Growing businesses hit a financial complexity wall faster than most owners expect. Revenue jumps from $500K to $2M, but cash flow becomes unpredictable and tax planning turns into guesswork.

We at Bette Hochberger, CPA, CGMA see this pattern repeatedly. The fractional CFO benefits become obvious when owners realize they need executive-level financial expertise without the $200K+ salary commitment.

What Exactly Is a Fractional CFO

A fractional CFO delivers senior-level financial expertise on a part-time basis, typically works 10-20 hours per week for $5,000-$7,000 monthly according to Business Talent Group data. Unlike traditional accounting services that focus on historical reports, fractional CFOs build forward-looking financial strategies, cash flow forecasts, and investor-ready financial models. The demand for these services has surged 103% year-over-year, with technology startups and healthcare organizations leading adoption rates.

The Strategic Difference From Traditional Accounting

Traditional CPAs handle compliance and historical data, while fractional CFOs operate as strategic partners who optimize pricing models, implement dynamic budgeting tools like Ramp or Brex, and identify waste from unused SaaS subscriptions that organizations squander approximately $21 million annually on. Full-time CFOs cost $200,000+ with benefits (making them unaffordable for businesses under $10M revenue). Fractional CFOs bridge this gap and provide executive financial leadership at 30-40% lower costs than full-time hires.

Industries That See Maximum Impact

Technology companies between $2M-$10M revenue show the highest fractional CFO adoption rates, particularly those that prepare for Series A funding rounds. Healthcare organizations leverage fractional CFOs for revenue cycle optimization and compliance management, while real estate firms use them for complex deal structure and tax optimization. Manufacturing businesses benefit most during rapid scale phases when cash flow management becomes complex and working capital requirements multiply.

How the Service Model Works

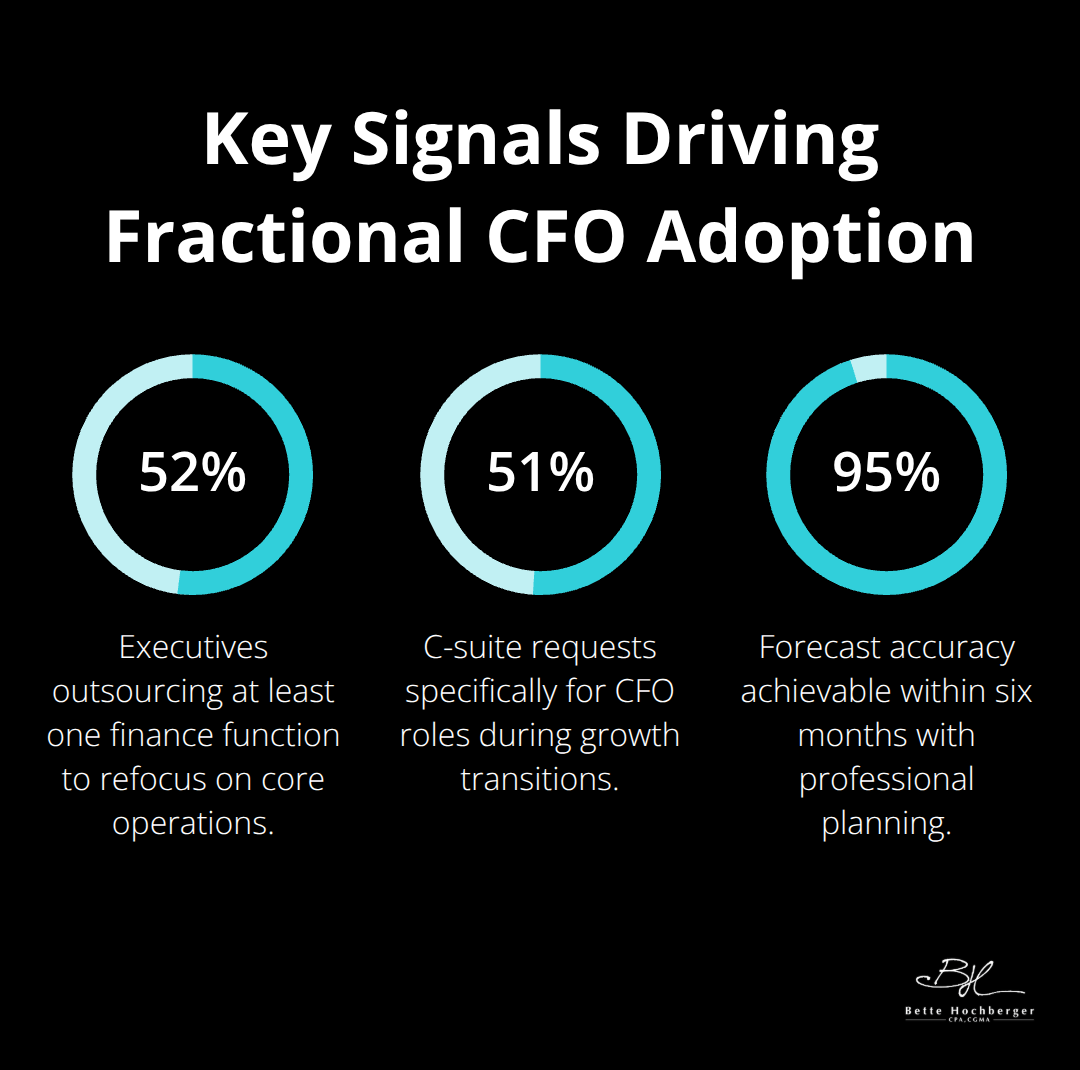

Most fractional CFO arrangements last 6 months to 5 years, with initial agreements commonly set for 1-2 years. These professionals implement tailored financial systems, train internal personnel, and provide hands-on support that influences overall service costs. Companies continue to use fractional CFOs beyond initial agreements to sustain growth until they can support a full-time, in-house CFO (with 51% of C-suite requests specifically for CFO roles).

The question becomes: how do you know when your business has reached the point where this level of financial expertise becomes necessary?

When Does Your Business Need a Fractional CFO

Your business hits a financial tipping point when monthly revenue exceeds $1M and cash flow patterns become unpredictable despite strong sales growth. The owner-managed financial approach breaks down when you spend more than 15 hours weekly on financial tasks instead of business development, or when your accountant cannot answer strategic questions about pricing optimization or working capital requirements. Deloitte research shows that 52% of executives outsource at least one finance function specifically to regain focus on core operations while improving cash-flow analysis accuracy.

The Revenue Complexity Threshold

Companies between $2M-$10M annual revenue face the steepest financial management challenges because traditional bookkeeping cannot handle multi-location operations, complex inventory management, or investor reporting requirements. Your business needs executive-level financial expertise when you reach the revenue threshold where companies assess moving to full-time CFO services after crossing $10-15 million. Technology startups particularly struggle at this stage because they require investor-ready financial models and burn rate optimization that standard accounting services cannot provide.

Cash Flow Crisis Prevention

Cash flow problems emerge weeks before they become visible in traditional financial reports, but AI-powered forecasting tools can predict shortages in advance and prevent operational disruptions. Your business needs fractional CFO intervention when accounts receivable days exceed 45 days, when seasonal fluctuations create cash shortages despite profitable operations, or when you cannot accurately project cash needs beyond 90 days. Automated accounts receivable management can reduce Days Sales Outstanding by over 30% (but implementation requires strategic oversight that goes beyond basic accounting functions).

Investment and Exit Readiness

Private Equity firms now demand minimum 20% profitability before considering SaaS company acquisitions, while investors expect clean financials with organized data rooms that contain real-time KPIs and unit economics. Your business needs fractional CFO support when preparing for Series A funding rounds, planning acquisitions, or structuring exit strategies that require audit-ready financials and cap table management. The preparation timeline for investment opportunities typically spans 6-12 months and requires financial expertise that most growing businesses lack internally.

Strategic Financial Decision Points

Your business reaches a strategic inflection point when you face decisions about new market expansion, product line additions, or major capital investments without clear financial models to guide these choices. Standard accounting reports cannot provide the forward-looking analysis needed for pricing strategy optimization or competitive positioning decisions. Companies often realize they need fractional CFO expertise when they struggle to interpret financial data for strategic planning or when board members request sophisticated financial analysis that exceeds internal capabilities.

These warning signs point to immediate financial leadership needs, but the question remains: what specific financial benefits can you expect from this investment?

What Financial Returns Can You Expect

Fractional CFOs deliver immediate cost reductions that average 30-40% compared to full-time CFO salaries. Full-time CFOs command $200,000+ annually with benefits versus $60,000-$84,000 for fractional services according to Business Talent Group data. The financial impact extends beyond salary savings when fractional CFOs identify waste streams like unused SaaS subscriptions that drain IT budgets through underutilized software.

Direct Cost Savings and Waste Elimination

Companies see measurable returns within 90 days through improved cash flow forecasts and elimination of financial inefficiencies. Fractional CFOs optimize pricing strategies that increase profit margins by 10-15% and implement automated accounts receivable systems that reduce collection periods by over 30%. They identify subscription redundancies, negotiate better vendor terms, and streamline expense management processes that owners cannot spot without executive-level expertise.

Advanced Tax Strategy Implementation

Fractional CFOs implement sophisticated tax strategies that go beyond basic compliance, including entity structure optimization and strategic timing of income recognition. They coordinate with tax professionals to establish quarterly tax planning sessions and implement expense categorization systems that maximize deductions. Advanced depreciation methods and transaction structuring can reduce tax liabilities while maintaining full compliance with regulatory requirements.

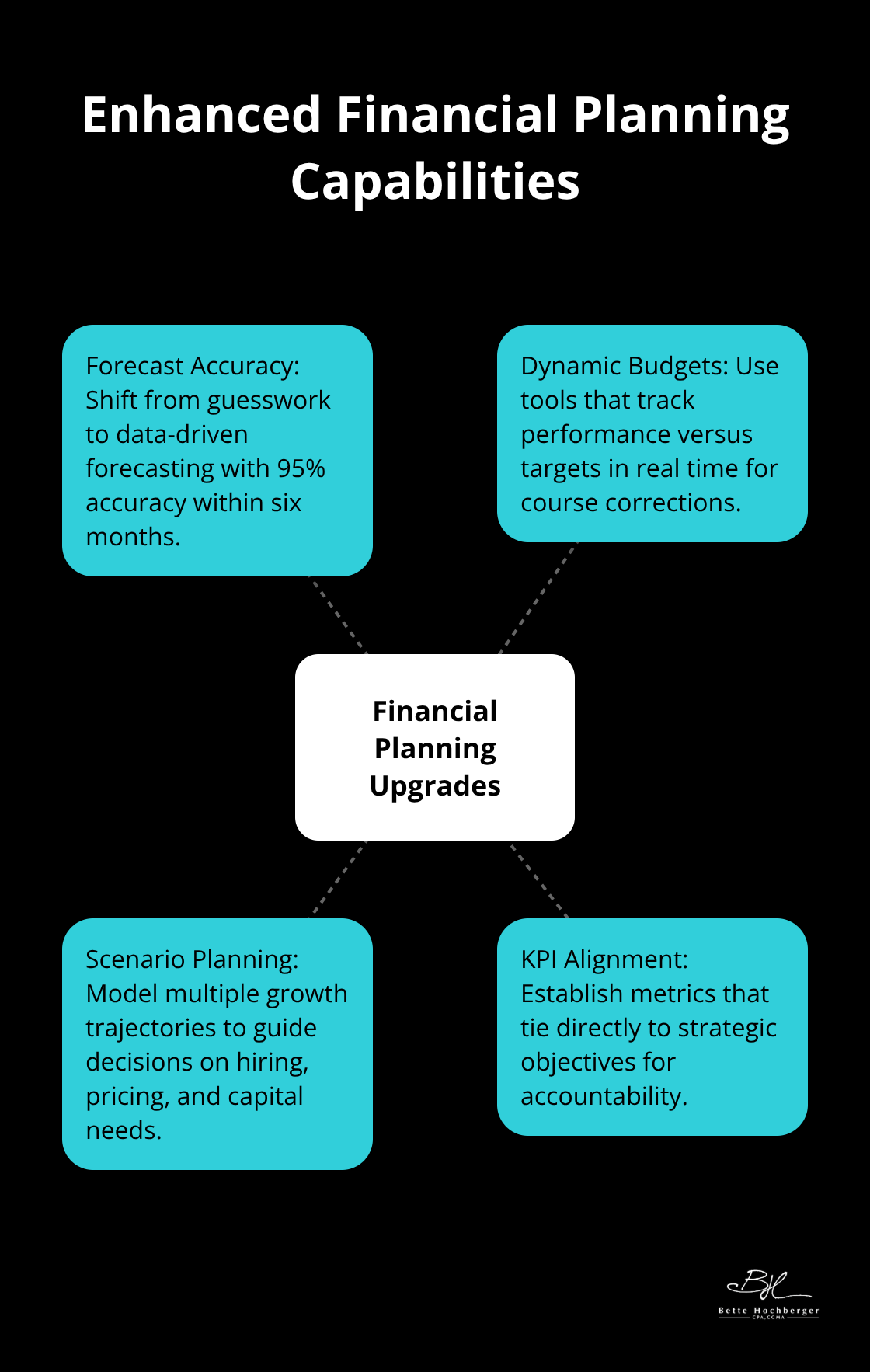

Enhanced Financial Planning Capabilities

Professional financial planning transforms cash flow predictability from guesswork into data-driven forecasts with 95% accuracy rates within six months of implementation. Fractional CFOs build dynamic budgets using tools like Adaptive Insights that track performance against targets in real-time. They create scenario plans for different growth trajectories and establish key performance indicators that align with strategic objectives.

Improved Capital Access and Terms

Better financial documentation and forecasts enable businesses to secure improved lending terms and negotiate better supplier payment schedules. Fractional CFOs prepare audit-ready financial records that support growth initiatives and investor due diligence processes. This preparation capability allows companies to make confident expansion decisions based on quantified financial projections rather than intuition.

Final Thoughts

The fractional CFO benefits for companies between $2M-$10M revenue extend far beyond simple cost reduction. These businesses access executive-level financial expertise at 30-40% lower costs than full-time hires while they gain sophisticated cash flow forecasts, tax optimization strategies, and investor-ready financial models. The 103% year-over-year demand increase shows how businesses now view fractional CFOs as strategic partners rather than expense items.

Business owners should evaluate their current financial management capacity and growth trajectory before they make this decision. Companies that spend over 15 hours weekly on financial tasks or struggle with cash flow predictability despite strong revenue growth need fractional CFO services for sustainable expansion. The investment pays for itself through improved financial controls and strategic guidance (particularly during rapid growth phases).

We at Bette Hochberger, CPA, CGMA provide fractional CFO services that combine strategic tax planning with advanced financial management. Our approach delivers personalized solutions that minimize tax liabilities and optimize cash flow for profitable growth. Contact us to discuss how fractional CFO expertise can transform your business financial strategy.