The Alternative Minimum Tax (AMT) can be a perplexing aspect of the U.S. tax system for many taxpayers. At Bette Hochberger, CPA, CGMA, we often encounter clients who are caught off guard by this parallel tax structure.

Our guide aims to demystify the AMT, explaining who it affects and how it’s calculated. We’ll also share practical strategies to help minimize its impact on your finances.

What Is the Alternative Minimum Tax?

Definition and Purpose

The Alternative Minimum Tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits. The IRS introduced the AMT in 1969 to ensure individuals with substantial economic income pay at least a minimum amount of tax.

How the AMT Works

The AMT operates alongside the regular tax system. Taxpayers must calculate their tax liability under both systems and pay the higher amount. This dual calculation often results in unexpected tax bills for those unfamiliar with the process.

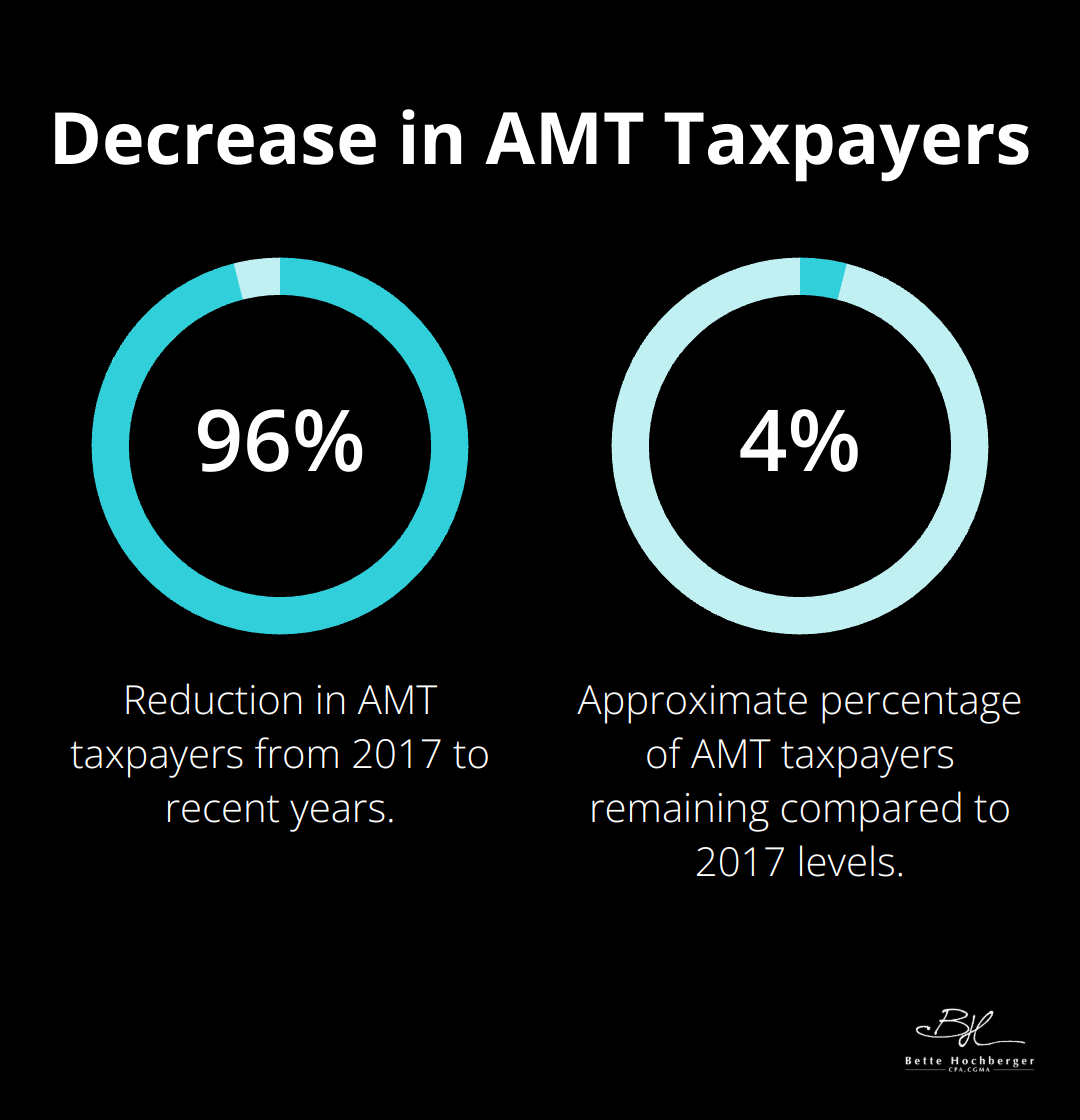

The Tax Policy Center projects that the number of AMT taxpayers fell from more than 5 million in 2017 to just 200,000 in recent years. This marks a significant decrease from before the Tax Cuts and Jobs Act (TCJA) of 2017.

However, the TCJA provisions will expire in 2025, which could increase the number of taxpayers impacted by the AMT.

Who’s Likely to Face the AMT?

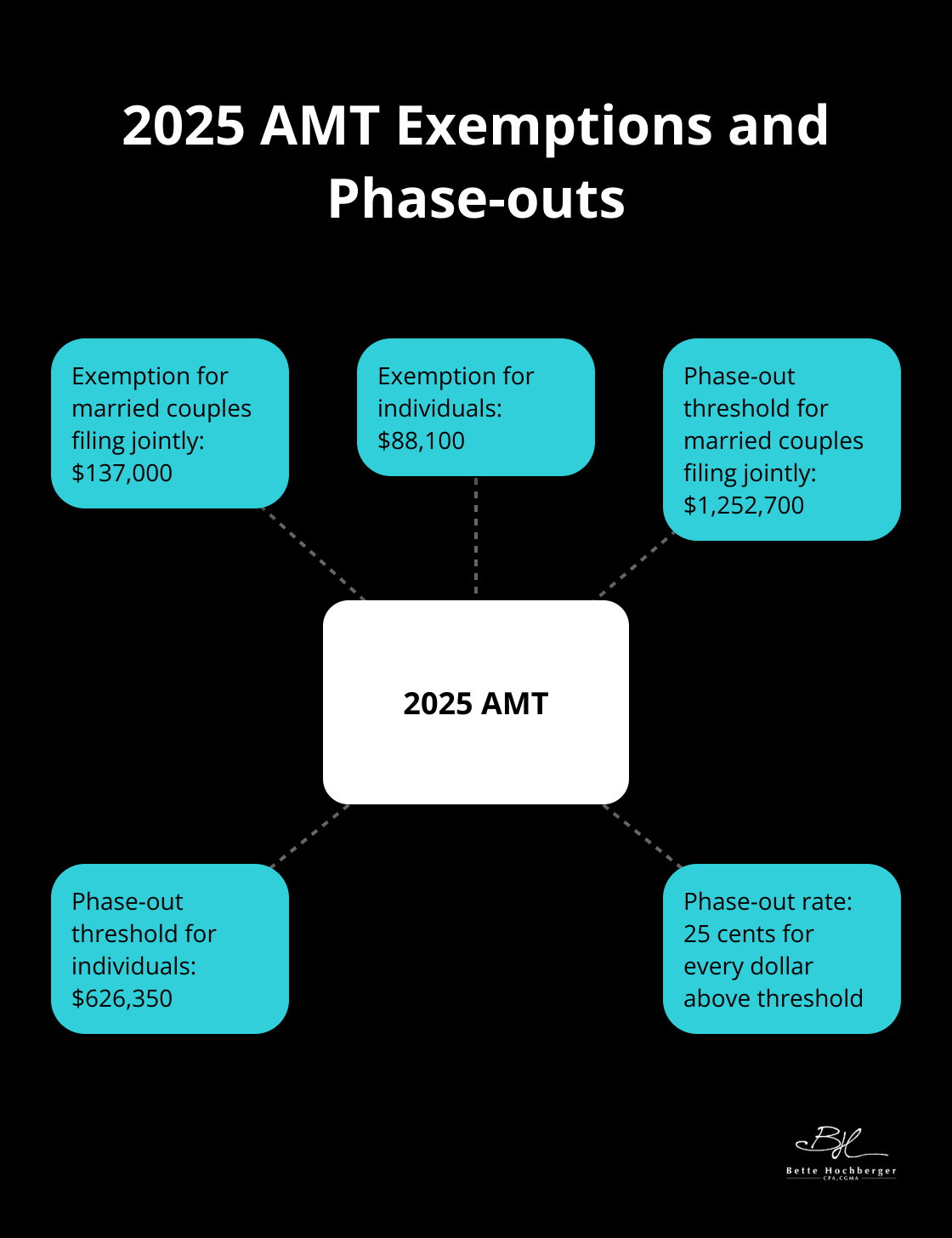

High-income earners are the primary targets of the AMT. For the 2025 tax year, the AMT exemption is $88,100 for individuals and $137,000 for married couples filing jointly. These exemptions begin to phase out at income levels of $626,350 for single filers and $1,252,700 for married couples.

Taxpayers with incomes exceeding $200,000 have a higher chance of being affected by the AMT. The likelihood varies depending on specific circumstances.

Key Differences from Regular Income Tax

The AMT differs from regular income tax in several important ways:

- It disallows many common deductions (such as state and local taxes and personal exemptions).

- The AMT uses only two tax rates: 26% for income up to $220,700 (or $110,350 for married filing separately) and 28% for income above these thresholds in 2025.

Some events can trigger AMT liability without actual cash movement. These include exercising incentive stock options or receiving significant capital gains.

Importance of Understanding AMT

Understanding the AMT is essential for effective tax planning. It’s advisable to consult with a tax professional or use reliable tax software to navigate its complexities and avoid unexpected tax liabilities. As we move forward, we’ll explore how to calculate the AMT and strategies to minimize its impact on your finances.

How to Calculate Your AMT Liability

Determining AMT Income

The Alternative Minimum Tax (AMT) calculation begins with your regular taxable income. You must add back certain deductions to determine your AMT income. These add-backs often include state and local taxes, personal exemptions, and miscellaneous itemized deductions. For instance, if you paid $15,000 in state and local taxes, you would add this amount back to your income for AMT purposes.

The IRS Form 6251 guides taxpayers through the necessary adjustments and preferences. Common adjustments include the exercise of incentive stock options, certain mortgage interest deductions, and private activity bond interest.

AMT Exemptions and Phase-outs

For the 2025 tax year, the AMT exemption amounts are:

- $137,000 for married couples filing jointly

These exemptions begin to phase out at higher income levels:

- $1,252,700 for married couples filing jointly

The phase-out reduces the exemption by 25 cents for every dollar of AMT income above these thresholds.

High-income earners may lose their entire exemption, which can increase their AMT liability significantly.

AMT Tax Rates

After you calculate your AMT income and apply the appropriate exemption, the AMT tax rates come into play. For 2025, there are two AMT tax rates:

- 26% for AMT income up to $220,700 ($110,350 for married filing separately)

- 28% for AMT income above these thresholds

These rates are generally lower than the top regular income tax rates. However, the broader tax base often results in a higher overall tax liability for those subject to AMT.

Importance of Accurate Calculations

Accurate AMT calculations require attention to detail and a thorough understanding of tax laws. While tax software can help, consulting with a tax professional is often the best way to ensure correct AMT liability calculations and explore strategies to minimize its impact.

Many taxpayers find themselves surprised by the AMT’s impact on their tax situation. For example, a high-earning executive might discover that substantial charitable donations don’t provide the expected tax relief due to AMT limitations. This underscores the importance of understanding how various financial decisions can affect your AMT liability.

As we move forward, we’ll explore strategies to help minimize the impact of AMT on your finances and discuss the importance of multi-year tax planning.

How to Minimize AMT Impact

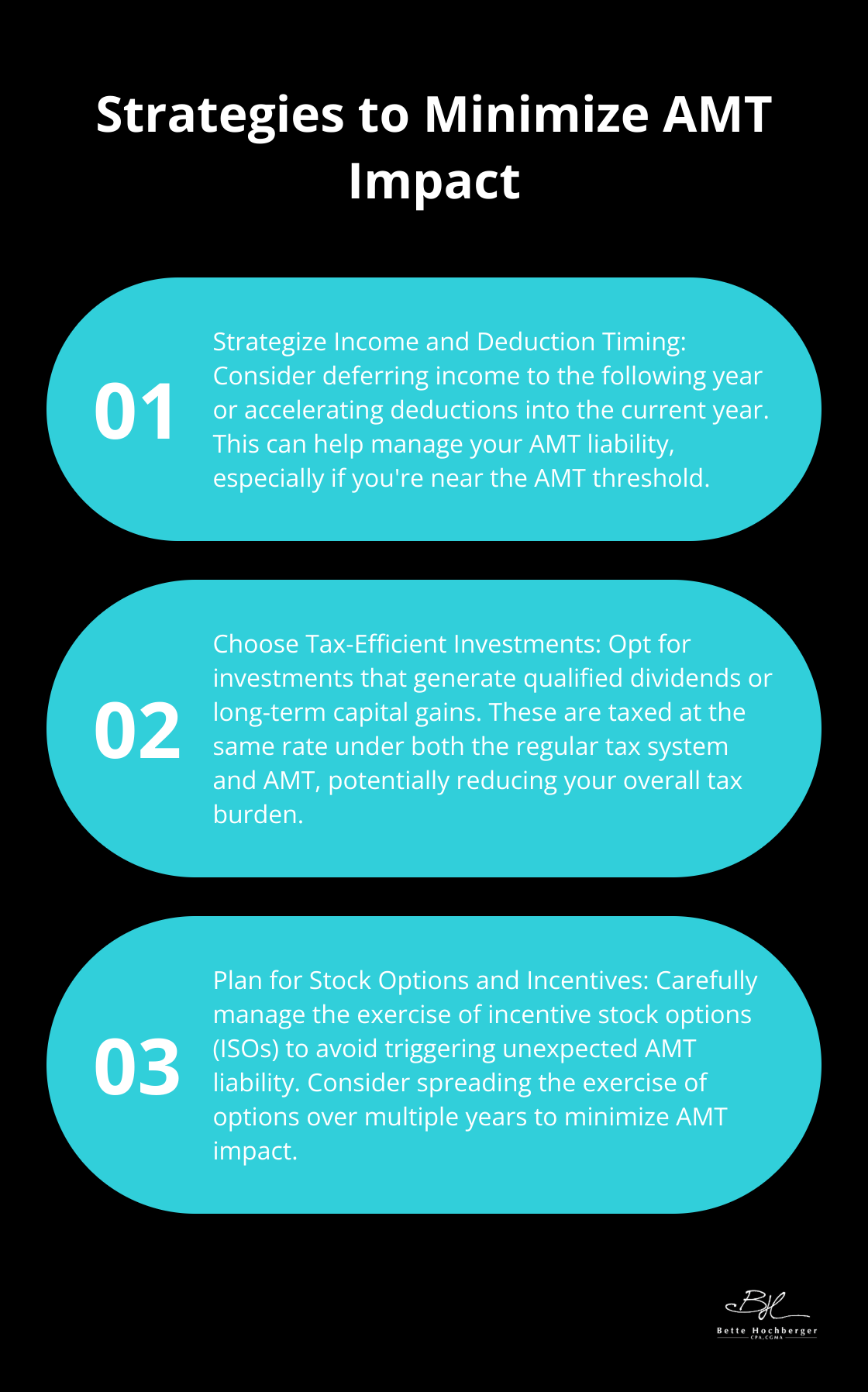

Strategize Income and Deduction Timing

The Alternative Minimum Tax (AMT) applies only to some taxpayers. However, you can minimize its impact through careful planning. If you’re near the AMT threshold, consider deferring income to the following year or accelerating deductions into the current year. Self-employed individuals might delay billing clients until January to push income into the next tax year. You could also prepay property taxes or make charitable donations before year-end to increase your deductions.

Be cautious with this approach, though. The IRS limits the deductibility of state and local taxes under the AMT system. In 2025, this deduction is capped at $10,000 for both single and married filers. Prepaying these taxes might not provide the expected benefit if you’re subject to AMT.

Choose Tax-Efficient Investments

Your investment strategy can play a significant role in managing AMT liability. Tax-exempt municipal bonds may be subject to the Alternative Minimum Tax (AMT). The interest from private activity bonds (a type of municipal bond) is tax-exempt for regular tax purposes but taxable under AMT rules.

Instead, try investments that generate qualified dividends or long-term capital gains. These are taxed at the same rate under both the regular tax system and AMT, potentially reducing your overall tax burden.

Plan for Stock Options and Incentives

If you receive stock options or participate in incentive plans, plan carefully. Exercising incentive stock options (ISOs) can trigger AMT liability, even if you don’t sell the shares. The spread between the exercise price and the fair market value of the stock at exercise is considered income for AMT purposes.

To mitigate this, consider exercising options early in the year. This gives you time to assess your potential AMT liability and decide whether to sell some shares to cover the tax. Alternatively, you might spread the exercise of options over multiple years to avoid a large AMT hit in a single year.

Implement Multi-Year Tax Planning

The AMT landscape is complex and ever-changing. What works one year might not be optimal the next. That’s why multi-year tax planning is essential. Work with a tax professional who can help you develop a comprehensive, long-term strategy tailored to your unique financial situation (such as the experts at Bette Hochberger, CPA, CGMA).

These strategies can help minimize AMT impact, but they should be part of a broader tax and financial planning approach. Your specific circumstances will dictate the most effective combination of strategies. Always consult with a qualified tax professional before making significant financial decisions based on AMT considerations.

Keep taxes low by maximizing your tax deductions and tax credits as part of your overall strategy to minimize AMT impact.

Final Thoughts

The Alternative Minimum Tax (AMT) remains a complex aspect of the U.S. tax system, designed to ensure high-income earners pay their fair share. Understanding AMT calculations, exemptions, and triggers will help you navigate its intricacies and potentially minimize its impact on your finances. The AMT landscape changes constantly, and you must stay informed about current regulations and potential future changes.

The Tax Cuts and Jobs Act reduced the number of taxpayers affected by AMT, but these provisions will expire in 2025. This expiration could increase AMT liability for many taxpayers, making proactive planning more important. A qualified tax professional can provide personalized advice tailored to your specific financial circumstances and help you develop strategies to manage your AMT exposure.

At Bette Hochberger, CPA, CGMA, we offer tax planning and preparation services, including AMT strategies. Our team can help you navigate the complexities of AMT, minimize your tax liabilities, and prepare for potential future changes in tax legislation. With the right knowledge and professional support, you can develop a tax strategy that aligns with your financial goals and minimizes unnecessary tax burdens.