Wealthy families face mounting pressure from rising estate tax rates and shrinking exemptions. The current federal estate tax exemption of $13.61 million per person expires in 2025, potentially cutting future exemptions in half.

We at Bette Hochberger, CPA, CGMA see families scrambling to implement estate planning strategies before these changes take effect. Smart tax moves today can save millions in future estate taxes.

Advanced Trust Structures for Tax Optimization

Grantor Trusts and Income Tax Benefits

Grantor trusts represent the most powerful tax optimization tool for wealthy families. These structures allow you to transfer asset appreciation to beneficiaries while you retain income tax obligations, which effectively provides tax-free gifts. Intentionally Defective Grantor Trusts (IDGTs) generate strong results for wealthy families seeking transfer tax savings. The grantor pays income taxes on trust earnings, which constitutes additional gifts without consuming lifetime exemptions.

Generation-Skipping Transfer Tax Planning

Generation-skipping transfer tax planning through dynasty trusts preserves wealth across multiple generations. These trusts avoid the GST tax while they maintain assets outside taxable estates indefinitely.

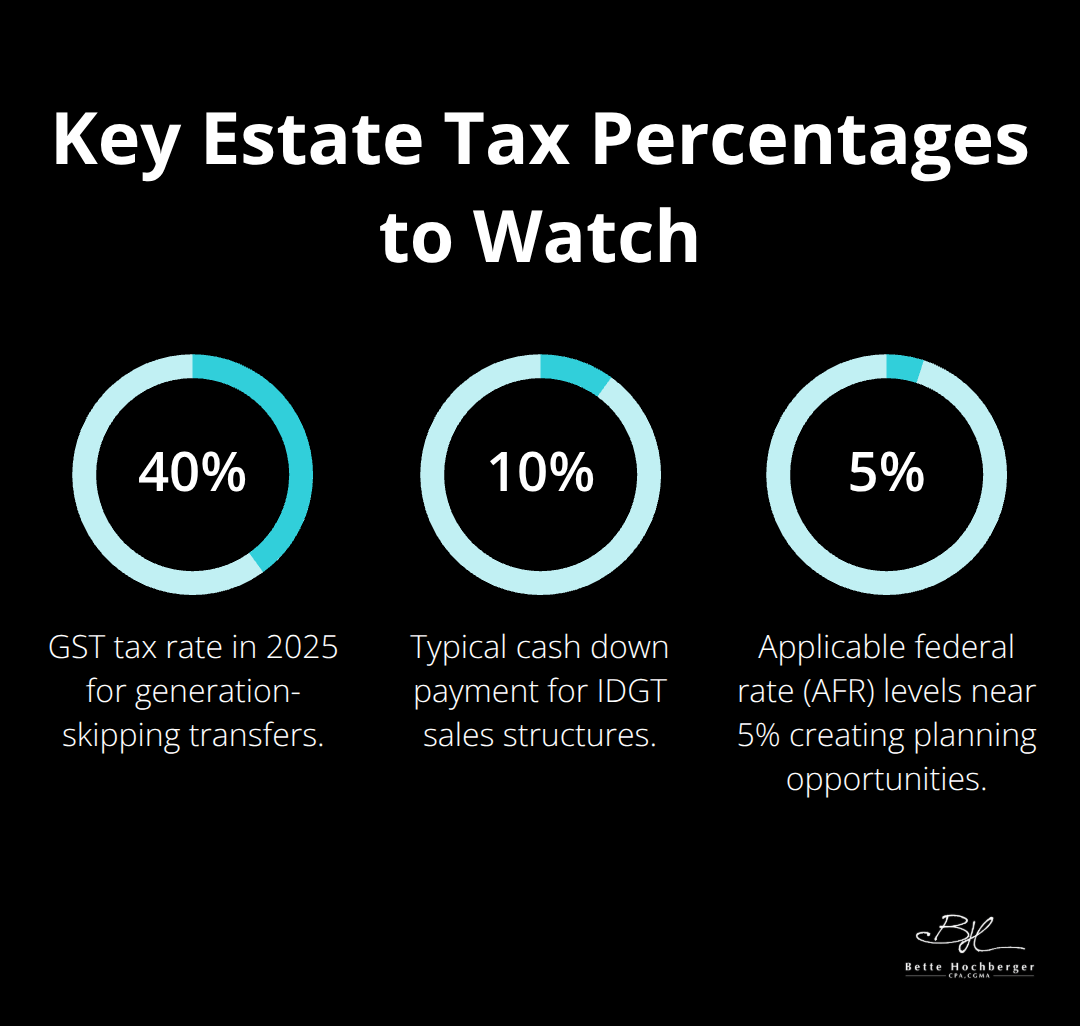

Families with $50 million or more should prioritize GST planning immediately, as the current $13.61 million GST exemption expires in 2025, with the tax rate at 40% in 2025. Dynasty trusts protect assets from creditors and divorce settlements while they transfer wealth to grandchildren and great-grandchildren.

Charitable Remainder and Lead Trusts

Charitable remainder trusts provide immediate income tax deductions of 10-50% of contributed asset values while they generate lifetime income streams. High-net-worth families typically see 6-8% annual returns from CRT investments. Charitable lead trusts work inversely and provide gift and estate tax benefits while they support philanthropy. CLTs reduce transfer tax values by 15-30% for assets that appreciate. The IRS Section 7520 rate of 5.6% in 2024 makes both strategies particularly attractive. Families should contribute appreciated securities to maximize deductions and avoid capital gains taxes.

These trust structures form the foundation of sophisticated estate planning, but they work best when combined with strategic annual gifts that maximize your exemptions.

Gifting Strategies to Minimize Estate Taxes

Annual Exclusion Maximization Techniques

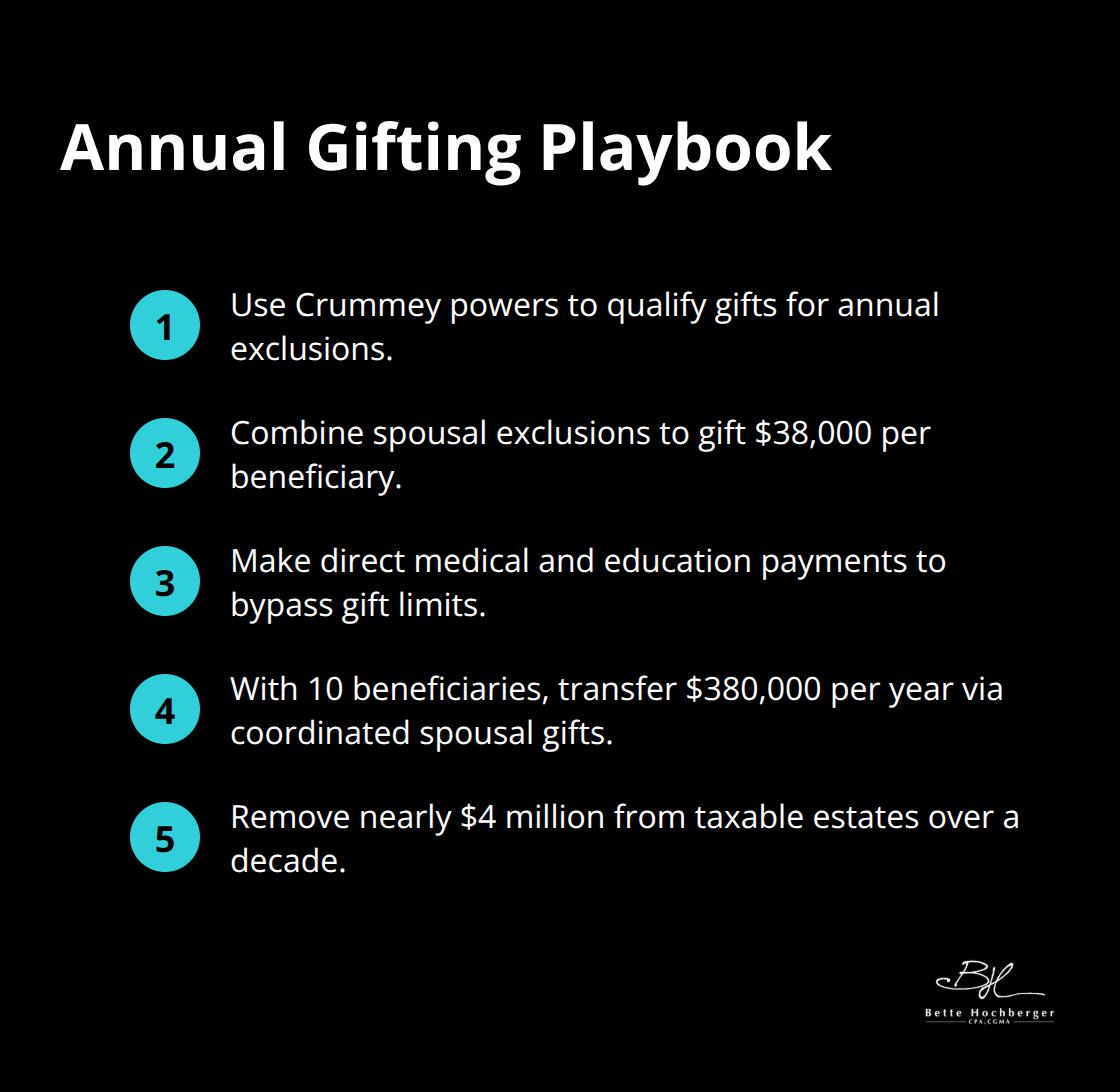

The 2025 annual gift tax exclusion of $19,000 per recipient represents just the starting point for sophisticated wealth transfer strategies. Wealthy families should leverage present interest gifts through Crummey powers, which convert future interest gifts into present interest gifts that qualify for annual exclusions. Married couples can combine their exclusions to gift $38,000 annually to each beneficiary without consuming lifetime exemptions.

Medical and educational payments made directly to institutions bypass gift tax limits entirely. Families with 10 beneficiaries can transfer $380,000 annually through coordinated spousal gifts, removing nearly $4 million from taxable estates over a decade. This strategy works particularly well for families with multiple children and grandchildren.

Grantor Retained Annuity Trusts (GRATs)

GRATs excel when asset values fluctuate significantly or when interest rates favor the structure. The IRS Section 7520 rate is 120 percent of the applicable federal midterm rate, creating opportunities for families who hold growth assets. Sequential two-year rolling GRATs maximize benefits while they minimize risk and capture appreciation.

Facebook founder Mark Zuckerberg famously used GRATs to transfer billions in value while the stock price remained volatile. Tech executives and real estate developers should prioritize GRAT strategies for pre-IPO shares and development properties. Zero-out GRATs eliminate gift tax exposure while they transfer excess returns to beneficiaries tax-free.

Sales to Intentionally Defective Grantor Trusts

IDGT sales generate superior results compared to traditional gifts because they freeze estate values while they transfer future appreciation. Families typically structure sales with 10% cash down and promissory notes for the balance. Current AFR rates near 5% make IDGT sales particularly attractive for assets expected to appreciate above this threshold.

The grantor’s income tax payments on trust earnings constitute additional tax-free gifts that don’t consume exemptions. Private equity interests, operating businesses, and real estate investments work exceptionally well in IDGT structures. Professional valuations often support minority interest discounts which amplify transfer benefits significantly.

These advanced strategies require careful coordination with business succession planning to maximize their effectiveness across all family assets.

Business Succession and Valuation Discounts

Family Limited Partnerships for Asset Transfer

Family Limited Partnerships deliver significant valuation discounts available for estate planning through reduced taxable value of transferred interests. FLPs work exceptionally well for real estate portfolios, investment accounts, and operating businesses where parents retain management control while they transfer ownership interests to children.

The key advantage lies in minority interest and marketability discounts that professional appraisers routinely support. Parents maintain voting control as general partners while they gift limited partnership interests at substantially reduced values. The IRS accepts these discounts when families follow proper formalities and maintain legitimate business purposes.

Real estate investment portfolios benefit most from FLP structures because property values support significant marketability discounts. Investment accounts with diversified holdings also qualify for substantial reductions when transferred through partnership interests.

Installment Sales and Self-Canceling Notes

Self-canceling installment notes provide superior flexibility compared to traditional sales because the note cancels automatically at death and removes future payments from the estate. SCANs work particularly well for assets expected to appreciate significantly, such as pre-IPO stock or development properties.

The installment structure spreads capital gains over multiple years while it freezes estate values at the sale date. Current low interest rates make SCAN structures especially attractive, with AFR rates near 5% that create opportunities for assets that appreciate above this threshold.

Professional valuations often support additional discounts for illiquid assets transferred through installment sales. Private company stock and real estate development projects frequently qualify for marketability discounts that amplify the transfer benefits.

Buy-Sell Agreements and Valuation Strategies

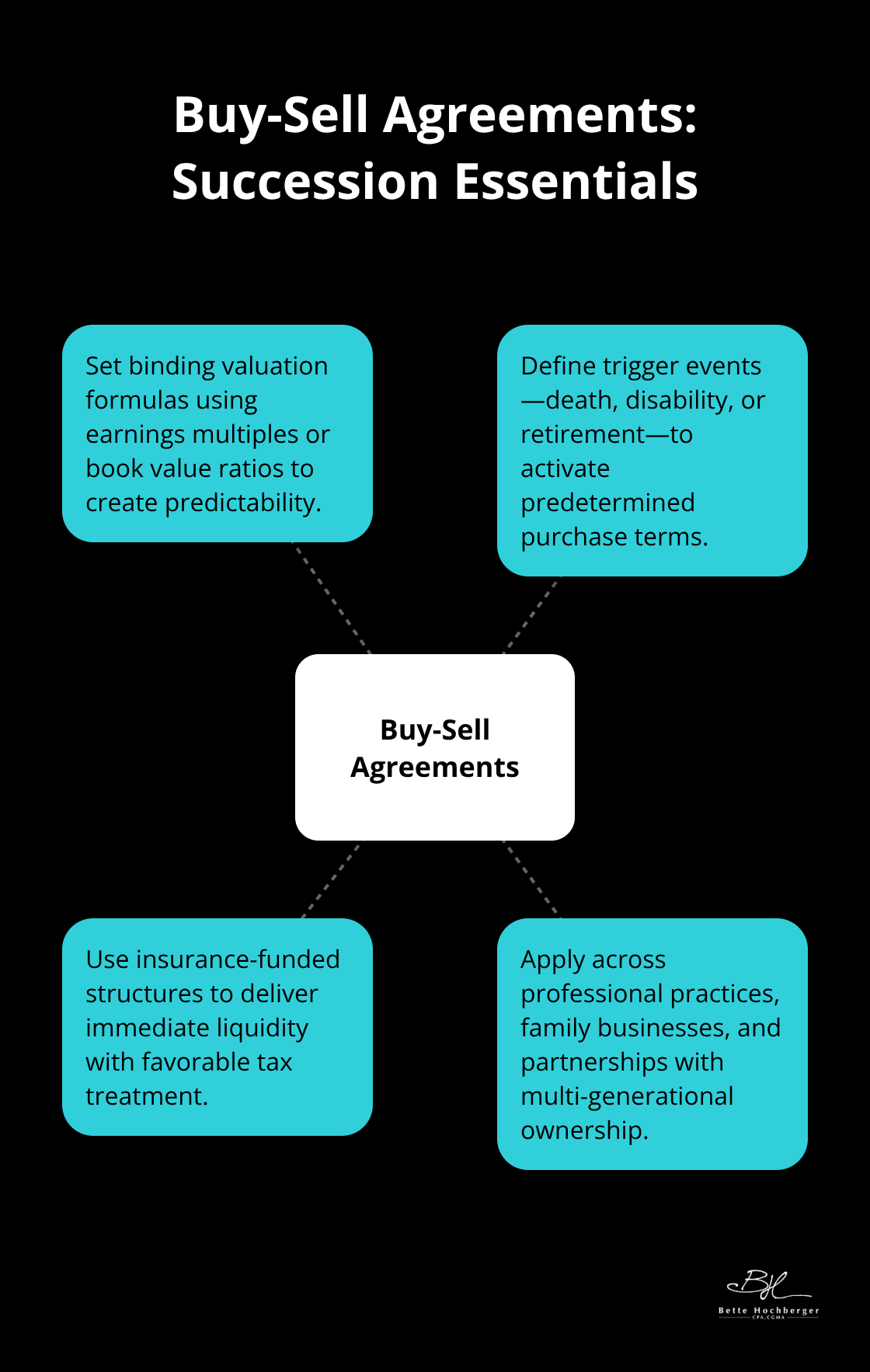

Buy-sell agreements establish binding valuation formulas that prevent IRS challenges while they facilitate smooth business transitions. Formula-based valuations that use earnings multiples or book value ratios provide predictability for estate planning purposes.

Trigger events (death, disability, or retirement) activate predetermined purchase terms that remove valuation uncertainty. Insurance-funded buy-sell agreements provide immediate liquidity while they maintain favorable tax treatment for both buyers and sellers.

These structures prove particularly effective for professional practices, family businesses, and investment partnerships where multiple generations participate in ownership. The IRS respects arm’s-length valuations established through properly structured buy-sell agreements.

Final Thoughts

Wealthy families must act immediately to implement these estate planning strategies before the 2025 exemption sunset reduces transfer opportunities by half. The current $13.61 million exemption creates a narrow window for maximizing wealth transfers through advanced trust structures, strategic gifts, and business succession plans. Professional guidance proves indispensable when you navigate complex tax regulations and valuation requirements.

The IRS scrutinizes sophisticated strategies closely, which makes expert implementation critical for compliance and effectiveness. Families who attempt DIY approaches risk costly mistakes that professional oversight prevents. Long-term wealth preservation requires coordinated strategies that adapt to changing tax laws and family circumstances (dynasty trusts protect assets across generations while charitable structures provide tax benefits and philanthropic impact).

We at Bette Hochberger, CPA, CGMA help clients minimize tax liabilities while we build comprehensive estate plans that preserve wealth for future generations. Our team works with high-net-worth families to develop personalized tax strategies. The time for action is now, before legislative changes eliminate these powerful tax optimization opportunities.