Charitable deductions offer business owners a powerful way to support causes they care about while reducing their tax burden. At Bette Hochberger, CPA, CGMA, we’ve seen firsthand how strategic giving transforms both bottom lines and communities.

The difference between random donations and intentional charitable strategies is substantial. This guide shows you exactly how to structure your giving for maximum impact.

How Charitable Deductions Cut Your Business Taxes

Qualified charitable contributions directly reduce your business taxable income, but the mechanics depend on your business structure. C corporations claim charitable deductions at the corporate level, reducing taxable income dollar-for-dollar up to 10% of taxable income. Partnerships, S corporations, and sole proprietorships pass charitable deductions through to owners on their personal tax returns, where the 50% AGI limit applies to cash gifts and 30% to appreciated assets donated to public charities. This structural difference matters enormously-a C corporation donating $100,000 in appreciated stock saves roughly $21,000 in federal taxes at the 21% corporate rate, plus avoids capital gains tax on the appreciation itself. Your business structure determines whether you claim that deduction at the corporate level or on your personal return, which affects timing and overall tax efficiency.

A tax advisor can help you position charitable gifts where they deliver maximum value before year-end.

Timing Donations to Match High-Income Years

Year-end giving is standard practice, but strategic timing around income spikes delivers far better results. If you anticipate a business sale, large contract, or unusually profitable year, accelerate charitable contributions into that year to offset the spike. The IRS allows cash contributions up to 60% of AGI for individuals and 10% of taxable income for corporations, with appreciated securities capped at 30% of AGI. If your donation exceeds these limits, you can carry forward excess deductions for five additional years, but most business owners benefit more from concentrating gifts in high-income years. Donor-Advised Funds let you claim the deduction immediately in the high-income year while distributing grants to charities over subsequent years, solving the timing puzzle entirely. You fund the DAF with appreciated assets in 2025 when your income peaks, take the full deduction that year, then recommend grants to charities whenever you choose. This approach eliminates the pressure to identify specific charities by December 31 and removes the false choice between tax benefits and thoughtful giving.

Appreciated Assets Outperform Cash Donations

Donating appreciated securities, real estate, or inventory beats writing a check because you avoid capital gains tax while still deducting the full fair market value. If you own stock that appreciated $30,000 and donate it instead of selling, you eliminate that $30,000 capital gain entirely, saving roughly $4,500 in federal taxes at a 15% capital gains rate. The charitable deduction itself saves another $7,050 at a 35% tax bracket, totaling $11,550 in tax benefits from a single $50,000 donation. Most business owners miss this opportunity because they think about cash donations first. Appreciated inventory also qualifies for enhanced deductions if donated to help the ill, needy, or infants, allowing businesses to deduct up to 25% of net income rather than the standard limits. Food manufacturers and distributors benefit especially here-your business receives a tax benefit while moving inventory that might otherwise sit on shelves, creating dual value that pure cash giving cannot match.

Document Everything Before Year-End

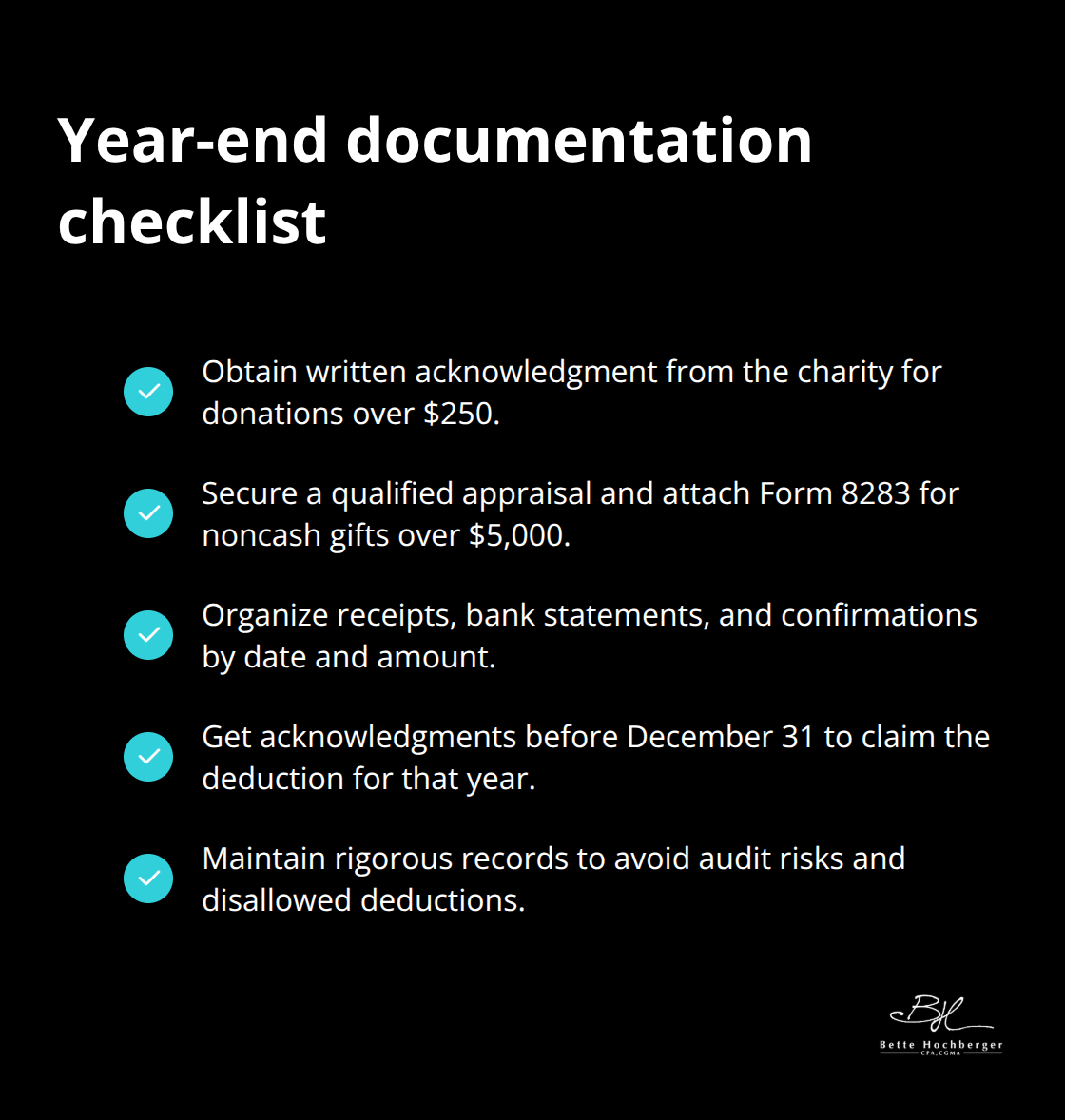

Proper documentation separates legitimate deductions from disallowed ones. The IRS requires written acknowledgment from the charity for donations over $250, including the amount, description of assets, and whether you received goods or services in return. For noncash assets exceeding $5,000, you need a qualified appraisal and Form 8283 attached to your tax return. Keep receipts, bank statements, and charity confirmations organized by donation date and amount. Missing documentation costs you the deduction entirely, regardless of whether the gift was legitimate.

Many business owners donate in December but fail to obtain written confirmation until January, missing the year-end deadline. Ensure your charity provides acknowledgment before December 31 so you can claim the deduction on that year’s return. Strategic charitable giving requires the same rigor you apply to other business expenses-sloppy recordkeeping transforms a tax benefit into a compliance risk that auditors scrutinize closely.

How to Structure Charitable Giving for Maximum Tax Efficiency

Donor-Advised Funds: Immediate Deductions, Flexible Timing

Donor-Advised Funds solve the timing problem that plagues most business owners. You contribute appreciated assets to a DAF, claim the full tax deduction immediately in the year you fund it, then recommend grants to charities over time. Fidelity Charitable distributed $14.9 billion to charities in 2024 and serves more than 350,000 donors using this exact structure. The mechanics work like this: you donate $100,000 in appreciated stock in December when your income spikes, deduct the full amount on that year’s return, avoid all capital gains tax on the appreciation, then spend the next several years strategically directing those funds to causes that matter.

Your money grows tax-free inside the DAF while sitting there, so if markets rise, your charitable impact compounds without annual tax drag. Most DAFs charge minimal fees and require no minimum contribution, making them accessible whether you’re giving $10,000 or $500,000. The psychological benefit matters too: you separate the tax decision from the giving decision, eliminating year-end pressure to identify charities quickly and allowing thoughtful, strategic philanthropy instead of rushed December donations.

Appreciated Assets and Inventory: The Dual Tax Win

Appreciated Assets and Inventory donations outperform every other giving method when structured correctly. Real estate, private stock, equipment, or inventory donated to qualified charities deliver dual tax wins that cash cannot match. A business donating appreciated real estate worth $500,000 with a cost basis of $200,000 avoids $45,000 in capital gains tax while claiming a $500,000 charitable deduction, totaling roughly $220,000 in federal tax savings at a combined 35 percent rate.

Food and beverage companies benefit from enhanced inventory deductions allowing up to 25 percent of net income rather than standard limits, meaning a manufacturer with $2 million in net income can deduct up to $500,000 in qualified food donations. The key is working with a qualified appraiser and your tax advisor before donating noncash assets, because valuation errors and missing documentation eliminate deductions entirely. Direct donations of appreciated assets work best when you’ve held them long enough to establish substantial unrealized gains, making them far more valuable than liquidating and donating cash.

Charitable Remainder Trusts for Ongoing Income

Charitable Remainder Trusts provide income streams for business owners seeking ongoing cash flow alongside charitable impact. These trusts allow you to donate appreciated assets, receive regular distributions during your lifetime, and ultimately transfer remaining assets to charity. The structure works well for owners who want both personal income and philanthropic legacy, though it involves greater complexity and upfront costs that typically make sense only for donations exceeding $250,000.

A CRT can hold appreciated real estate or securities, distribute income to you monthly or annually, and eventually benefit your chosen charities. This approach appeals to business owners nearing retirement who want to convert illiquid assets into reliable income while securing substantial tax deductions. Your tax advisor can model whether a CRT makes sense for your specific situation and asset mix, comparing it against simpler alternatives like DAFs or direct donations.

Working With Your Tax Advisor on Asset Valuation

Proper valuation separates legitimate deductions from disallowed ones when donating noncash assets. The IRS requires qualified appraisals for noncash donations exceeding $5,000, and Form 8283 must attach to your tax return documenting the asset description, valuation method, and appraiser credentials. Valuation errors trigger audits and deduction denials, so engage a qualified appraiser before committing to any noncash gift. Your tax advisor works alongside the appraiser to confirm the valuation supports your deduction and complies with IRS standards, protecting you from aggressive positions that invite scrutiny.

Real estate, private business interests, and specialized equipment require particularly careful appraisals because fair market value isn’t always obvious. An appraiser with experience in your asset type (real estate, equipment, art, or securities) produces credible documentation that withstands IRS review. Coordinating with your tax advisor ensures the appraisal methodology aligns with IRS Publication 561 standards and that you’ve documented everything needed to support the deduction on your return.

Timing Your Gifts Around Business Events

Strategic timing around income spikes delivers far better results than standard year-end giving. If you anticipate a business sale, large contract, or unusually profitable year, accelerate charitable contributions into that year to offset the spike. The IRS allows cash contributions up to 60 percent of AGI for individuals and 10 percent of taxable income for corporations, with appreciated securities capped at 30 percent of AGI. If your donation exceeds these limits, you can carry forward excess deductions for five additional years, but most business owners benefit more from concentrating gifts in high-income years.

A business sale, partnership dissolution, or major contract win creates the perfect opportunity to fund a DAF or donate appreciated assets you’ve held for years. These events generate substantial taxable income, making charitable deductions especially valuable in offsetting that spike. Creating a small business tax strategy before the transaction closes allows you to structure the gift timing and asset type for maximum efficiency, transforming a one-time windfall into lasting philanthropic impact.

Where Charitable Donations Actually Go Wrong

Most business owners lose substantial tax benefits through preventable mistakes that auditors spot immediately. The IRS disallowed substantial charitable deductions, with the majority stemming from documentation failures rather than ineligible gifts. Missing written acknowledgment from charities, donating assets that don’t qualify, or overlooking industry-specific deductions turns legitimate giving into wasted opportunities. These errors compound because you lose not only the deduction itself but also face potential penalties and audit exposure that cost far more than the original tax savings would have delivered.

Documentation Failures Cost You Everything

The IRS requires written acknowledgment from the charity for any donation exceeding $250. The acknowledgment must specify the donation amount, describe what was donated, confirm whether you received any goods or services in return, and come directly from the charity before you file your return. Missing this single document eliminates your deduction completely, regardless of whether you gave $1,000 or $100,000.

Most business owners donate in December but fail to obtain written confirmation until January, then claim the deduction on their current-year return. The IRS disallows these deductions automatically. For noncash assets exceeding $5,000, you need a qualified appraisal completed before the donation and Form 8283 attached to your return, with the appraiser’s signature and credentials documented. Underestimating the value of donated real estate or equipment invites audits because auditors access comparable sales data and market records that expose inflated appraisals immediately.

Clients often value donated equipment at replacement cost rather than fair market value-completely different numbers that trigger audit flags. Keep receipts organized by donation date, charity name, and asset description. Request written confirmation from each charity before year-end, then store these acknowledgments with your tax return permanently. This discipline takes minimal time but protects you from automatic deduction denials.

Non-Qualified Recipients and Asset Types Disqualify Gifts

Donating to organizations that lack IRS qualification status wastes your tax benefit entirely. The IRS maintains the Tax Exempt Organization Search tool where you can verify whether a charity qualifies before donating. Many business owners donate to political organizations, foreign charities, or private foundations that don’t meet section 170(c) requirements, then claim deductions that the IRS immediately disallows.

Contributions to Canadian organizations are generally not deductible unless you have Canadian-source income and the organization qualifies under tax treaty rules. Donating appreciated securities works beautifully for stocks and bonds held long-term, but donating personal use property like vehicles or artwork typically caps deductions at fair market value minus depreciation, eliminating the appreciation benefit entirely.

Some assets don’t qualify for deduction at all. If you donate inventory that doesn’t meet the enhanced deduction rules for food or medical supplies, you can only deduct the cost basis, not the retail value. A business with $50,000 in surplus equipment can deduct only its remaining book value, not what you could sell it for. Appreciated real estate works better than appreciated equipment because fair market value is easier to establish and document. Before donating any noncash asset, verify that both the recipient organization and the asset type qualify for the deduction you’re planning.

Industry-Specific Deductions Most Businesses Miss Entirely

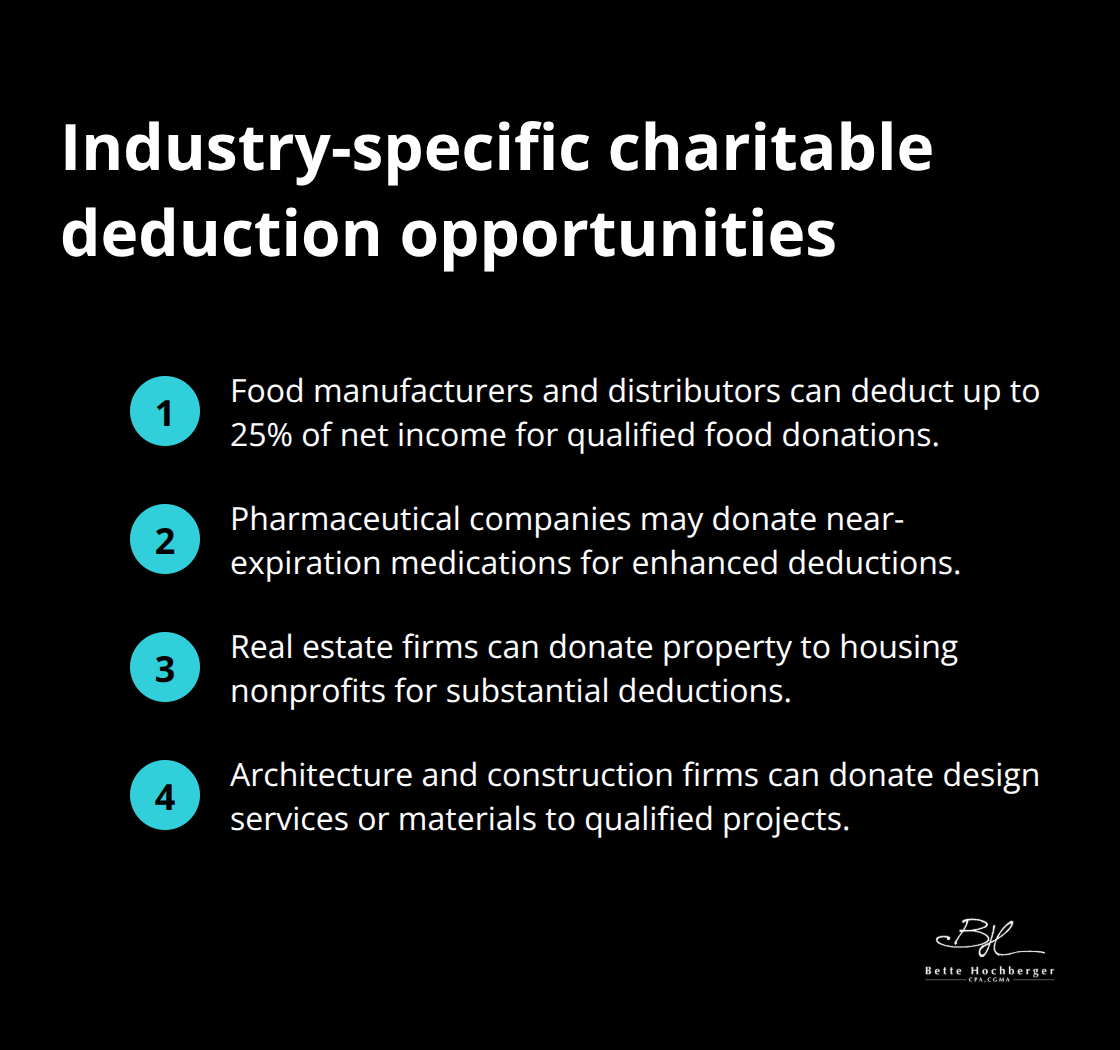

Food manufacturers and distributors qualify for enhanced inventory deductions when donating to food banks, food rescue organizations, or programs serving the ill, needy, or infants. A food company with $2 million in annual net income can deduct up to $500,000 in qualifying food donations, compared to the standard 10 percent corporate limit for other inventory. Most food businesses donate nothing because they don’t understand this opportunity exists.

Pharmaceutical companies can donate medications nearing expiration dates to qualifying organizations and receive enhanced deductions as well. Real estate firms donating property to housing nonprofits or community development organizations can structure gifts to generate substantial deductions while supporting affordable housing initiatives. Architectural and construction firms can donate design services or materials to qualified charitable projects.

These industry-specific rules exist precisely because they align business assets with community needs, creating mutual benefit that general donation rules don’t capture. Your industry likely has specialized giving opportunities that generic tax advice never mentions. Speaking with a tax advisor who understands your specific business type reveals deduction strategies that competitors miss entirely. The IRS published detailed guidance on enhanced inventory deductions in Publication 526, but few business owners consult it. If your business generates inventory surplus, expired products, or specialized assets, ask your tax advisor whether your industry qualifies for enhanced deductions before donating anything.

Final Thoughts

Strategic charitable deductions transform how your business operates and what your community receives. When you align donations with tax strategy, you create genuine impact while reducing your tax burden substantially. The businesses that succeed at charitable giving treat it as a core financial decision, not an afterthought squeezed into December.

Your charitable deductions work hardest when you structure them intentionally-timing gifts around high-income years, donating appreciated assets instead of cash, and using vehicles like Donor-Advised Funds multiply the value of every dollar you give. A $100,000 donation structured correctly can generate $30,000 or more in tax savings, freeing capital for reinvestment or additional giving. That efficiency matters because it means your business supports more causes while strengthening your bottom line.

Connect charitable giving to your broader financial strategy by reaching out to Bette Hochberger, CPA, CGMA to discuss how strategic charitable deductions can strengthen both your business and the causes you care about. We help businesses structure tax planning that includes charitable giving aligned with your specific situation, whether you anticipate a business sale, manage consistent profitability, or seek to maximize community impact. We position charitable deductions where they deliver maximum value for your business and your community.