Business owners seeking tax advantages while supporting charitable causes can benefit significantly from a charitable LLC tax strategy. This structure combines business flexibility with meaningful tax deductions.

We at Bette Hochberger, CPA, CGMA see growing interest in these arrangements as entrepreneurs look for ways to reduce their tax burden while making a positive impact. The key lies in proper implementation and compliance with IRS requirements.

Understanding Charitable LLC Tax Strategy Basics

What Makes Charitable LLCs Different

A charitable LLC operates as a hybrid structure where business owners donate 99% of their non-managing member shares to a qualifying 501(c)(3) organization while they retain 1% ownership for control purposes. This arrangement differs fundamentally from traditional LLCs because the charitable entity becomes the primary beneficiary of profits and distributions. The IRS permits these structures to pursue for-profit activities related to the charity’s exempt purposes without jeopardizing tax-exempt status, which creates flexibility that standard charitable organizations cannot match.

Tax Advantages That Drive Implementation

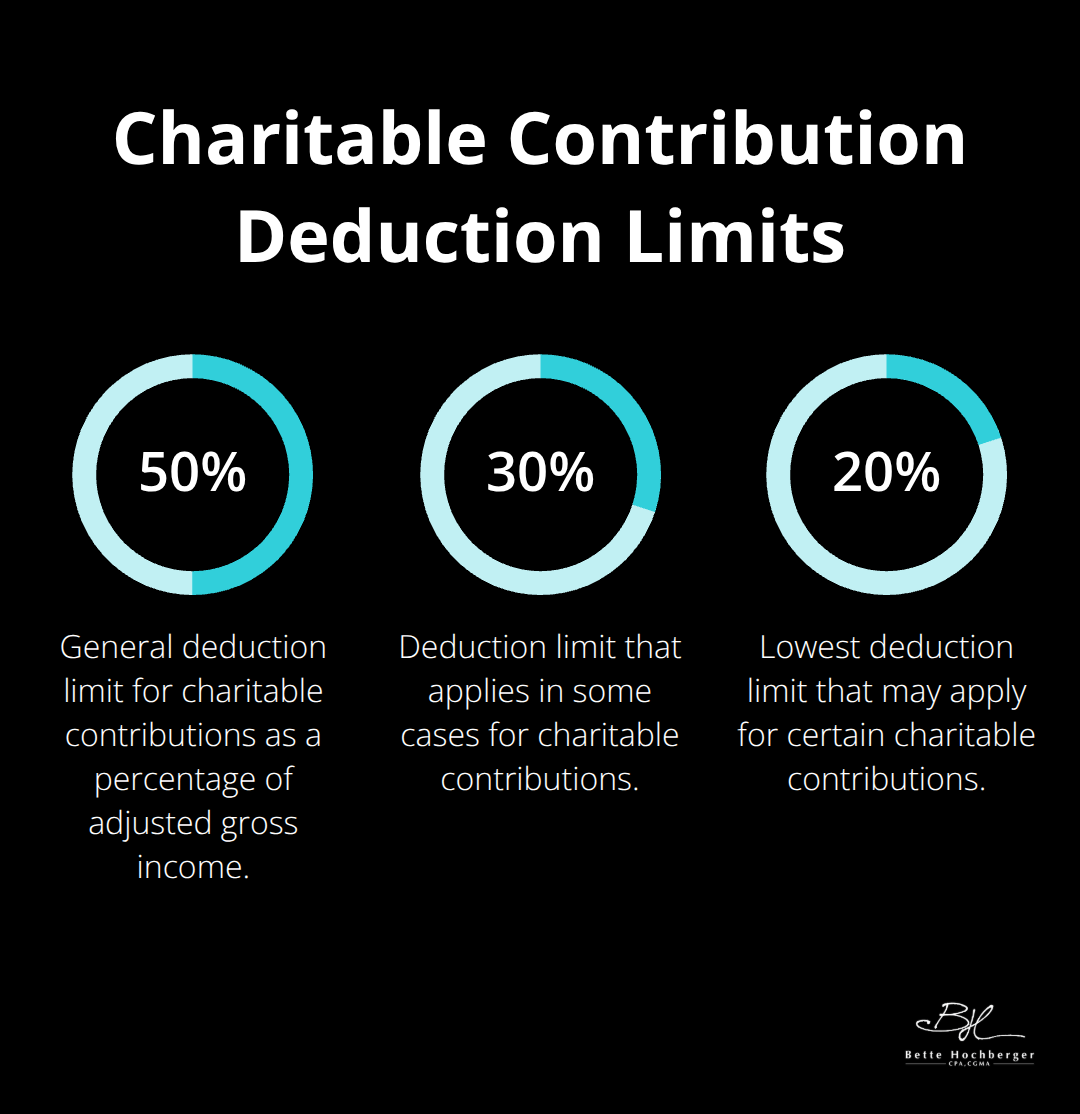

Business owners with high adjusted gross incomes see maximum benefits from charitable LLC structures. The donated assets generate immediate tax deductions that can be claimed in the donation year or carried forward for five years through itemized deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. Unlike traditional charities bound by strict proportional distribution rules, charitable LLCs offer greater control in income distribution among members and face no mandatory distribution requirements (providing additional privacy and operational fluidity).

IRS Compliance Requirements You Must Follow

The IRS has issued guidance about charitable LLCs that fail to meet deduction requirements, particularly those that allow donors to retain control rights under IRC Section 170(f)(3)(A). Proper compliance demands that the charity maintains exclusive legal control over contributed assets, with no agreements that permit asset buybacks at discount prices. Form 8283 must be completed for donations that exceed $250, accompanied by qualified appraisals from certified appraisers for closely held business interests. Annual distributions of at least $5,000 to qualified charities align with the structure’s purpose and reduce IRS scrutiny risk.

Investment Flexibility and Risk Management

Charitable LLCs can make riskier investments than traditional charities because they are not bound by the same investment restrictions that limit conventional charitable organizations. This flexibility allows for potentially higher returns on donated assets (though with corresponding increased risk exposure). The structure also permits the creation of an Investment LLC that holds the assets donated to the Charitable LLC, which separates charitable assets from personal assets while maintaining operational control through the retained managing member interest.

The proper establishment of these complex structures requires careful attention to legal formation procedures and ongoing compliance requirements.

Setting Up Your Charitable LLC Structure

Entity Formation and Legal Architecture

The foundation of a successful charitable LLC begins with the creation of two separate entities: the Investment LLC that holds your assets and the Charitable LLC that receives the donated shares. You must establish the Investment LLC first, then transfer your assets into this entity before you donate 99% of the non-managing member interests to a qualified 501(c)(3) organization. This two-entity structure provides the legal separation the IRS requires while it maintains your control through the 1% managing member interest. The Investment LLC should be formed in a business-friendly state like Delaware or Wyoming, where LLC laws offer maximum flexibility and protection. Most successful implementations require the Investment LLC to have a clear operating agreement that defines the managing member’s authority and limits the charity’s control over day-to-day operations.

Required Documentation and Filing Procedures

Form 8283 must be filed for noncash charitable contributions of more than $500, and qualified appraisals from certified appraisers are mandatory for closely held business interests. The appraisal must be completed no earlier than 60 days before the donation date and no later than the tax return due date. The charity must provide written acknowledgment for donations above $250, and this documentation becomes essential for IRS compliance. You must maintain thorough records that demonstrate the separation between your personal activities and the charitable LLC operations to avoid audit risks.

Working with Tax Professionals and Legal Advisors

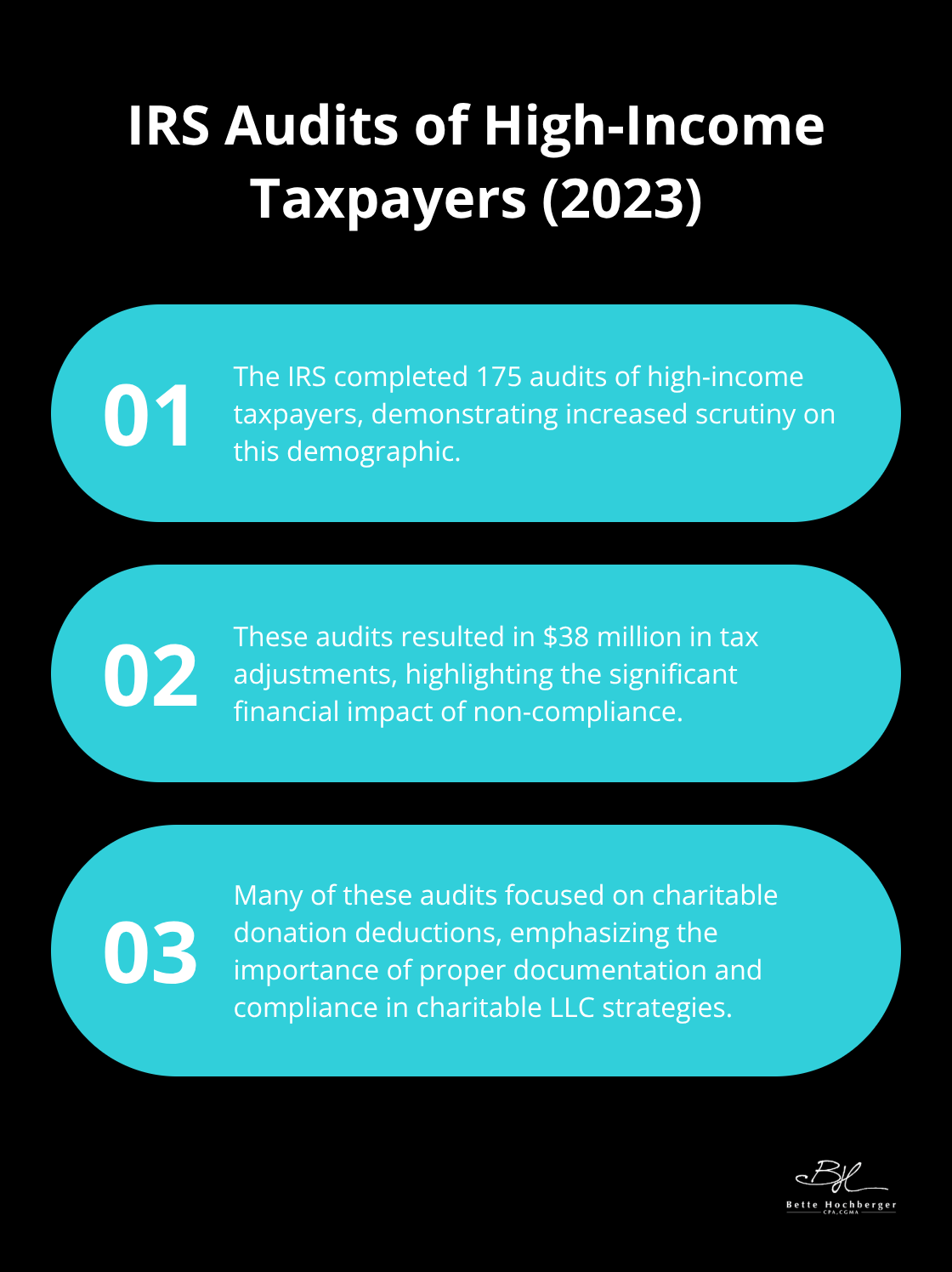

Experienced tax attorneys who specialize in charitable tax strategies become non-negotiable given the IRS’s increased scrutiny of these arrangements. The IRS completed 175 audits of high-income taxpayers in 2023, which resulted in $38 million in tax adjustments (with many focused on charitable donation deductions). Professional guidance helps you avoid the red flags that trigger audits, such as transactions that lack legitimate business purposes or arrangements that allow donors to retain prohibited control rights. These professionals also help structure the entities to maximize tax benefits while they maintain full IRS compliance through strategic tax planning.

The proper structure sets the foundation, but the real value comes from how you maximize the tax deductions and benefits available through these arrangements.

Maximizing Tax Deductions and Benefits

Strategic Asset Selection and Contribution Timing

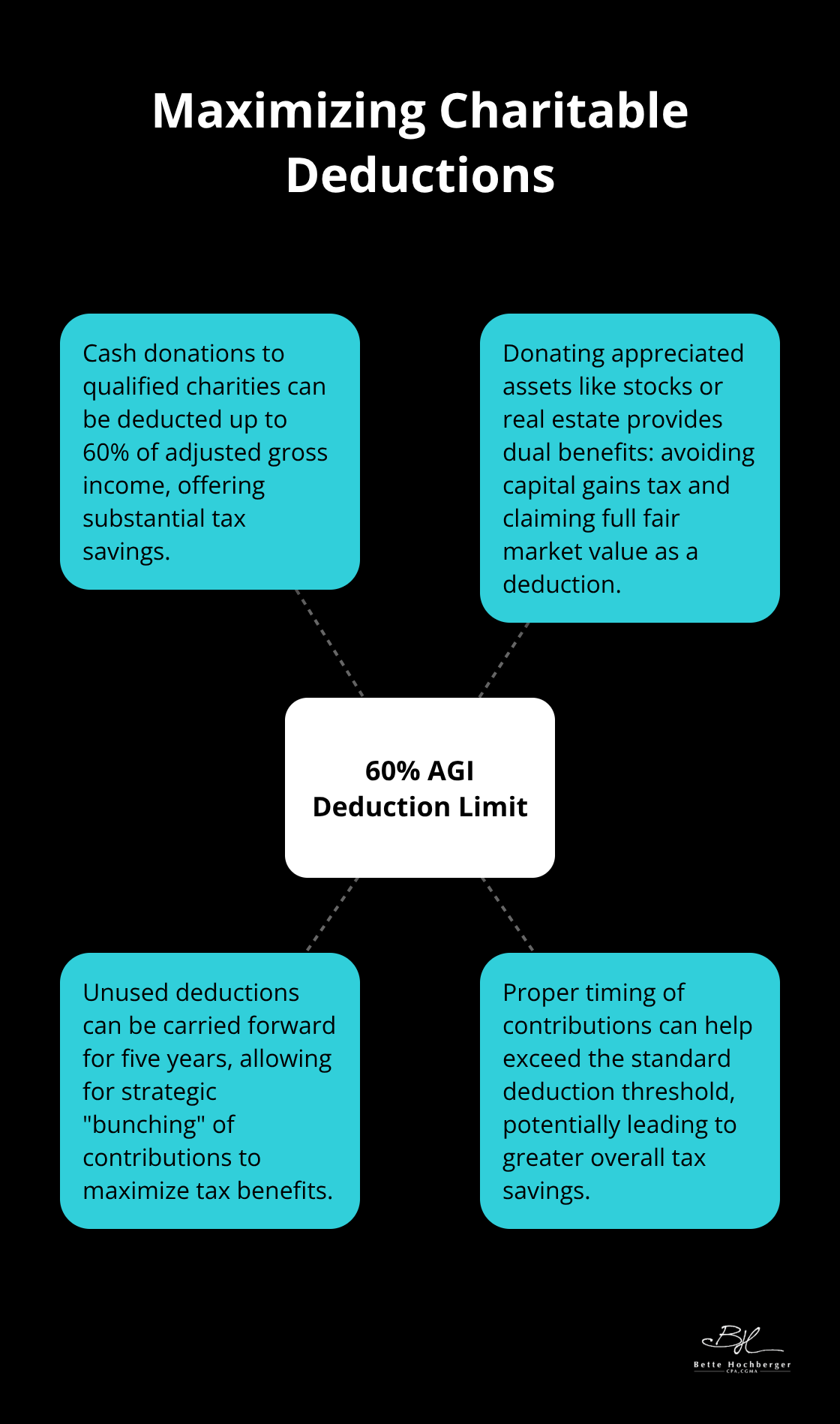

The timing of your charitable contributions determines the magnitude of your tax benefits. Business owners with adjusted gross incomes can deduct up to 60% of their AGI for cash donations. Donated appreciated assets like stocks or real estate provide dual benefits: you avoid capital gains tax that would arise from selling the assets first while you claim the full fair market value as a deduction. The IRS allows you to carry forward unused deductions for five years, which means you can bunch multiple years of charitable contributions into a single tax year to maximize your deductions above the standard deduction threshold.

Income Distribution Control and Tax Elimination

Charitable LLCs provide unique income distribution flexibility that traditional charities cannot match. The structure allows you to direct business income through the charitable entity while you maintain operational control through your 1% interest. This arrangement can eliminate much of the capital gains tax on appreciated business assets while it creates substantial personal income tax deductions. The absence of mandatory distribution requirements gives you privacy and operational fluidity that standard charitable organizations lack (unlike traditional charities bound by strict proportional distribution rules).

Documentation Requirements That Prevent IRS Scrutiny

The IRS has increased enforcement efforts against high-income taxpayers, with many audits focused on charitable donation deductions. Your documentation must demonstrate complete separation between personal activities and the charitable LLC operations. Qualified appraisals from certified appraisers are mandatory for closely held business interests, completed no earlier than 60 days before donation and no later than your tax return due date. The charity must maintain exclusive legal control over contributed assets with no buyback agreements at discount prices.

Annual Distribution Strategy and Compliance

Annual distributions of at least $5,000 to qualified charities maintain the structure’s charitable purpose and reduce IRS scrutiny risk. Form 8283 must accompany all noncash contributions that exceed $500 (with proper completion essential for audit protection). The charity must provide written acknowledgment for donations above $250, and this documentation becomes vital for IRS compliance. Thorough record maintenance that demonstrates operational separation between you and the charitable LLC operations helps avoid the audit risks that trigger increased IRS attention.

Final Thoughts

A charitable LLC tax strategy demands careful planning and professional guidance to achieve maximum benefits while you maintain IRS compliance. The process starts with proper entity formation, where you create both an Investment LLC and establish relationships with qualified 501(c)(3) organizations. Success depends on how well you maintain complete operational separation between personal activities and charitable operations while you document all transactions thoroughly.

Business owners who execute these strategies correctly eliminate significant capital gains taxes while they generate substantial income tax deductions. The structure provides ongoing benefits through flexible income distribution control and investment opportunities that traditional charitable vehicles cannot match. Annual distributions to qualified charities maintain the arrangement’s legitimacy and reduce audit risks (especially given increased IRS scrutiny of high-income taxpayers).

The IRS has increased scrutiny of high-income taxpayers, which makes professional guidance essential for you to avoid costly mistakes. We at Bette Hochberger, CPA, CGMA help clients navigate complex charitable tax strategies while we minimize tax liabilities. Our team guides business owners through the implementation process while we maintain full compliance with IRS requirements.

![Are VC-Funded Startups Leaving Money on the Table? [Tax Guide]](https://bettehochberger.com/wp-content/uploads/emplibot/Are-VC-Funded-Startups-Leaving-Money-on-the-Table_-_Tax-Guide__1759839079-500x383.jpeg)