As the year draws to a close, smart taxpayers turn their attention to end-of-year tax planning. At Bette Hochberger, CPA, CGMA, we know that strategic moves made now can significantly impact your tax bill come April.

This guide will walk you through key strategies to maximize your deductions and minimize your tax liability. From reviewing your finances to leveraging tax-saving opportunities, we’ll cover essential steps to optimize your tax situation before the year ends.

How to Review Your Finances for Tax Planning

Compile Your Financial Records

The first step in effective end-of-year tax planning requires a thorough review of your financial situation. Start by gathering all relevant financial documents. This includes pay stubs, bank statements, investment records, receipts for major purchases, and documentation of any significant life events that occurred during the year. Don’t overlook digital records – many financial transactions now leave an electronic trail that can be easily missed.

Analyze Your Income

Take a close look at your income sources and amounts. This isn’t just about your salary. Consider all forms of income, including freelance work, investment dividends, rental income, and even gambling winnings. Understanding your total income is crucial for accurate tax planning.

Identify Deductible Expenses

Turn your attention to expenses. Look for items that may be tax-deductible. These could include mortgage interest, property taxes, charitable donations, medical expenses, and work-related costs. If you’re self-employed, include home office expenses, professional development costs, and business-related travel.

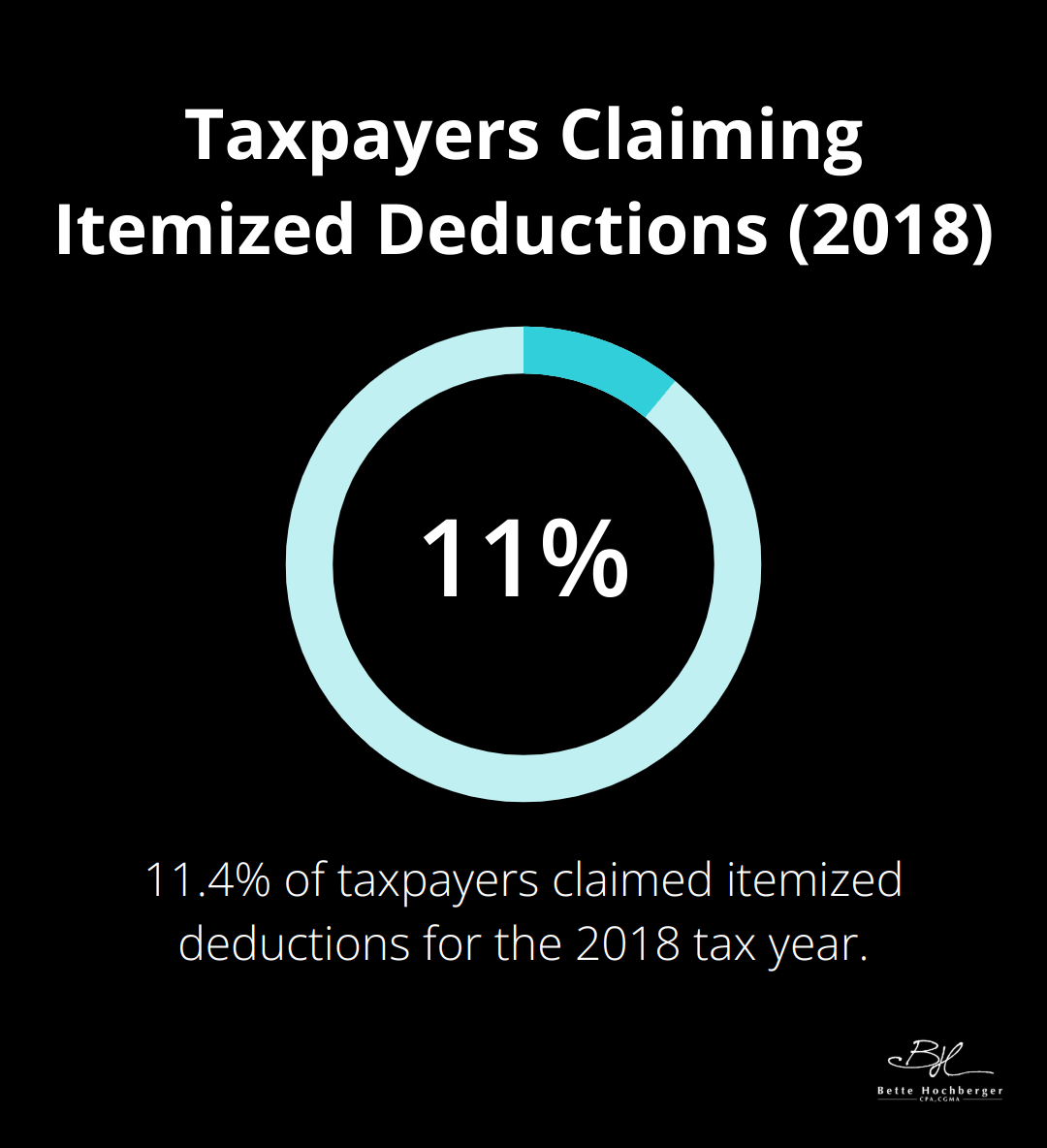

According to IRS statistics, 11.4% of taxpayers claimed itemized deductions for the 2018 tax year. This shows the significant impact that properly identified deductions can have on your tax liability.

Timing Matters

As you review your finances, consider opportunities to defer income or accelerate deductions. For instance, if you expect a year-end bonus, you might ask your employer to delay payment until January. This could potentially lower your taxable income for the current year.

On the flip side, you might accelerate expenses, maximize deductions, and minimize your tax bill before December 31st. This strategy (known as “bunching”) can be particularly effective if it pushes you over the threshold for itemizing deductions.

Seek Professional Guidance

Tax planning involves complex financial decisions. A professional can provide personalized advice on how to optimize your tax situation based on your unique financial circumstances. They can help you navigate the intricacies of tax law and ensure you don’t miss any potential deductions or credits.

As you complete your financial review, you’ll be well-positioned to take the next crucial step in your tax planning journey: maximizing your retirement contributions. This strategy not only secures your financial future but also offers significant tax advantages in the present.

How to Maximize Retirement Contributions for Tax Benefits

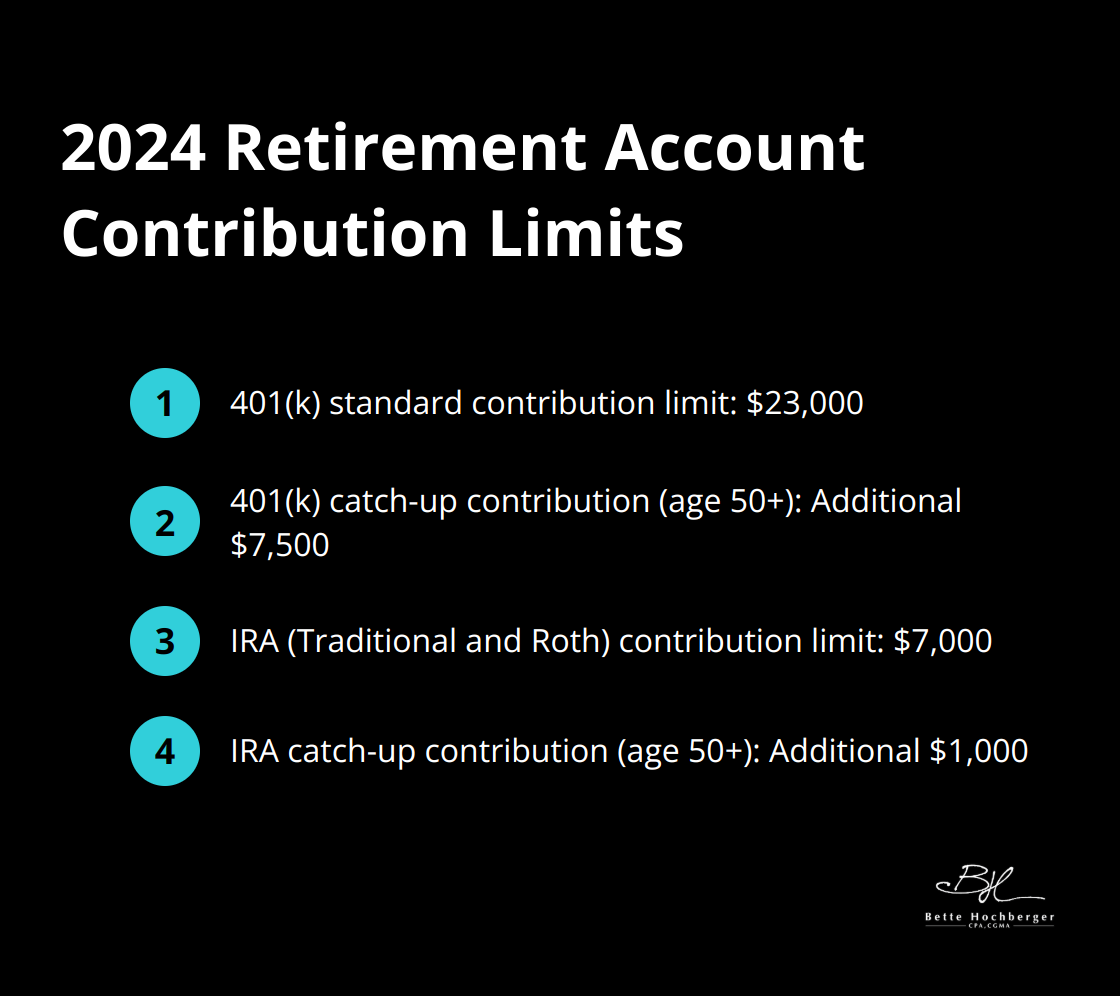

Understand Contribution Limits

The IRS sets specific contribution limits for retirement accounts. For 2024, 401(k) plans allow contributions up to $23,000. Individuals aged 50 or older can make an additional catch-up contribution of $7,500, bringing their total to $30,500. Traditional and Roth IRAs have a limit of $7,000, with an extra $1,000 allowed for those 50 and above.

These limits represent significant tax-saving opportunities. Maximizing your contributions could potentially reduce your taxable income by tens of thousands of dollars.

Leverage Employer-Sponsored Plans

If your employer offers a 401(k) match, contribute at least enough to capture the full match. This is essentially free money that also reduces your taxable income. Some employers offer after-tax contributions to 401(k) plans, which can be an excellent way to save even more if you’ve maxed out your pre-tax contributions.

Consider Roth Conversions

Roth IRA conversions offer tax-free growth and tax-free withdrawals in retirement, making them an attractive option for many investors. For those in a lower tax bracket this year, converting some of your traditional IRA to a Roth IRA could be beneficial. You’ll pay taxes on the converted amount now, but future withdrawals will be tax-free. This strategy can be particularly effective if you anticipate being in a higher tax bracket in retirement.

Meet Contribution Deadlines

The deadline for most retirement account contributions is December 31st. However, you have until the tax filing deadline (usually April 15th) to contribute to an IRA for the previous tax year. This flexibility allows for strategic planning at year-end.

Analyze Your Savings Rate

A recent study by Fidelity found that outstanding 401(k) loans and average loan amounts continue to trend downward, with 401(k) loans matching the lowest percentage on record. This suggests that many people are becoming more aware of the importance of preserving their retirement savings. Try to increase your contribution rate each year, even if by a small percentage.

Maximizing retirement contributions is just one piece of the tax planning puzzle. The next section will explore additional tax-saving strategies to further optimize your financial decisions and minimize your tax burden.

How Can You Slash Your Tax Bill?

Smart tax planning can significantly reduce your tax liability. Let’s explore some powerful strategies to help you keep more of your hard-earned money.

Tax Loss Harvesting: A Powerful Tool

Tax-loss harvesting can lower your tax bill and better position your portfolio going forward. You sell underperforming investments to use the losses to reduce your taxable income. The IRS allows you to deduct up to $3,000 of net capital losses against ordinary income each year. Any excess losses carry forward to future tax years.

For example, if you have $10,000 in capital gains and $13,000 in capital losses, you use $10,000 of the losses to offset your gains completely. The remaining $3,000 deducts against your ordinary income. This strategy works particularly well for high-income earners in higher tax brackets.

Strategic Charitable Giving

Charitable donations support causes you care about and provide substantial tax benefits. For 2024, you can deduct cash contributions up to 60% of your adjusted gross income (AGI). The key is to give strategically.

Consider donating appreciated stocks or mutual funds instead of cash. This avoids capital gains tax on the appreciation while still deducting the full fair market value of the donation. It maximizes your tax benefit and charitable impact.

For those aged 73 or older, a Qualified Charitable Distribution (QCD) counts toward the year’s required minimum distribution (RMD). This doesn’t include in your taxable income.

Maximize Your HSA Contributions

Health Savings Accounts (HSAs) offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. For 2024, individuals contribute up to $4,150, and families contribute up to $8,300. If you’re 55 or older, you add an extra $1,000 as a catch-up contribution.

Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year to year. This makes them an excellent vehicle for both current healthcare expenses and long-term savings. If you haven’t maxed out your HSA for the year, do so before December 31st to reduce your taxable income.

The Power of Bunching Deductions

With the standard deduction set at $14,600 for single filers and $29,200 for married couples filing jointly in 2024, many taxpayers find it challenging to itemize. However, bunching deductions effectively surpasses this threshold.

This concentrates deductible expenses into a single tax year. For instance, you make two years’ worth of charitable donations in one year, or schedule elective medical procedures to occur in the same tax year. Bunching these expenses allows you to itemize in one year and take the standard deduction in the alternate year, potentially saving thousands in taxes over time.

Implementing these strategies requires careful planning and execution. While they lead to significant tax savings, you must consider your overall financial picture and long-term goals.

Final Thoughts

End-of-year tax planning requires proactive steps to maximize savings. We recommend you start early to explore all available options and make informed decisions. Professional guidance can help you navigate complex tax laws and implement strategies tailored to your unique financial situation.

Bette Hochberger, CPA, CGMA offers expert assistance in tax planning, preparation, and Fractional CFO services. Our team specializes in minimizing tax liabilities and optimizing financial growth for our clients. We can help you implement effective strategies to reduce your tax burden and set you up for long-term financial success.

Take control of your finances today. Gather your financial documents and consult with a professional to create a comprehensive tax plan. With the right approach and expert guidance, you can transform tax season from a stressful obligation into an opportunity for financial optimization.