Cryptocurrency taxation has become increasingly complex as the IRS implements stricter reporting requirements for 2025. Digital asset transactions now face enhanced scrutiny, with new forms and compliance obligations that catch many investors off guard.

We at Bette Hochberger, CPA, CGMA see taxpayers struggling with crypto tax compliance every day. The stakes are higher than ever, with penalties reaching thousands of dollars for missed reporting requirements.

What Crypto Tax Changes Hit in 2025?

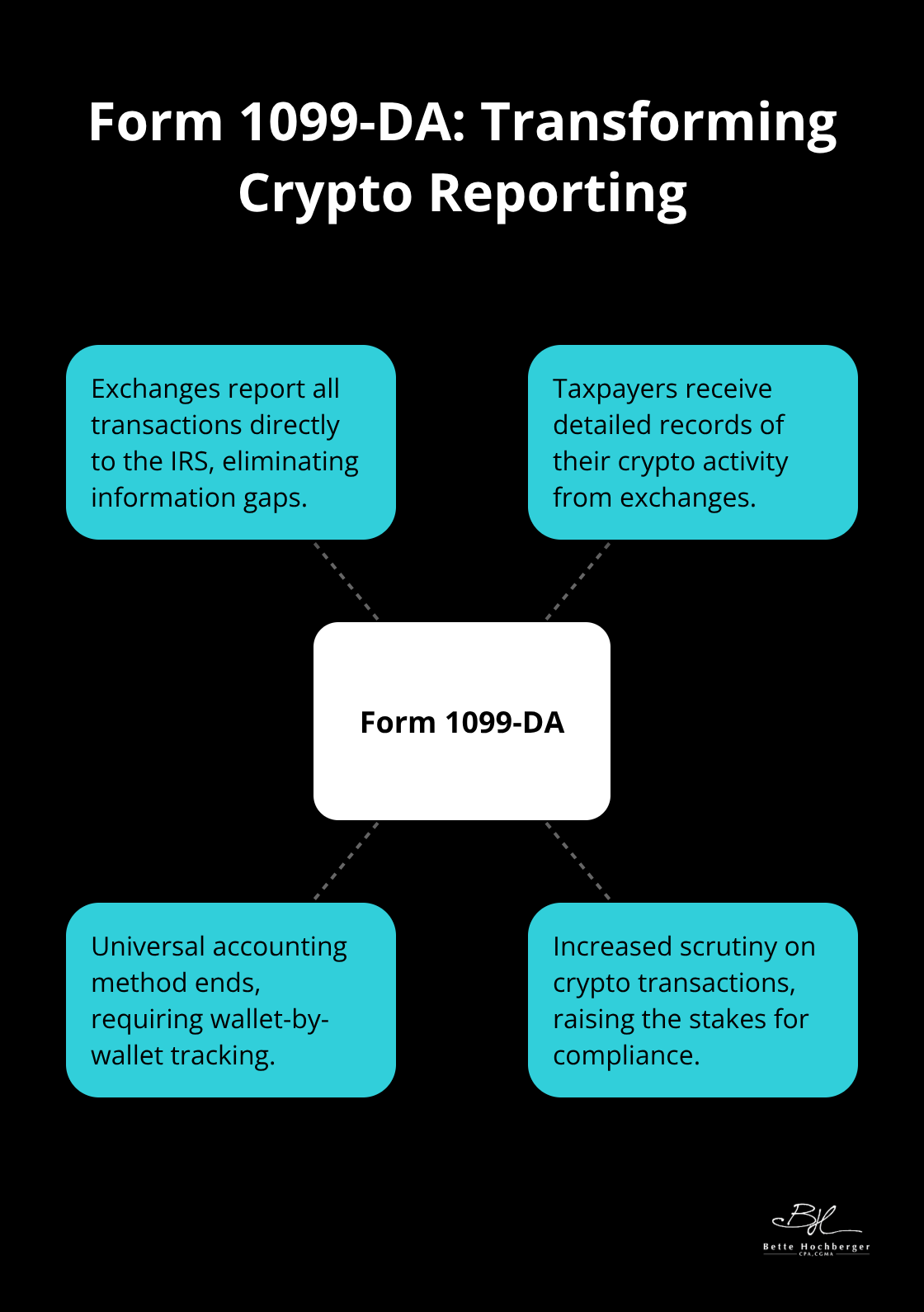

New Form 1099-DA Transforms Exchange Reporting

The IRS launched Form 1099-DA for 2025, which requires U.S. crypto exchanges to report all your transactions directly to the government. Platforms like Coinbase and Kraken now send detailed records of your crypto activity to both you and the IRS. This eliminates the information gap that existed in previous years.

The universal accounting method for cost basis calculations ended on January 1, 2025. You must now use wallet-by-wallet tracking, which makes your record-keeping significantly more complex. Each crypto wallet requires separate cost basis calculations, and transfers between your own wallets demand meticulous documentation to maintain accurate reporting.

Every Transaction Creates Tax Consequences

Trading one cryptocurrency for another triggers a taxable event. The IRS views crypto-to-crypto trades as sales of the first asset followed by purchases of the second, which creates capital gains or losses at fair market value. Converting to stablecoins counts as a sale under current regulations.

Interest earned on crypto assets generates ordinary income taxed at rates up to 37%. Mining and staking produce immediate taxable income when you receive the coins. Spending crypto on goods or services creates a taxable disposal event. Even airdrops generate taxable income based on the tokens’ fair market value at receipt.

Documentation Requirements Get Stricter

The IRS expects transaction dates, amounts, fair market values in USD, wallet addresses, and transaction purposes for every crypto activity. Missing documentation leads to IRS penalties that start at 20% of unpaid taxes (with willful evasion reaching 75%). You need screenshots of exchange records, wallet transaction histories, and fair market value data from transaction dates.

Paper trails prove your cost basis calculations when the IRS questions your reporting. Automated tracking tools help manage the overwhelming documentation burden, but manual verification remains necessary for accuracy. These stricter requirements set the stage for understanding which specific mistakes can trigger costly penalties and audits.

Common Crypto Tax Mistakes to Avoid

Crypto investors make three devastating mistakes that cost them thousands in penalties and missed savings. The most expensive error involves underreported income, which triggers significant financial charges for underreporting taxes. Taxpayers who receive crypto payments for services, earn rewards from staking, or participate in DeFi protocols often treat these as non-taxable events.

The IRS considers all these activities ordinary income taxed at rates up to 37%. Missing just $10,000 in crypto income results in substantial penalties before interest charges begin to accumulate.

Underreported Income Triggers Automatic Penalties

Service providers who accept Bitcoin payments must report the full USD value as income on the transaction date. Freelancers, consultants, and contractors frequently overlook this requirement when clients pay in cryptocurrency. The IRS tracks these payments through Form 1099-DA reports from exchanges.

Staking rewards generate taxable income the moment you receive them, not when you sell. Ethereum validators who earn 4% annual rewards must report this income at fair market value. A $100,000 staking position generates $4,000 in taxable income regardless of whether you convert to cash.

Cost Basis Calculation Errors Create Audit Red Flags

Digital asset transactions may need to be reported on your tax return, catching most investors unprepared. Transfer Bitcoin worth $50,000 from Coinbase to your hardware wallet requires precise cost basis documentation for each coin batch. Many investors use average cost calculations across all wallets, which violates current IRS rules and creates immediate audit triggers.

Exchange records often show different cost basis than your actual purchase prices (especially for dollar-cost averaging strategies). Manual tracking becomes impossible with frequent trades, yet automated tools miss nuanced transactions like peer-to-peer trades or decentralized exchange activity. The IRS expects transaction-level precision, not approximations.

Ignored Tax Loss Harvesting Wastes Thousands

Crypto losses offset gains dollar-for-dollar, yet 73% of crypto investors never claim their losses according to recent industry surveys. Sell positions at a loss before year-end to generate deductible capital losses that reduce your overall tax bill. The wash sale rule does not apply to cryptocurrency, which allows you to repurchase the same asset immediately after the sale.

A $25,000 crypto loss offsets $25,000 in stock gains and potentially saves $5,000 in taxes at the 20% capital gains rate. Smart investors harvest losses throughout the year instead of waiting until December when market conditions may not favor strategic sales. These missed opportunities compound when you understand the advanced strategies that can legally minimize your crypto tax burden.

How Can Smart Strategies Cut Your Crypto Tax Bill?

Tax Loss Harvesting Delivers Immediate Tax Savings

Crypto losses offset capital gains dollar-for-dollar, yet most investors waste this opportunity. Sell positions at a loss before December 31st to generate deductible capital losses that reduce your tax liability. Unlike stocks, cryptocurrency does not follow the wash sale rule, which means you can repurchase the same asset immediately after you sell for a loss.

A $15,000 Bitcoin loss offsets $15,000 in stock gains and saves $3,000 in taxes at the 20% capital gains rate. The IRS allows up to $3,000 in excess capital losses to offset ordinary income annually, with excess losses that carry forward indefinitely.

Smart investors monitor their portfolios monthly to identify tax loss opportunities instead of wait until year-end when market conditions may not favor strategic sales.

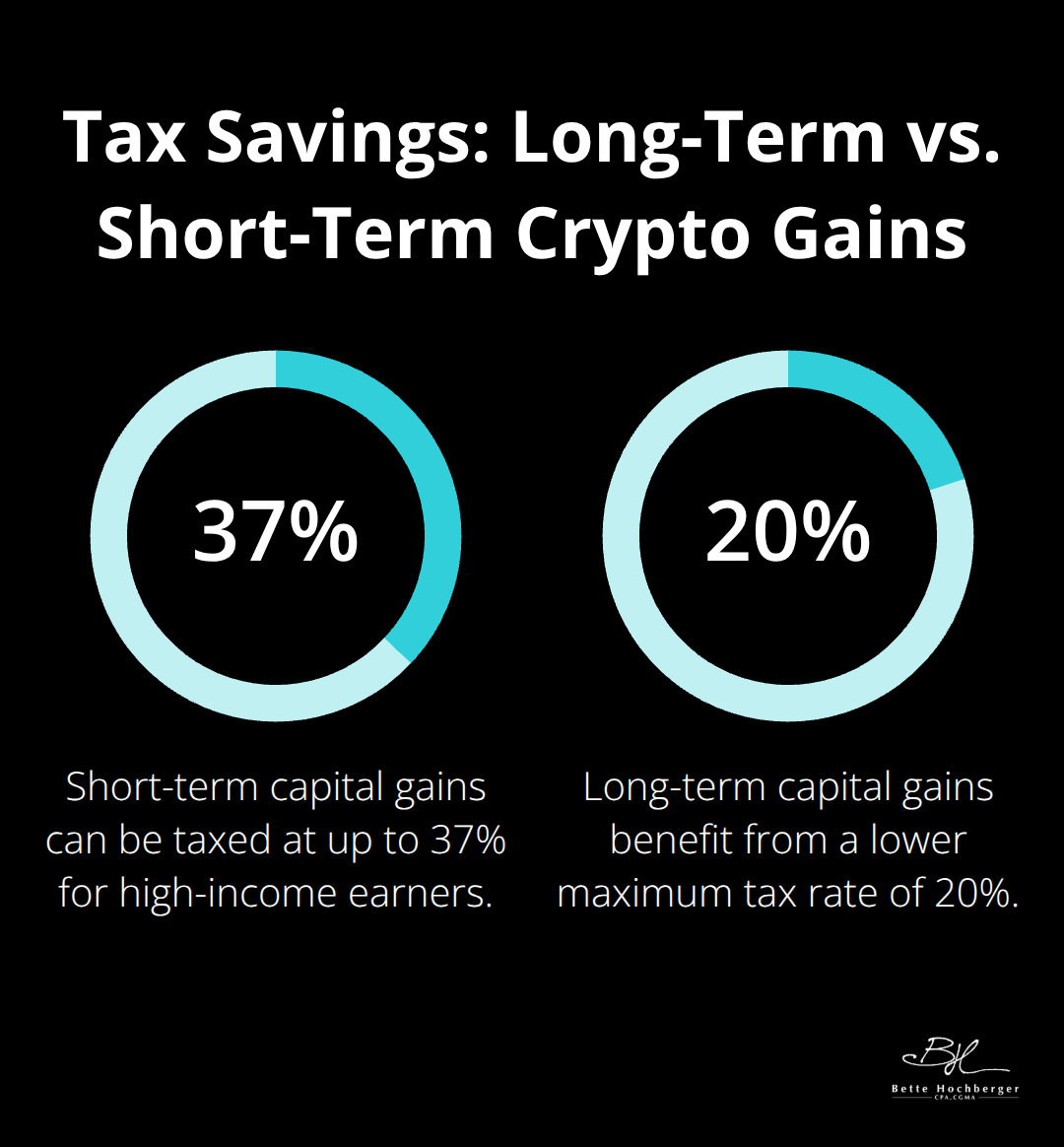

Hold Assets Over One Year for Massive Tax Savings

Short-term capital gains face ordinary income tax rates up to 37%, while long-term gains benefit from preferential rates of 0%, 15%, or 20% based on income levels. A $50,000 crypto gain held for 11 months costs $18,500 in taxes at the 37% rate, but the same gain held for 13 months reduces the tax to $10,000 at the 20% long-term rate.

This strategy saves $8,500 with one extra month of patience. Track your purchase dates meticulously because the IRS requires exact periods for rate determination. Long-term crypto holders benefit significantly from these preferential tax rates.

Self-Directed IRAs Maximize Tax Advantages

Self-directed IRAs allow crypto investments with complete tax deferral on gains. Standard contribution limits are $7,000 for individuals under age 50, with an additional $1,000 catch-up contribution for those aged 50 and over, totaling $8,000. Roth IRA crypto gains grow tax-free forever if you follow withdrawal rules, which makes this the ultimate long-term crypto tax strategy for younger investors who can wait decades before they access funds.

Traditional IRA contributions reduce your current taxable income while your crypto investments grow tax-deferred until retirement. The choice between Roth and traditional depends on whether you expect higher or lower tax rates in retirement compared to today.

Final Thoughts

Crypto taxation in 2025 demands meticulous attention to new IRS requirements and strategic planning to minimize your tax burden. The introduction of Form 1099-DA and wallet-by-wallet tracking creates unprecedented compliance complexity that catches most investors unprepared. Professional tax planning becomes indispensable when you deal with digital assets that generate multiple taxable events throughout the year.

Tax loss harvesting, strategic timing of asset sales, and retirement account utilization can save thousands in taxes when you implement them correctly. We at Bette Hochberger, CPA, CGMA help clients navigate complex regulations while minimizing tax liabilities through personalized approaches to digital asset taxation. Our team addresses the unique challenges that crypto taxation presents to individual investors and businesses.

Start to organize your crypto tax strategy now and gather transaction records, calculate accurate cost basis for each wallet, and identify tax loss opportunities before year-end. The penalties for non-compliance far exceed the cost of proper planning and professional guidance (with willful evasion penalties reaching 75% of unpaid taxes). Smart investors take action early rather than scramble during tax season when options become limited.