Most business owners and high earners leave substantial money on the table each year through reactive tax filing instead of strategic planning. The difference between basic tax preparation and comprehensive tax strategy consultation can mean hundreds of thousands in savings.

We at Bette Hochberger, CPA, CGMA see clients regularly recover 15-30% of their tax burden through proactive planning. Smart tax strategy transforms your financial future.

What Separates Tax Strategy from Tax Preparation

Tax preparation focuses on last year’s returns, while tax strategy shapes your financial future through forward-thinking plans. The IRS processed over 160 million individual tax returns in 2023, yet most taxpayers engage only with reactive preparation instead of proactive strategy. This reactive approach costs business owners and high earners significant money annually.

The Timeline Advantage Creates Real Savings

Traditional tax preparation happens after December 31st when your financial decisions lock in place. Strategic tax planning operates year-round and positions you to make informed decisions before they impact your tax burden. Companies that implement Management Service Organizations achieve annual tax deferrals through strategic timing of income and expenses.

Overlooked Deductions Cost Real Money

Research shows taxpayers who work with professional tax services receive larger refunds than self-preparers, primarily because professionals identify overlooked deductions and credits. Pass-through entity elections can significantly decrease tax liabilities for small business owners, yet many miss this opportunity without strategic guidance.

Strategic Structure Optimization Multiplies Benefits

The 20% qualified business income deduction for pass-through businesses represents substantial savings for eligible owners who structure their operations correctly. These changes create immediate opportunities for businesses that position themselves strategically rather than react to tax season deadlines.

Now that you understand the fundamental differences between reactive preparation and proactive strategy, let’s examine the specific high-impact techniques that generate the most substantial savings for our clients.

High-Impact Tax Strategies That Generate the Biggest Savings

Business Structure Transformations Create Immediate Impact

The One Big Beautiful Bill Act transformed opportunities for business owners in 2025. Bonus depreciation jumped to 100% for eligible equipment purchased after January 19, 2025 (up from 60% in 2024). Manufacturing companies that buy new machinery can write off the entire purchase price immediately instead of spreading costs over years.

The number 100% seems to be not appropriate for this chart. Please use a different chart type.

Management Service Organization implementation helps engineering firms defer up to $5 million annually, while retail companies achieve $550,000 in annual deferrals through strategic restructuring. Medical device companies save even more-one client deferred $850,000 in the first year alone through proper structure optimization.

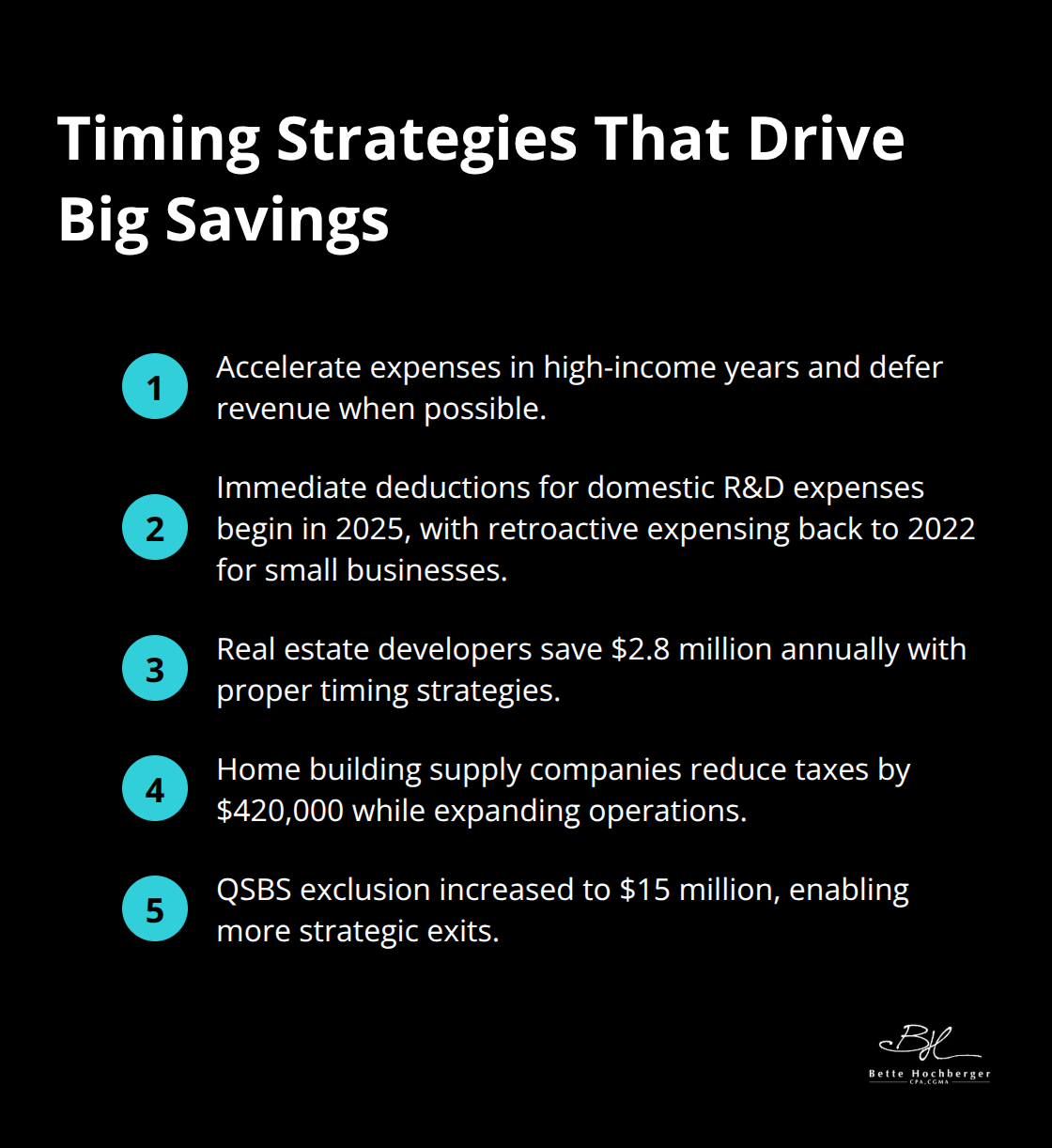

Strategic Income and Expense Timing Maximizes Benefits

Smart business owners accelerate expenses into high-income years while they defer revenue when possible. The OBBBA allows immediate deductions for domestic research and development expenses that start in 2025, plus retroactive expensing back to 2022 for small businesses.

Real estate developers save $2.8 million annually through proper timing strategies. Home building supply companies reduce taxes by $420,000 while they expand operations. The qualified small business stock exclusion increased from $10 million to $15 million, which creates massive opportunities for strategic exits.

Advanced Retirement and Investment Strategies

Pass-through entity elections allow tax deductions at the entity level and dramatically reduce liabilities for small business owners. Private wealth management firms save $831,000 through qualified business income deduction optimization. Business owners can contribute to retirement plans until tax return due dates (including extensions), which provides flexibility for last-minute strategies.

SIMPLE IRA and SEP IRA plans attract employees while they generate substantial tax deductions for contributions. Gift and estate tax exemptions rise to $15 million for individuals and $30 million for couples in 2026, which makes wealth transfer timing critical for high-net-worth families.

These powerful strategies work best when complex business situations require expert analysis and professional guidance to navigate successfully.

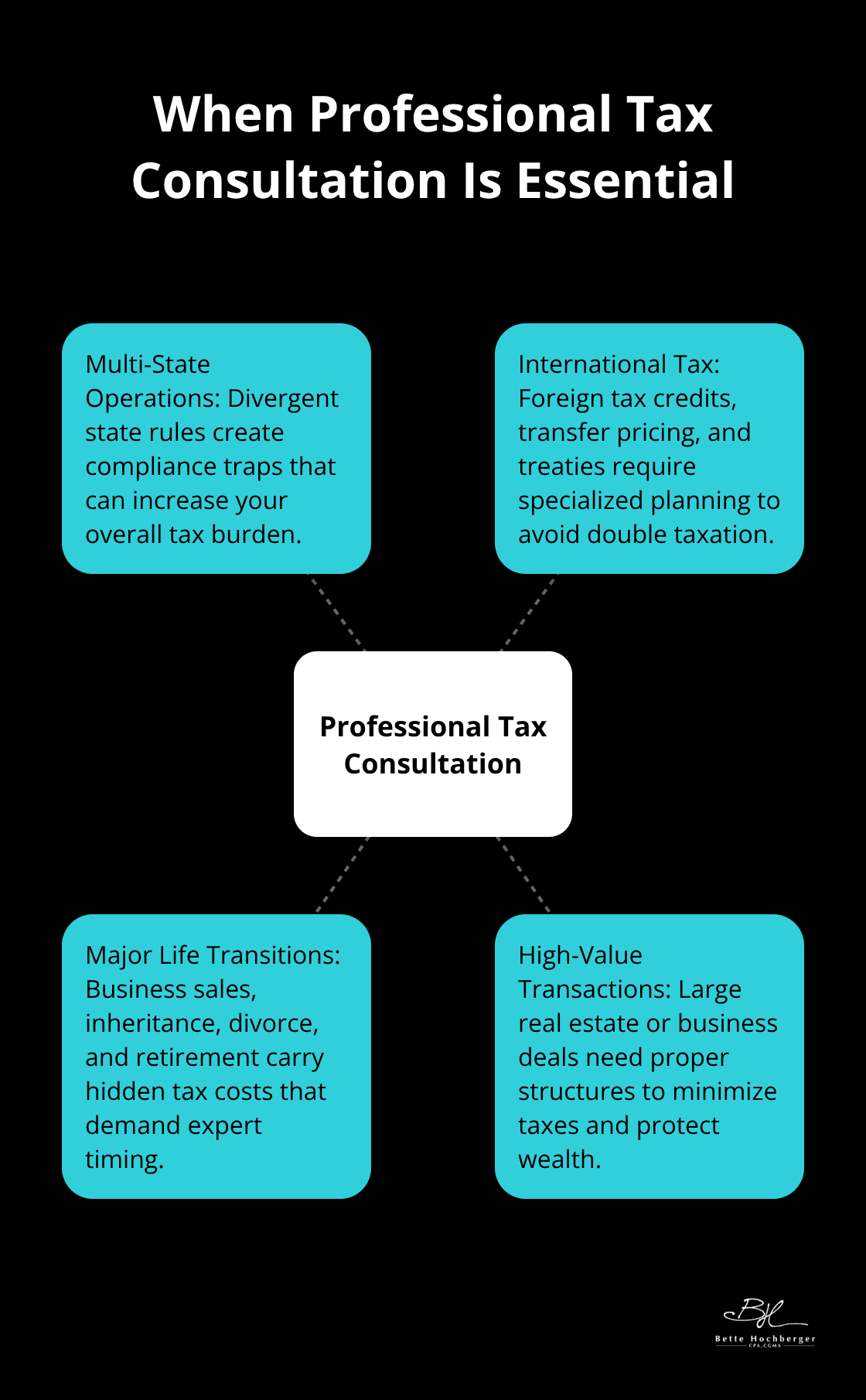

When Professional Tax Consultation Becomes Essential

Complex business operations demand expert analysis that extends far beyond basic tax preparation. Law firms that restructure their financial operations through Management Service Organizations can maximize their non-SSTB income and QBI deduction for owners. Optometrists reduce capital gains taxes by $270,000 before they sell by transitioning properties into proper structures. Multi-entity businesses, international operations, and high-value transactions create tax complexities that require specialized knowledge to navigate successfully.

Multi-State Operations Create Compliance Nightmares

Multi-state businesses face divergent state tax laws that often conflict with federal rules. This creates a hybrid tax landscape that traps unprepared business owners in costly compliance errors. Each state maintains different apportionment formulas, nexus thresholds, and deduction rules that can dramatically impact your total tax burden.

Professional tax strategists understand how to structure operations across state lines to minimize exposure while they maintain compliance. Companies that operate in multiple jurisdictions without proper guidance often pay taxes in states where they have no legal obligation to file returns.

International Tax Rules Multiply Complexity

International operations add layers of complexity through foreign tax credits, transfer pricing rules, and treaty considerations. Tax treaties between countries can reduce or eliminate withholding taxes and prevent double taxation. A business owner who sold a $4.5 million company saved $600,000 through proper international structuring techniques.

Foreign subsidiaries, overseas contractors, and international sales all trigger specific reporting requirements that carry severe penalties for non-compliance. Tax professionals who specialize in international matters help businesses navigate these requirements while they optimize global tax positions.

Major Life Transitions Trigger Hidden Costs

Business sales, inheritance, divorce, and retirement create tax consequences that amateur planning cannot address effectively. Family wealth protection requires strategic timing when you gift non-voting shares to younger beneficiaries while you maintain management control through periodic valuations.

The combination of Management Service Organizations with premium financing transforms substantial amounts into tax-free benefits, demonstrating how professional strategies multiply savings exponentially. Estate planning with $15 million individual exemptions and $30 million couple exemptions in 2026 demands precise timing and expert execution to maximize wealth transfer opportunities.

High-Value Asset Transactions Need Expert Structure

Real estate developers save $2.8 million annually through proper transaction structures and timing strategies. Family estates with high values face significant tax burdens without expert guidance that addresses both current liabilities and future wealth transfer goals.

Professional consultation becomes mandatory when businesses operate across jurisdictions or when major financial transitions occur. The stakes become too high to rely on basic preparation when complex structures and substantial assets require sophisticated tax strategies.

Final Thoughts

Professional tax strategy consultation delivers measurable returns that exceed investment costs by substantial margins. Engineering firms defer $5 million annually through Management Service Organizations, while retail companies achieve $550,000 in deferrals. Medical device companies save $850,000 in their first year alone, and real estate developers reduce tax burdens by $2.8 million annually through strategic plans.

The window for 2025 tax strategies closes rapidly as December 31st approaches. Bonus depreciation at 100% for equipment purchases after January 19, 2025 creates immediate opportunities that disappear after year-end. Gift and estate tax exemptions rise to $15 million for individuals in 2026 (making wealth transfer timing critical for high-net-worth families).

We at Bette Hochberger, CPA, CGMA help clients develop strategic tax plans that minimize liabilities while they maximize cash flow. Our team uses advanced technology to serve diverse industries with personalized financial strategies. Start your strategic tax planning consultation now because the difference between reactive preparation and proactive strategy can save you hundreds of thousands annually.