fixed and hourly rates.

The Importance of Professional Tax Preparation

Professional tax preparation proves invaluable for small business owners. It extends beyond mere form-filling; it involves strategic financial planning. While professional tax preparation can be beneficial, it’s important to note that the quality of service can vary. A GAO report found significant preparer errors during undercover site visits to 19 randomly selected preparers, highlighting the importance of choosing a qualified professional.

Maximizing Deductions and Minimizing Errors

One of the primary benefits of professional tax preparation is the ability to maximize deductions. The IRS reports that small businesses often overpay their taxes due to missed deductions. A skilled tax preparer can identify these opportunities, potentially saving thousands of dollars.

Moreover, the complexity of tax laws leads to frequent errors. The IRS assessed nearly $33 billion in civil penalties in 2020, many of which could have been avoided with professional help.

The Role of Technology in Tax Preparation

Modern tax preparation often involves the use of advanced software and cloud-based solutions. These tools streamline the process, reduce errors, and provide real-time updates on tax law changes. They also facilitate secure document sharing and storage, which proves particularly useful for small businesses with limited administrative resources.

As we move forward, it’s important to understand how these fees fit into the broader context of tax deductibility. The next section will explore the specific rules governing the deductibility of tax preparation fees for small business owners.

Can Small Businesses Deduct Tax Preparation Fees?

The Deductibility of Tax Preparation Fees

The IRS allows small business owners to deduct tax preparation fees as a legitimate business expense. This deduction can reduce your taxable income, potentially saving you money during tax season.

Business vs. Personal Tax Preparation Fees

It’s important to distinguish between business and personal tax preparation fees. Business-related fees are deductible, while personal tax preparation costs are not. This rule has been in effect since the Tax Cuts and Jobs Act of 2017. The Act allows a deduction of up to 20% of qualified business income for owners of some businesses.

Qualifying Deductible Expenses

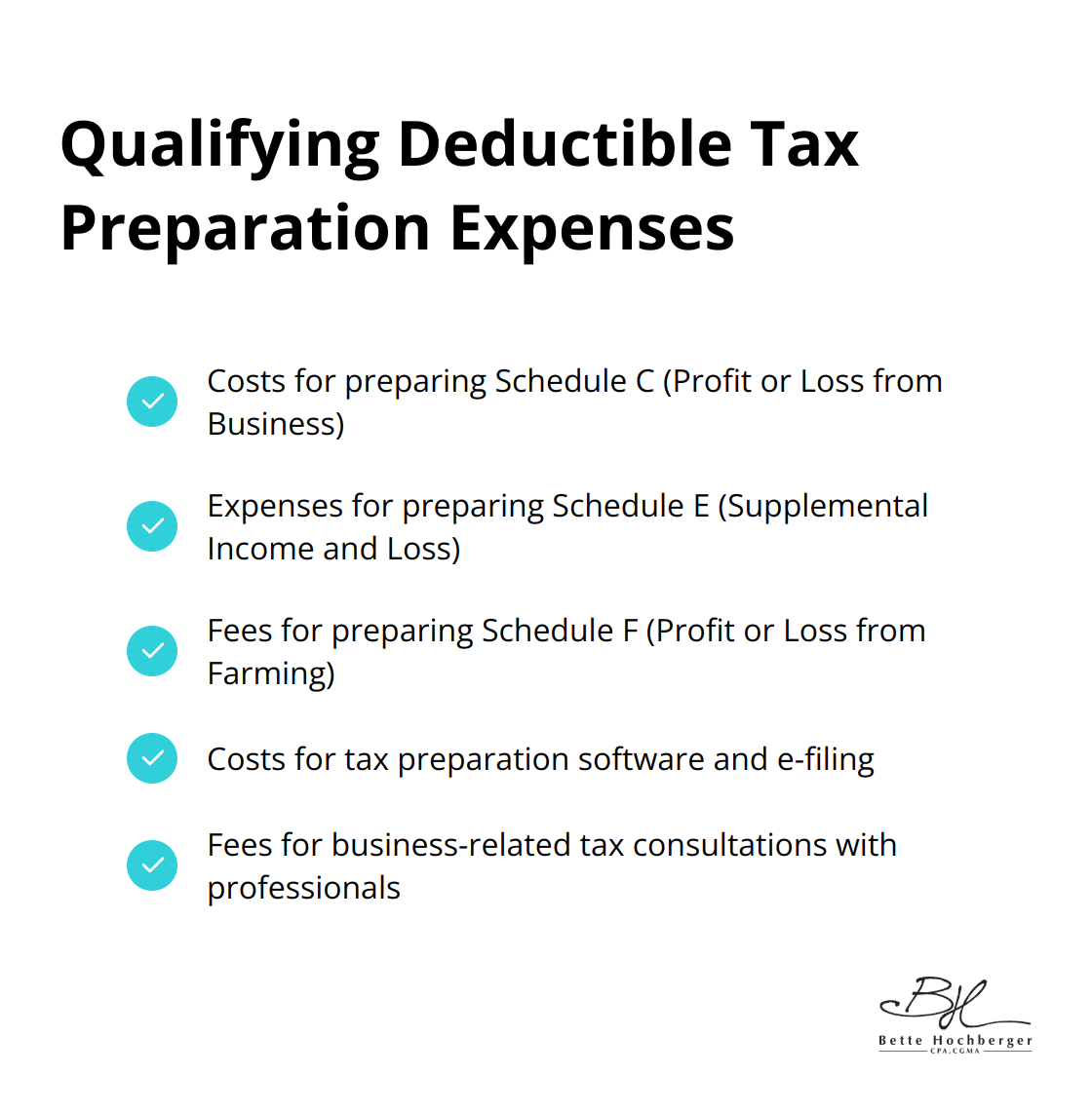

Tax preparation fees directly related to your business operations qualify for deduction. This includes costs for preparing:

- Schedule C (Profit or Loss from Business)

- Schedule E (Supplemental Income and Loss)

- Schedule F (Profit or Loss from Farming)

Fees for tax software, e-filing, and consultations with tax professionals about business matters also qualify.

Maximizing Your Deductions

To maximize your deductions, maintain detailed records of all tax preparation expenses. This includes receipts for software purchases, invoices from tax professionals, and documentation of any tax-related consultations. The IRS may request this information during an audit.

We recommend using separate credit cards or bank accounts for business expenses to simplify tracking. This practice not only aids in accurate deduction claims but also streamlines the overall tax preparation process.

The Value of Professional Assistance

While DIY tax preparation might seem cost-effective, professional assistance often pays for itself. Professional tax preparers can help you avoid costly mistakes and identify deductions you might otherwise miss.

As we move forward, it’s essential to understand how to effectively track and document these deductible expenses. The next section will explore strategies for maintaining accurate records and maximizing your tax benefits.

How to Maximize Tax Deductions for Your Small Business

Small business owners often miss out on valuable tax deductions. Let’s explore how you can maximize your deductions and retain more of your hard-earned money.

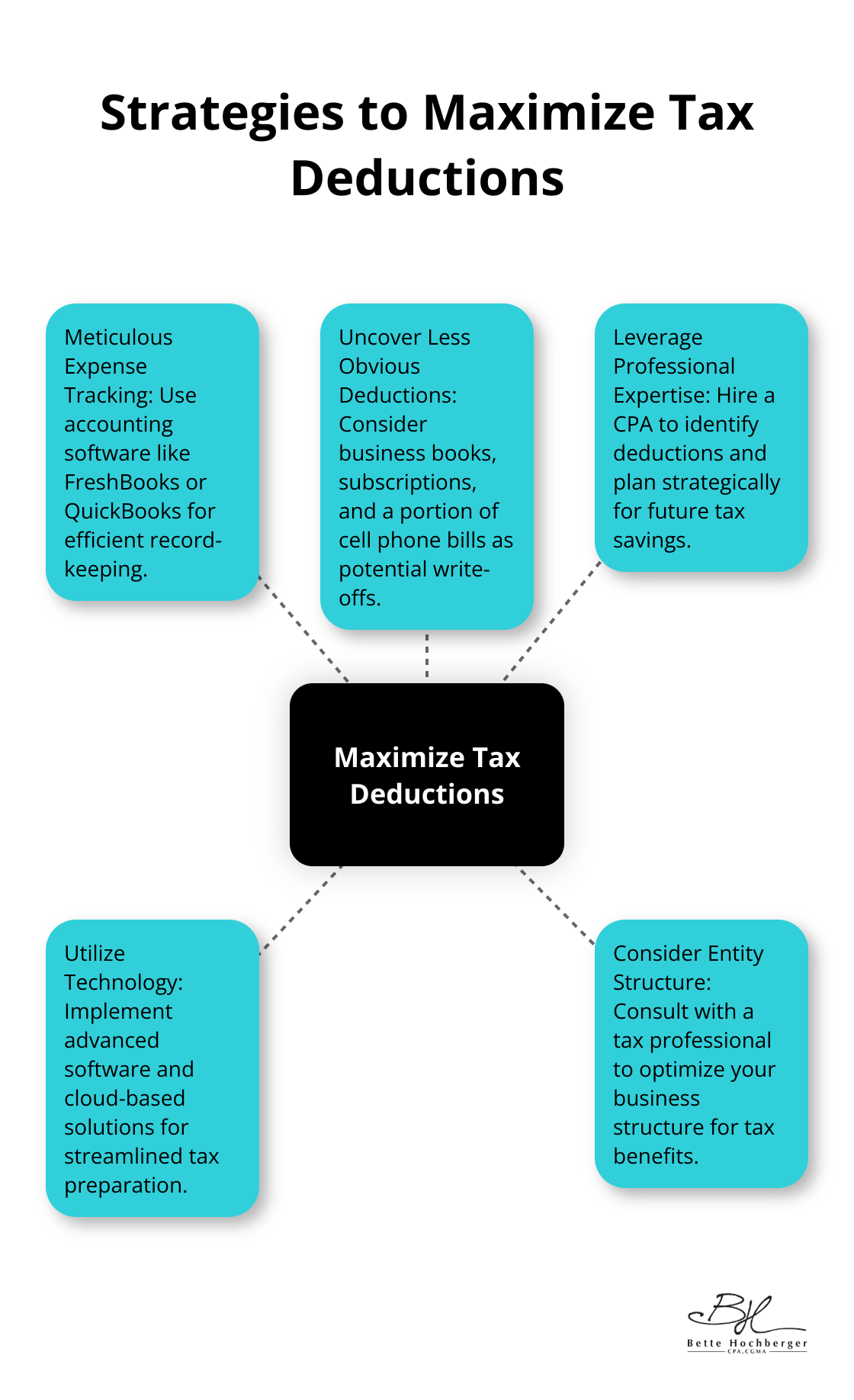

Meticulous Expense Tracking

The foundation of maximizing deductions is thorough record-keeping. Use accounting software like FreshBooks for affordability and efficiency, or consider QuickBooks Accounting for a pricier but robust option. These tools can help simplify expense tracking and categorization.

For cash expenses, a receipt scanning app proves useful. The IRS accepts digital copies, so you can discard paper receipts (just ensure you back up your digital records regularly).

Uncovering Less Obvious Deductions

Most business owners know about common deductions like office supplies and equipment, but many overlook less apparent write-offs. The cost of business books and subscriptions qualifies as a deduction. You can also write off a portion of your cell phone bill if you use it for work.

Vehicle expenses often go unclaimed. If you use your car for business, you can deduct either the actual expenses or use the standard mileage rate.

Leveraging Professional Expertise

A tax professional’s services can yield significant returns. CPAs make fewer errors and may be able to save you money by minimizing your tax bill and taking advantage of available deductions.

A skilled CPA identifies deductions you might miss and helps you plan strategically for the future. They stay current on tax law changes, which ensures you take advantage of every possible deduction.

Utilizing Technology for Tax Preparation

Modern tax preparation often involves advanced software and cloud-based solutions. These tools streamline the process, reduce errors, and provide real-time updates on tax law changes. They also facilitate secure document sharing and storage, which proves particularly useful for small businesses with limited administrative resources.

Considering Entity Structure

Your business entity structure impacts your tax obligations and available deductions. Consult with a tax professional to determine if your current structure (sole proprietorship, LLC, S-Corp, etc.) optimizes your tax situation. A change in entity structure could lead to substantial tax savings.

Final Thoughts

Tax preparation fees for small businesses offer a valuable opportunity to reduce taxable income. These deductions apply specifically to business-related tax preparation expenses, not personal ones. Small business owners must maintain meticulous records of all tax-related costs to maximize deductions and simplify the process during tax season.

Tax codes change frequently, and staying informed about tax laws and regulations ensures you take advantage of all available deductions while remaining compliant. Regular consultations with tax professionals can help you navigate these changes effectively. Professional tax preparation is an investment in your business’s financial health.

At our firm we specialize in helping small business owners optimize their tax strategies. Our team of experts offers personalized financial services, including strategic tax planning and preparation. We use advanced cloud technology to streamline processes and provide real-time updates on tax law changes (which can significantly impact your business).

I’ll see you next time!