At Bette Hochberger, CPA, CGMA, we understand that high-income earners face unique tax challenges. The best tax strategy for high-income earners involves a combination of smart planning and expert guidance.

In this post, we’ll explore effective methods to optimize your tax situation, potentially saving you thousands of dollars each year. From maximizing retirement contributions to leveraging advanced tax planning techniques, we’ll cover strategies that can help you keep more of your hard-earned money.

How Tax Brackets Impact High-Income Earners

The Progressive Tax System Explained

The progressive tax system operates on a progressive scale; tax rates increase as income rises. For high-income earners, a thorough understanding of this system is essential for effective tax planning.

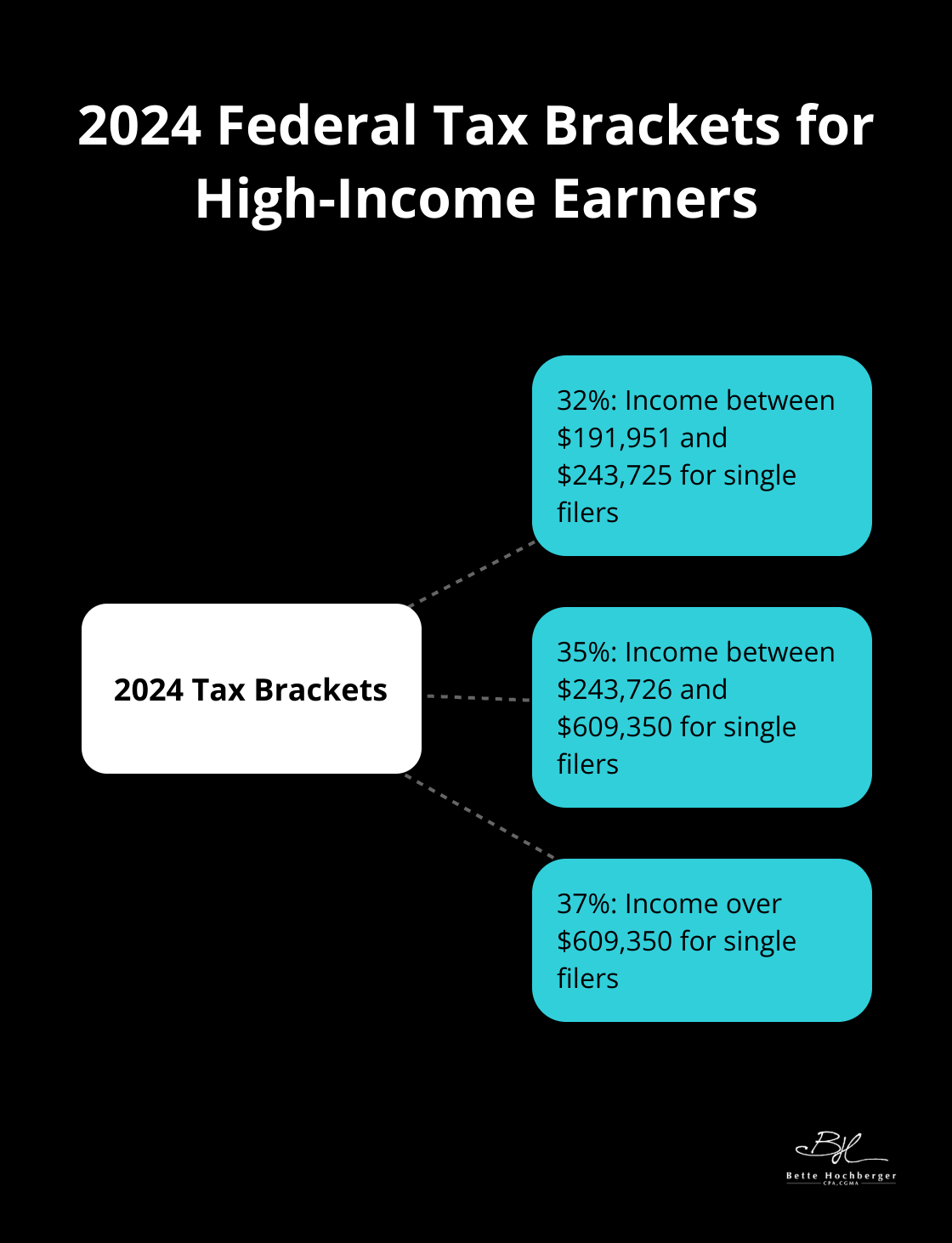

Breaking Down the 2024 Tax Brackets

In 2024, the federal tax code includes seven brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Each bracket applies to a specific income range. For example, a single filer with an income of $600,000 in 2024 will pay:

- 10% on the first $11,600

- 12% on income between $11,601 and $47,150

- 22% on income between $47,151 and $100,525

- 24% on income between $100,526 and $191,950

- 32% on income between $191,951 and $243,725

- 35% on income between $243,726 and $609,350

- 37% on income over $609,350

This structure ensures that not all income faces taxation at the highest rate, contrary to popular belief.

Marginal vs. Effective Tax Rates: What’s the Difference?

The marginal tax rate represents the tax on the last dollar of income. For our $600,000 earner, this rate is 35%. However, the effective tax rate (the average rate paid on all income) is significantly lower due to the progressive nature of the system.

Tax Management Strategies for High Earners

High-income individuals can employ several strategies to manage their tax brackets effectively:

- Income Timing: Shift income between tax years to stay in lower brackets.

- Deduction Planning: Concentrate deductions in specific years to reduce taxable income strategically.

- Investment Choices: Select tax-efficient investments to control overall tax liability.

The Alternative Minimum Tax (AMT): A Parallel System

High-income earners must also consider the AMT, a separate tax system designed to prevent wealthy taxpayers from using excessive deductions to avoid taxes entirely. For tax year 2025, the Max AMT exemption is $88,100 for individuals, $68,500 for married couples filing separately, and $137,000 for married couples filing jointly.

The complexities of the tax system (including brackets, rates, and the AMT) present both challenges and opportunities for strategic planning. A skilled tax professional can help navigate these intricacies and potentially reduce your tax bill significantly.

As we move forward, let’s explore specific strategies that high-income earners can use to optimize their tax situation and keep more of their hard-earned money.

Smart Tax Moves for High Earners

High-income earners have several powerful tools to reduce their tax burden. Let’s explore some of the most effective strategies that can lead to significant tax savings.

Maximize Retirement Contributions

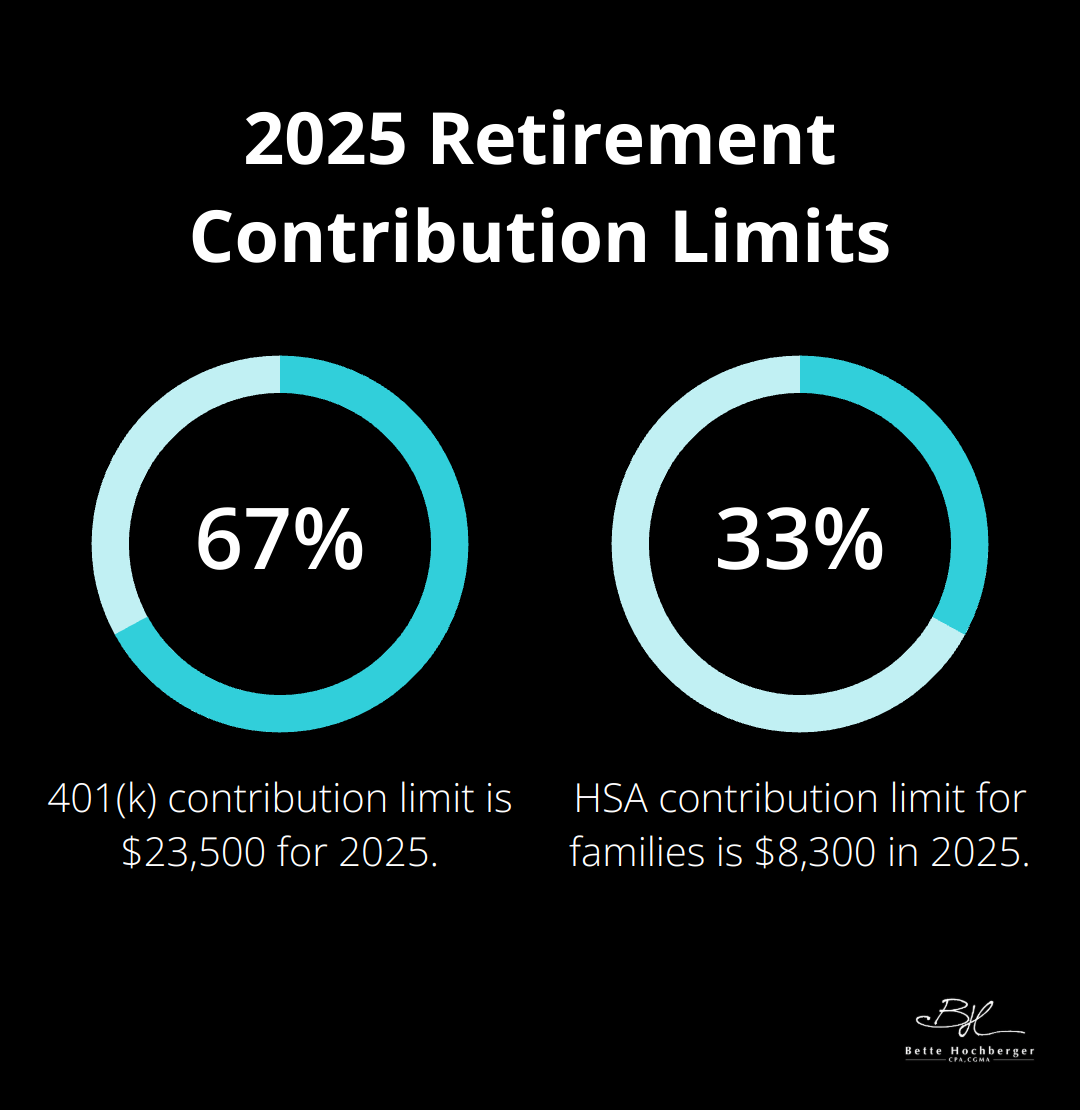

One of the simplest yet most impactful ways to lower your taxable income is to max out your retirement account contributions. In 2025, you can contribute up to $23,500 to your 401(k) or 403(b) plan. If you’re 50 or older, you can add an extra catch-up contribution of $11,250. This means you could potentially reduce your taxable income by $34,750 in a single year.

For those with access to a Health Savings Account (HSA), the contribution limit for 2025 is $4,150 for individuals and $8,300 for families. HSAs offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Invest in Tax-Advantaged Vehicles

Municipal bonds can be an excellent choice for high-income earners. The interest income from these bonds is typically exempt from federal taxes and, in many cases, state taxes if the investor resides in the issuing state. While the yields might be lower than corporate bonds, the tax benefits can make them more attractive on an after-tax basis.

Another option is to invest in tax-managed funds. These funds minimize taxable distributions, which can be particularly beneficial for high-income investors in taxable accounts. According to Morningstar, tax-managed funds can save investors up to 2% annually in taxes compared to similar non-tax-managed funds.

Strategic Charitable Giving

Charitable donations not only support causes you care about but can also provide significant tax benefits. Consider setting up a donor-advised fund (DAF). With a DAF, you can make a large contribution in one year, claim the tax deduction immediately, and then distribute the funds to charities over time.

For those over 70½, Qualified Charitable Distributions (QCDs) allow you to donate up to $100,000 directly from your IRA to a qualified charity. This counts towards your Required Minimum Distribution (RMD) but isn’t included in your taxable income.

Smart Capital Gains Management

Tax-loss harvesting is a strategy where you sell investments at a loss to offset capital gains. This can be particularly effective in years with high income or large capital gains. You can deduct up to $3,000 of net capital losses against your ordinary income each year, with any excess carried forward to future years.

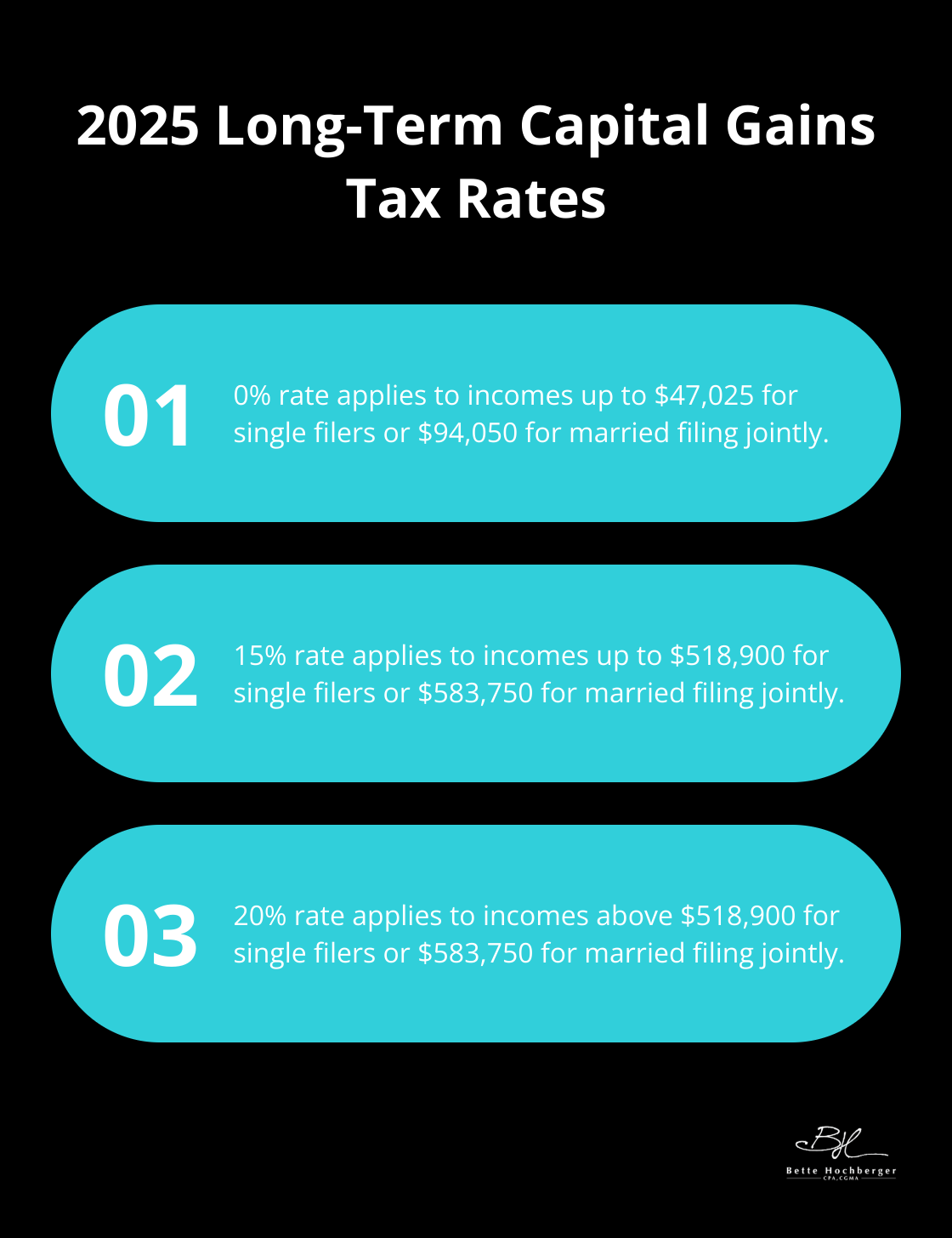

When it comes to realizing capital gains, timing is key. Try to hold investments for more than a year to qualify for long-term capital gains rates, which are significantly lower than short-term rates. For 2025, the long-term capital gains rate is 0% for incomes up to $47,025 for single filers ($94,050 for married filing jointly), 15% for incomes up to $518,900 ($583,750 for married filing jointly), and 20% for incomes above these thresholds.

These strategies can significantly reduce your tax burden, but they require careful planning and execution. In the next section, we’ll explore advanced tax planning techniques that can further optimize your financial situation.

Advanced Tax Strategies for Wealth Preservation

High-income earners often need to go beyond basic tax planning to truly optimize their financial situation. We will explore advanced strategies that can lead to significant tax savings and wealth preservation. Let’s examine some sophisticated techniques that can elevate your tax planning.

Qualified Opportunity Zones

Qualified Opportunity Zones (QOZs) offer a powerful tax deferral and reduction strategy for investors with significant capital gains. Investing realized capital gains into a Qualified Opportunity Fund (QOF) allows you to defer tax on those gains until December 31, 2026, or until you have an inclusion event, whichever is earlier. If you hold the investment for at least 10 years, you may qualify for a complete exemption from capital gains tax on the QOF investment’s appreciation.

For instance, if you invest $1 million of capital gains into a QOF and it grows to $2 million over 10 years, you would only pay taxes on the original $1 million gain (deferred until 2026), while the additional $1 million in appreciation could be completely tax-free.

Private Placement Life Insurance

Private Placement Life Insurance (PPLI) combines life insurance with tax-advantaged investment opportunities. PPLI policies allow high-net-worth individuals to invest in a wide range of assets while benefiting from tax-free growth and customized investment options.

PPLI can potentially eliminate current income taxes on investment gains and provide a tax-free death benefit. However, you must work with experienced professionals to structure these policies correctly, as they are subject to complex IRS regulations.

Estate Planning for Tax Efficiency

For high-income earners, estate planning is not just about passing on wealth-it’s also a critical component of tax strategy. The current estate tax exemption is historically high, set at $13.61 million per individual for 2024. However, this exemption will decrease significantly in 2026, making proactive planning essential.

One effective strategy involves the use of irrevocable trusts. Transferring assets into an irrevocable trust removes them from your taxable estate while potentially maintaining some control over their distribution. Grantor Retained Annuity Trusts (GRATs) and Intentionally Defective Grantor Trusts (IDGTs) can be particularly effective for transferring wealth while minimizing gift and estate taxes.

Family Limited Partnerships

A Family Limited Partnership (FLP) allows you to transfer assets to family members at a discounted value for gift tax purposes while retaining control over the assets. This strategy proves especially useful for business owners or those with significant real estate holdings.

These advanced strategies require careful planning and execution. It’s important to work with experienced professionals who can help you navigate the complex legal and tax implications.

Final Thoughts

High-income earners face unique tax challenges that require a multifaceted approach. The best tax strategy for high-income earners combines immediate actions with long-term planning. Tax laws change frequently, so professional guidance becomes essential to navigate these complex waters effectively.

Bette Hochberger, CPA, CGMA offers personalized financial services tailored to high-income earners and businesses. Our expertise in strategic tax planning can help minimize tax liabilities and ensure long-term profitability. We specialize in providing Fractional CFO services and tax preparation to support your financial goals.

Proactive tax planning builds a robust financial future. Implementing these strategies consistently and adjusting them as your situation evolves creates a tax-efficient framework. This approach supports wealth accumulation goals for years to come (while keeping more of your hard-earned money working for you).