Bonus depreciation remains one of the most powerful tax-saving tools available to businesses, yet many taxpayers leave thousands of dollars on the table each year.

The current rules allow businesses to deduct 60% of qualifying asset costs immediately in 2024, with rates continuing to phase down through 2027. We at Bette Hochberger, CPA, CGMA see clients regularly miss these opportunities due to timing mistakes and documentation errors.

Understanding the strategic applications can transform your tax liability significantly.

How Does Bonus Depreciation Actually Work

The Mechanics Behind Immediate Deductions

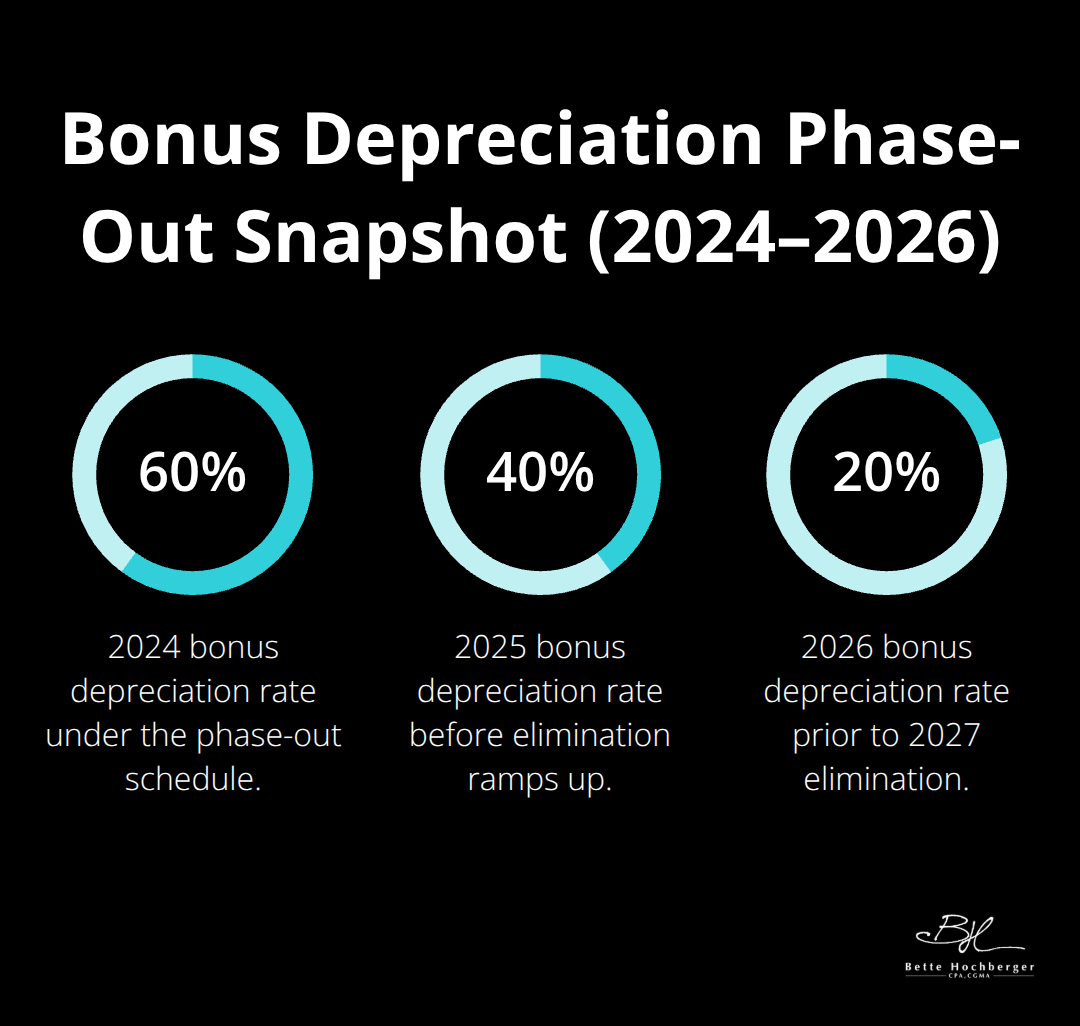

Bonus depreciation functions as an accelerated write-off that allows businesses to deduct a substantial percentage of asset costs in the purchase year, rather than spread deductions over the asset’s useful life. The Tax Cuts and Jobs Act temporarily expanded this benefit to 100% for assets placed in service between September 27, 2017, and December 31, 2022. The current phase-out schedule reduces these percentages: 80% in 2023, 60% in 2024, 40% in 2025, 20% in 2026, and complete elimination in 2027.

The One Big Beautiful Bill Act changed this trajectory permanently for assets acquired and placed in service after January 19, 2025, and reinstated 100% bonus depreciation. Assets purchased between January 1, 2025, and January 19, 2025, remain limited to the 40% rate. Unlike Section 179 deductions (which cap at $1.22 million for 2024 with income limitations), bonus depreciation has no dollar limits and can exceed your annual income, which creates net losses that carry forward.

Property Requirements and Asset Types

Assets must have a Modified Accelerated Cost Recovery System recovery period of 20 years or less to qualify. This includes computer equipment, office furniture, vehicles, and production machinery. Qualified improvement property, which encompasses interior upgrades to commercial buildings like new flooring or HVAC systems, also qualifies. The asset must be new to your business and placed in service during the tax year you claim the deduction.

Software purchases and certain film production costs qualify as well, which expands opportunities beyond traditional equipment purchases. The IRS requires that you acquire the property from unrelated parties and that the asset serves your business operations directly.

Acquisition Date Rules and Rate Determination

The acquisition and service dates determine your depreciation rate under current ltaxaw. Assets acquired before January 20, 2025, qualify for only 40% bonus depreciation regardless of when you place them in service. Smart businesses accelerate purchases of assets before year-end to maximize current-year deductions and improve cash flow immediately.

Cost Segregation Opportunities

Cost segregation studies can reclassify building components into shorter recovery periods, which converts what would be 39-year depreciation into immediate bonus depreciation opportunities. These studies identify qualifying improvements that contractors often bundle into longer depreciation schedules (such as specialized lighting, flooring, or equipment installations). Professional cost segregation analysis on any commercial property acquisition can reveal substantial additional deductions that many businesses overlook completely.

The strategic application of these rules becomes even more powerful when you understand how they compare to other depreciation methods and when you time your purchases correctly.

Strategic Applications for Maximum Tax Savings

Section 179 vs Bonus Depreciation Decision Framework

Section 179 works best for smaller purchases under $1.22 million, while bonus depreciation dominates for larger investments. The Section 179 deduction phases out dollar-for-dollar once equipment purchases exceed $3.05 million, which makes it ineffective for substantial capital investments. Bonus depreciation has no income limitations or purchase caps, which means you can deduct 60% of a $10 million equipment purchase in 2024.

The key difference lies in flexibility: Section 179 requires sufficient business income to claim the full deduction, while bonus depreciation creates net operating losses that carry forward to future tax years. You can combine both methods in the same tax year to maximize your total deduction.

Asset Purchase Schedule Optimization

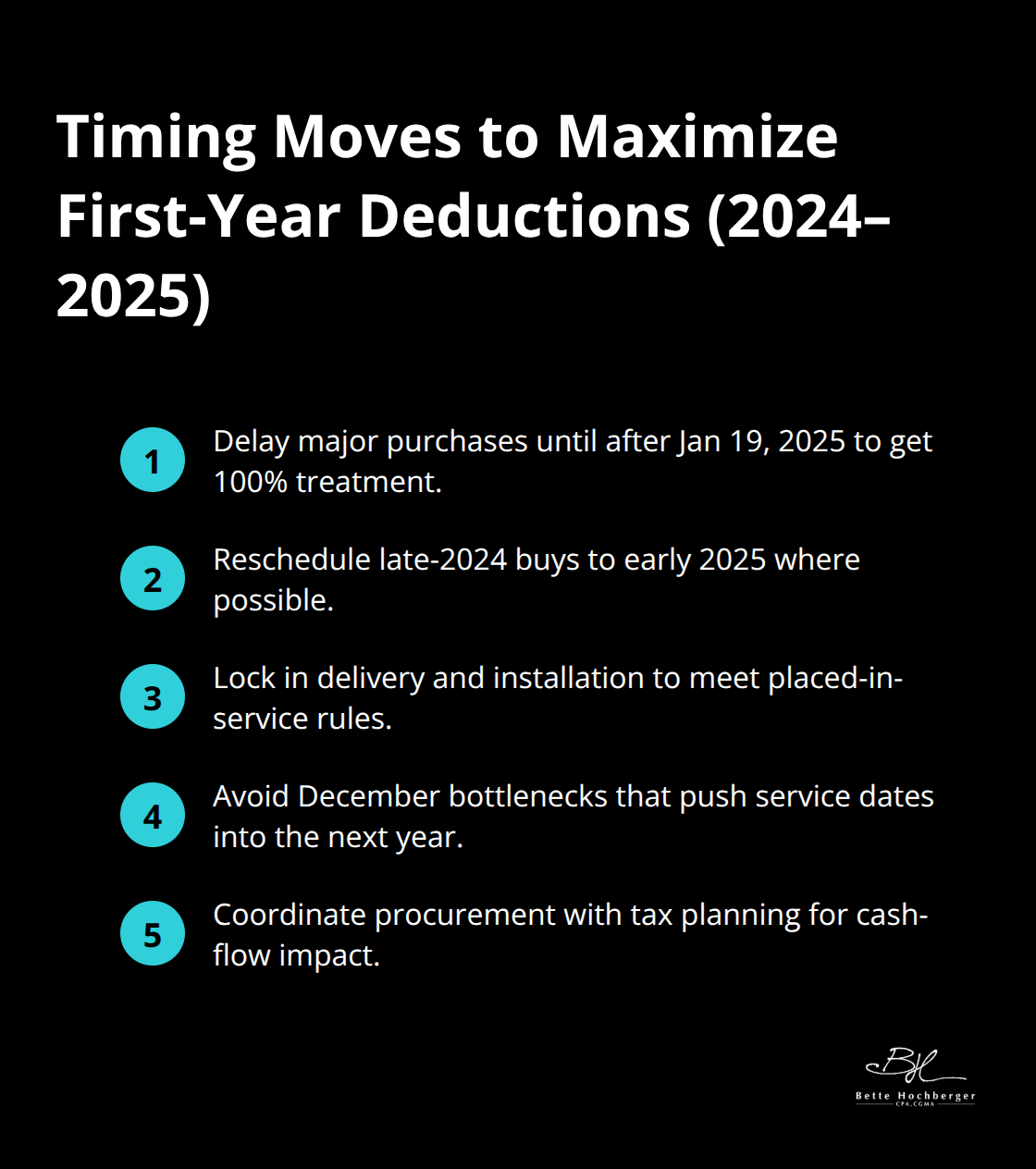

Purchase dates determine your depreciation rate under current law. Assets acquired before January 20, 2025, qualify for only 40% bonus depreciation, while those acquired after this date receive 100% treatment. This creates a 60-percentage-point advantage for postponing major purchases just 19 days into 2025.

Businesses should delay equipment acquisitions scheduled for late 2024 or early January 2025 to capture the full deduction. The placed-in-service requirement means you must actually use the asset before year-end to claim the deduction, so plan delivery and installation schedules accordingly. December purchases often create logistical challenges that can push service dates into the following year.

Manufacturing Facility Investment Opportunities

Qualified production property now qualifies for 100% bonus depreciation through 2032, which creates unprecedented opportunities for manufacturing facility investments. New construction projects that start after January 19, 2025, or previously non-manufacturing facilities converted to production use qualify for immediate write-offs.

This applies to entire manufacturing buildings, not just equipment inside them. The IRS defines qualified production property as nonresidential real property used in manufacturing, which includes warehouses, production floors, and specialized manufacturing structures. Companies can write off millions in facility costs immediately rather than depreciate over 39 years.

Real Estate Investment Acceleration Strategies

Real estate investors should focus on qualified improvement property within commercial buildings, as interior renovations like new HVAC systems, flooring, and lighting systems qualify for immediate deductions. Cost segregation studies on any commercial property acquisition identify and reclassify certain components of a commercial or income-producing property into shorter depreciation categories.

These studies transform 39-year depreciation schedules into immediate tax benefits. Professional cost segregation analysis costs $5,000-$15,000 but often generates six-figure deductions that would otherwise take decades to claim. The analysis reclassifies building components into asset categories with recovery periods of 5, 7, or 15 years instead of 39 years.

Smart investors coordinate their property acquisitions with cost segregation studies to maximize first-year deductions. However, these aggressive depreciation strategies create significant recapture obligations that require careful strategic tax planning to avoid costly mistakes.

Common Mistakes That Cost Taxpayers Money

Qualified Improvement Property Classification Errors

The most expensive mistake involves classifying qualified improvement property as 39-year real estate instead of bonus depreciation assets. Interior renovations like new flooring, lighting systems, fire safety equipment, and HVAC upgrades qualify for immediate deductions when taxpayers document them properly. The IRS requires these improvements to occur after the building’s initial placement in service, which excludes original construction components from qualification.

Taxpayers lose significant first-year deductions when they treat these improvements as long-term real estate depreciation. Professional cost segregation studies help accelerate depreciation, reduce taxes, and boost cash flow, but many businesses skip this analysis and accept standard depreciation schedules from their contractors.

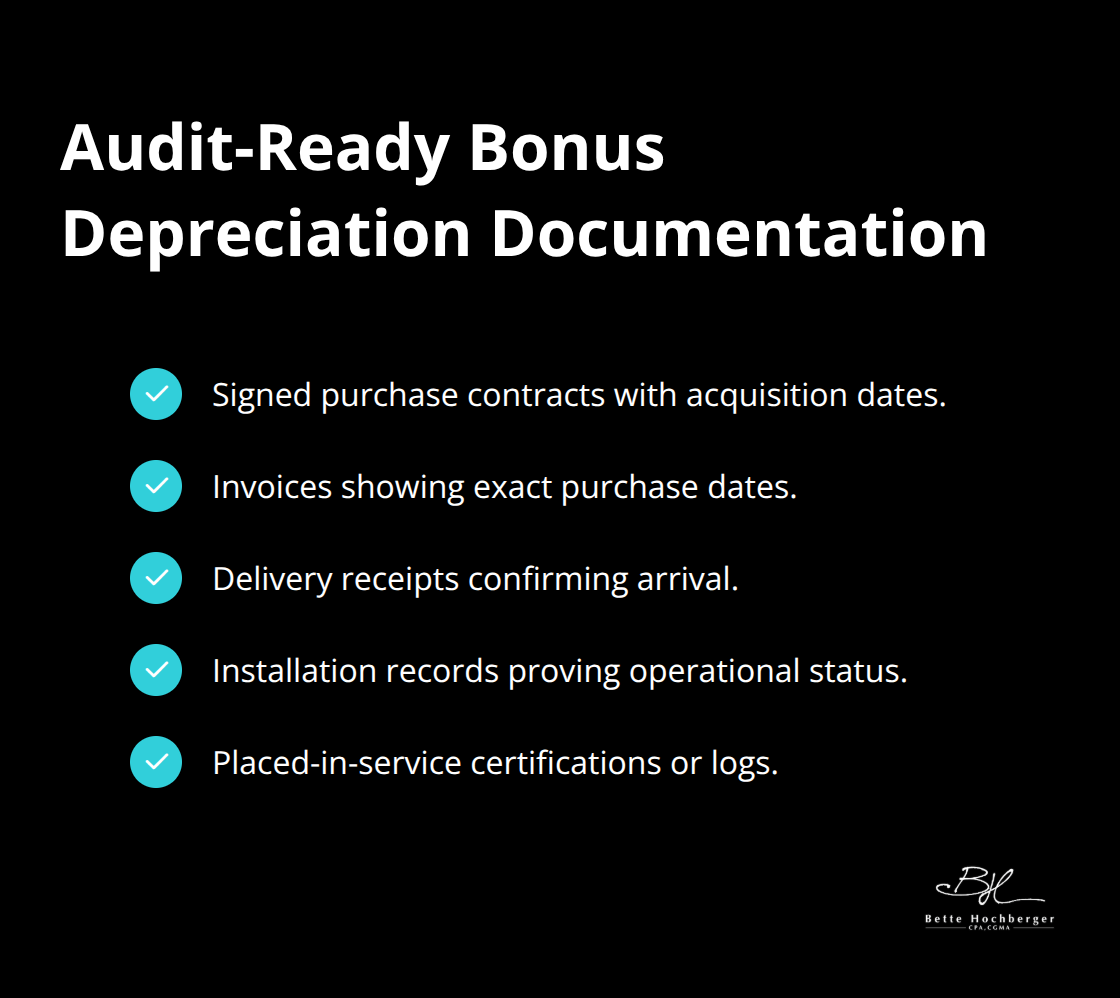

Documentation Failures That Trigger Audit Problems

Poor record-keeping destroys bonus depreciation benefits during IRS examinations. The agency requires detailed acquisition dates, purchase contracts, and placed-in-service documentation for every claimed asset. Businesses must maintain invoices that show exact purchase dates, delivery receipts, and installation records that prove when assets became operational.

Missing documentation results in complete disallowance of bonus depreciation claims, plus interest and penalties on additional tax owed. Form 4562 errors compound these problems when the IRS rejects returns with incomplete asset descriptions or incorrect depreciation calculations.

Asset Timing and Service Date Mistakes

Businesses frequently purchase assets in December but fail to place them in service before year-end, which eliminates their current-year deduction eligibility. The IRS requires assets to be “ready and available for use” to qualify for bonus depreciation in the purchase year. Equipment that sits in warehouses or requires installation after December 31st cannot generate current-year tax benefits.

Smart taxpayers coordinate delivery schedules with installation teams to complete asset placement before year-end (particularly for the 2025 transition period when acquisition dates determine 40% versus 100% depreciation rates).

Depreciation Recapture Planning Oversights

Aggressive bonus depreciation creates substantial recapture obligations when businesses sell assets or convert them to personal use. The IRS treats previously claimed bonus depreciation as ordinary income rather than capital gains, which can push taxpayers into higher tax brackets unexpectedly. Businesses that claim 100% bonus depreciation on vehicles face full recapture if they sell within the asset’s recovery period.

This recapture applies to real estate sales as well, where cost segregation studies that generated immediate deductions create ordinary income obligations that many taxpayers fail to anticipate in their exit planning strategies.

Final Thoughts

Bonus depreciation represents a powerful tax reduction strategy that requires precise execution to maximize benefits. The permanent reinstatement of 100% deductions for assets acquired after January 19, 2025, creates unprecedented opportunities for businesses to accelerate tax savings and improve cash flow immediately. Success depends on understanding the critical timing differences between acquisition dates and service requirements.

Assets purchased before January 20, 2025, remain limited to 40% deductions, while those acquired afterward qualify for full write-offs. This 60-percentage-point difference makes purchase timing decisions worth thousands in additional tax savings. The complexity of qualified improvement property rules, depreciation recapture obligations, and documentation requirements demands professional expertise to avoid costly mistakes.

Businesses that attempt to navigate these regulations without proper guidance frequently miss substantial deductions or create future tax liabilities through improper planning. We at Bette Hochberger, CPA, CGMA help businesses implement these strategies correctly and coordinate them with broader financial objectives (while managing long-term tax consequences). Our approach focuses on maximizing depreciation benefits while minimizing overall tax liabilities and optimizing cash flow management.