Short-term rentals have become a popular way for property owners to earn extra income. However, the tax implications of hosting on platforms like Airbnb and VRBO can be complex.

At my firm, we understand the challenges short-term rental hosts face when it comes to taxes. This guide will help you navigate the key tax considerations, from income reporting to deductible expenses and self-employment tax issues.

How to Report Short-Term Rental Income

Short-term rental income can significantly impact your tax situation. The complexities of reporting this income correctly often challenge hosts. Let’s break down the essential aspects you need to know.

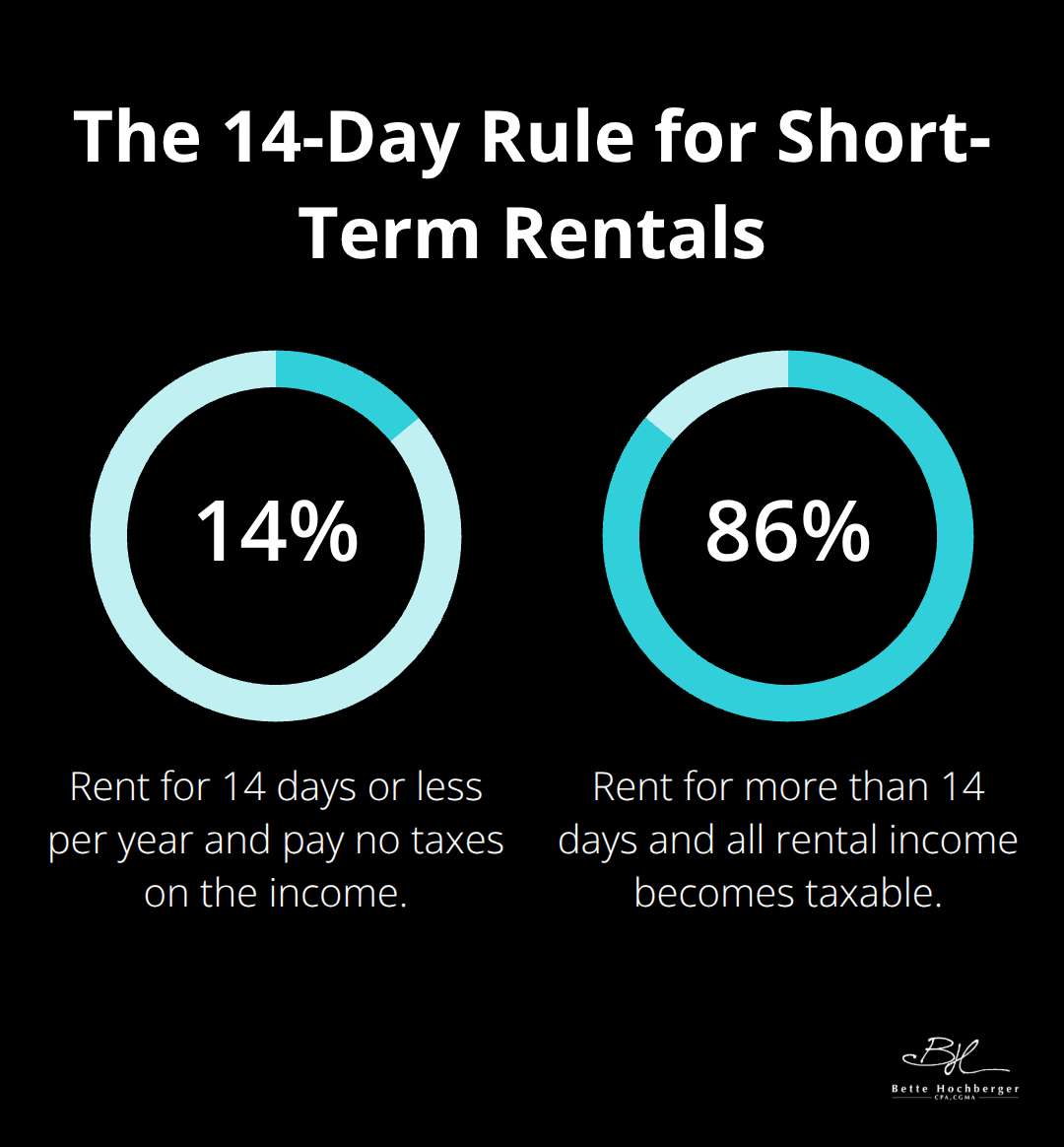

The 14-Day Rule: A Tax-Free Threshold

The IRS has a special provision known as the 14-day rule. If you rent out your property for 14 days or less in a year, you don’t have to report the rental income on your tax return. This can benefit occasional hosts substantially. However, if you exceed this threshold, all your rental income becomes taxable.

Schedule E: Your Go-To Form for Rental Income

For most short-term rental hosts, Schedule E is the appropriate form for reporting rental income. This form is part of your personal tax return (Form 1040) and reports income or loss from rental real estate. You must include all rental income received, regardless of whether you received a 1099 form from platforms like Airbnb or VRBO.

Personal Use vs. Rental Use: A Critical Distinction

The IRS treats your property differently based on how you use it. If you use the property for personal purposes for more than 14 days or 10% of the total days rented at fair rental price (whichever is greater), it’s considered a personal residence. This classification affects which expenses you can deduct and how you report them.

For example, if you rent out a vacation home for 200 days and use it personally for 20 days, it’s treated as a rental property. However, if you use it personally for 25 days, it becomes a personal residence for tax purposes. This distinction can significantly impact your deductions and overall tax liability.

Accurate Tracking: The Key to Compliance

Accurate tracking of personal and rental use days is essential. Try using a dedicated calendar or app to log these days meticulously. This practice not only ensures compliance but also maximizes your potential deductions.

The tax landscape for short-term rentals is complex and ever-changing. While this guide provides a solid foundation, each situation is unique. Many hosts find that professional guidance (such as that provided by firms like Bette Hochberger, CPA, CGMA) can help navigate these intricacies to optimize their tax position and ensure compliance.

Now that we’ve covered income reporting, let’s explore the various expenses you can deduct to reduce your taxable rental income.

What Expenses Can Short-Term Rental Hosts Deduct?

Short-term rental hosts can reduce their tax liability by properly deducting expenses. Understanding which expenses are deductible and how to claim them will maximize your rental income.

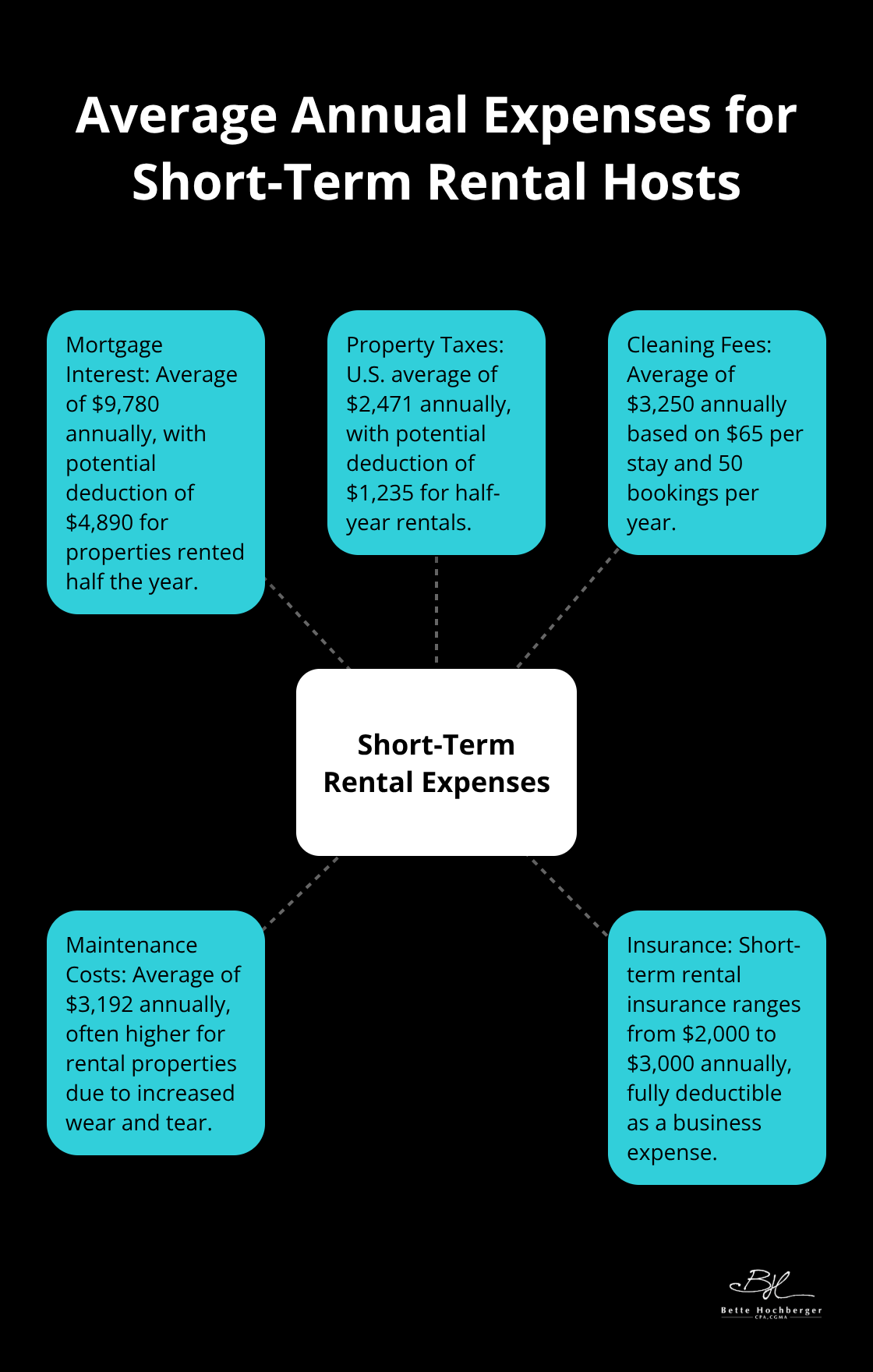

Mortgage Interest and Property Taxes

Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for primary residences. The IRS allows you to deduct these costs based on the percentage of time your property is rented.

The National Association of Realtors reports that the average mortgage interest paid in 2024 was $9,780. For a property rented half the year, this could mean a deduction of nearly $4,890. Property taxes vary widely by location, but the average U.S. household paid $2,471 in 2024, potentially adding another $1,235 to your deductions if rented for 180 days.

Cleaning and Maintenance

Cleaning fees and maintenance costs are fully deductible when directly related to your rental activity. This includes professional cleaning services, cleaning supplies, and repairs. AirDNA states that the average cleaning fee for short-term rentals is $65 per stay. If you have 50 bookings a year, that’s $3,250 in deductible cleaning expenses.

Maintenance costs can add up quickly. A study by HomeAdvisor found that homeowners spend an average of $3,192 annually on home maintenance. For a rental property, these costs are often higher due to increased wear and tear.

Utilities and Insurance

Utility costs (such as electricity, water, gas, internet, and cable TV) are deductible based on the portion used for rental purposes. If your property is a dedicated rental, these expenses are fully deductible. For mixed-use properties, you’ll need to calculate the percentage used for rental activities.

Insurance is another significant expense. Insurance.com reports that the average annual homeowners insurance premium in the U.S. is $1,899. Short-term rental insurance can be more expensive, often ranging from $2,000 to $3,000 annually, but it’s fully deductible as a business expense.

Depreciation: A Powerful Tax Tool

Depreciation deduction is carved into deductible amounts based on space rented as a percentage of total space and the number of days rented. The IRS sets the depreciation period for residential rental property at 27.5 years.

Furnishings and appliances can be depreciated over a shorter period, typically 5-7 years. This accelerated depreciation can provide substantial tax benefits in the early years of your rental business.

Proper tracking and claiming of these deductions can lead to significant tax savings. However, the rules can be complex, and mistakes can be costly. We recommend keeping meticulous records and consulting with a tax professional to ensure you maximize your deductions while staying compliant with IRS regulations.

Now that we’ve covered deductible expenses, let’s explore how self-employment tax considerations can impact short-term rental hosts.

Do Short-Term Rentals Trigger Self-Employment Tax?

Short-term rental income often raises questions about self-employment tax. The answer isn’t always straightforward and depends on several factors.

When Rentals Become a Business

The IRS typically views rental income as passive income, not subject to self-employment tax. However, if you provide substantial services to your guests, your rental activity might be classified as a business. Substantial services go beyond the basics of property maintenance and might include daily cleaning, breakfast service, or guided tours.

A 2024 survey by Airbnb revealed that 18% of hosts offer some form of additional services to their guests. If you fall into this category, you might operate a business in the eyes of the IRS.

The Impact on Your Tax Bill

If the IRS deems your rental activity a business, you’ll face self-employment tax on top of income tax. As of 2025, the self-employment tax rate is 15.3% on the first $160,200 of net earnings and 2.9% on earnings above that threshold.

For example, if your short-term rental business nets $50,000 in a year, you could owe $7,650 in self-employment tax alone (in addition to any income tax you might owe on these earnings).

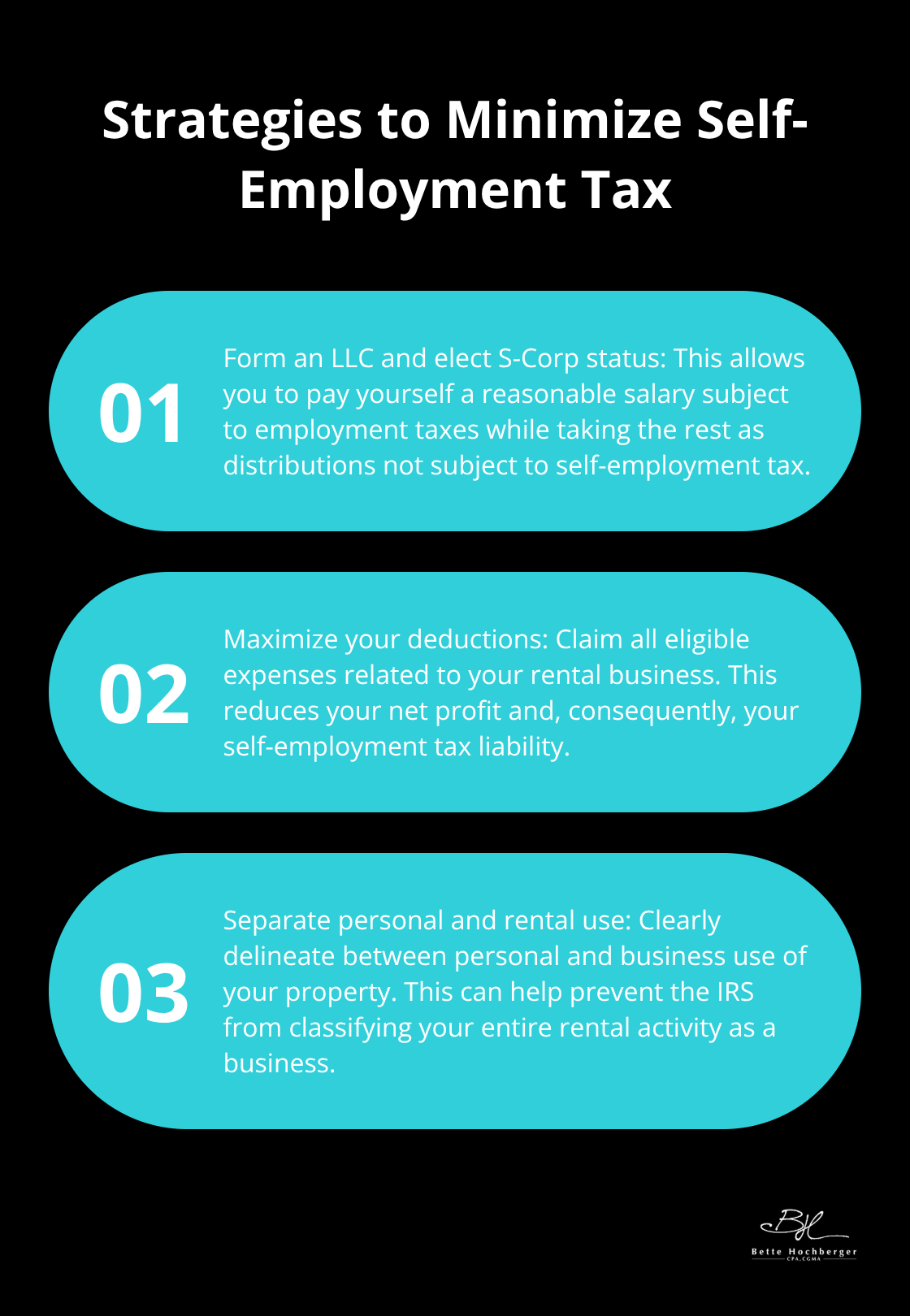

Strategies to Minimize Self-Employment Tax

If you find yourself subject to self-employment tax, you can potentially reduce your liability:

- Form an LLC and elect S-Corp status: This strategy allows you to pay yourself a reasonable salary (subject to employment taxes) while taking the rest as distributions (which aren’t subject to self-employment tax).

- Maximize your deductions: Claim all eligible expenses related to your rental business. This reduces your net profit and, consequently, your self-employment tax.

- Separate personal and rental use: Clearly delineate between personal and business use of your property. This can help prevent the IRS from classifying your entire rental activity as a business.

The National Association of Tax Professionals reports that proper tax planning can reduce self-employment tax liability by up to 30% for some short-term rental hosts.

Seek Professional Guidance

The line between passive rental income and active business income isn’t always clear. A tax professional who specializes in rental properties can help you classify your income correctly and take advantage of all available tax-saving strategies. At Bette Hochberger, CPA, CGMA, we offer personalized guidance to navigate these complex tax situations and optimize your financial position.

Final Thoughts

Short-term rentals and taxes create a complex landscape for hosts. Accurate record-keeping forms the foundation of successful tax management, potentially saving thousands in taxes annually. The dynamic nature of tax laws and unique rental situations make professional guidance invaluable for navigating issues like depreciation and self-employment tax strategies.

Bette Hochberger, CPA, CGMA offers personalized financial services for short-term rental hosts. Our team uses cloud technology to provide strategic tax planning and preparation designed to minimize tax liabilities. We understand the nuances of short-term rental taxation and can help grow your wealth while maintaining compliance.

Every decision regarding your short-term rental can impact your taxes. Staying informed and seeking professional advice can transform your rental property into a thriving, tax-efficient business venture. Our expertise in short-term rentals and taxes can guide you through the complexities of this unique financial landscape.