At Bette Hochberger, CPA, CGMA, we often field questions about 1031 exchanges from real estate investors looking to optimize their tax strategies.

These powerful tools allow investors to defer capital gains taxes when selling investment properties and reinvesting the proceeds.

Understanding the ins and outs of 1031 exchanges can be complex, but the potential benefits make them worth exploring for many property owners.

What Is a 1031 Exchange?

The Power of Tax Deferral

A 1031 exchange stands as a potent tax strategy for real estate investors. It allows them to defer capital gains taxes when they sell an investment property and reinvest the proceeds into a new property. This IRS-approved method can significantly increase an investor’s purchasing power and accelerate wealth accumulation.

Qualifying Properties and Requirements

To qualify for a 1031 exchange, both the property sold (relinquished property) and the property acquired (replacement property) must serve investment or business purposes. Personal residences do not meet the criteria. The replacement property’s value must equal or exceed that of the relinquished property to fully defer taxes.

The Federation of Exchange Accommodators estimates that around $100 billion worth of real estate assets were exchanged through 1031 exchanges in 2019. This impressive figure highlights the strategy’s popularity and effectiveness among astute investors.

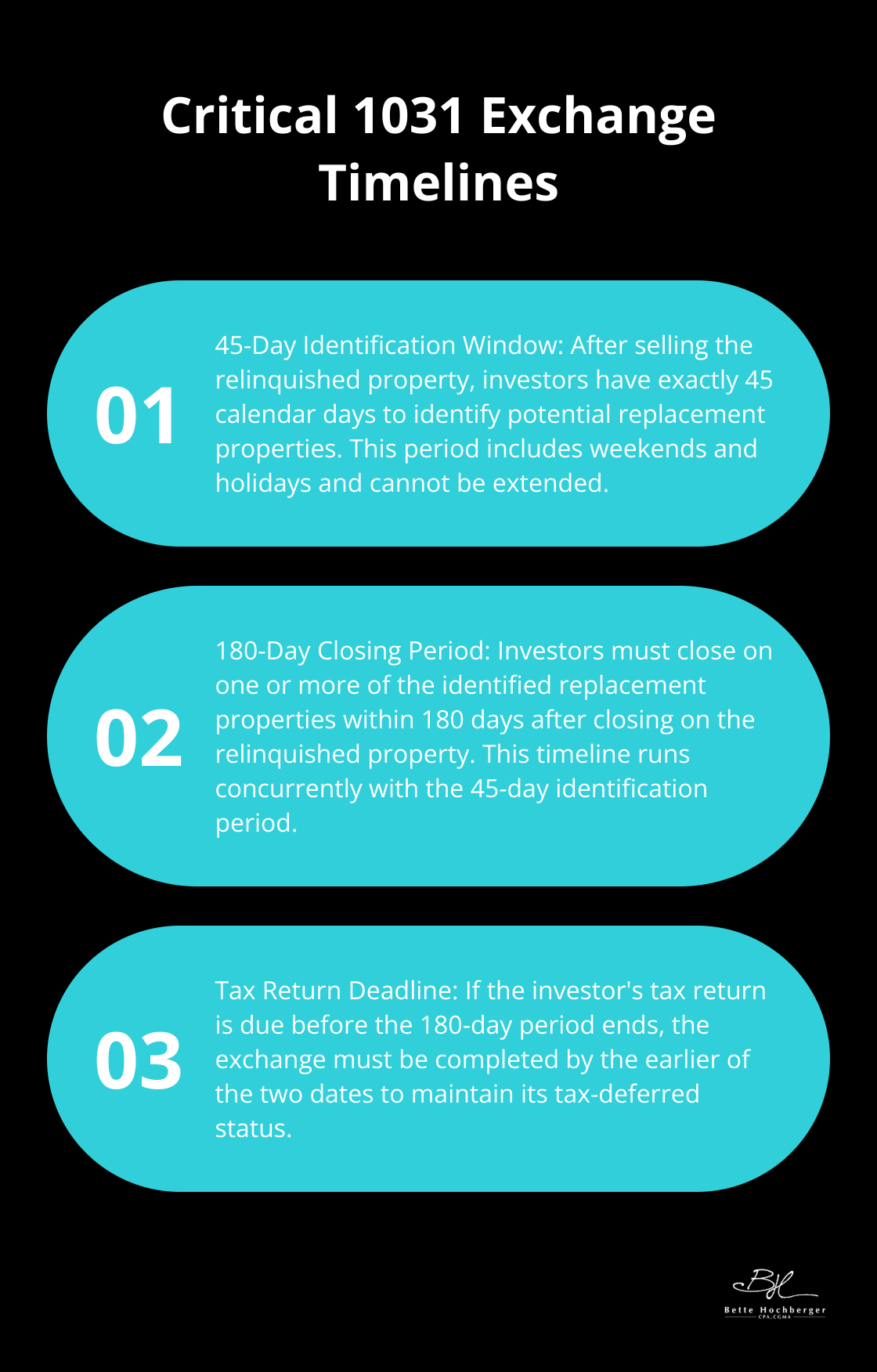

Critical Timelines

Time constraints play a crucial role in 1031 exchanges. Investors must identify potential replacement properties within 45 days of selling their relinquished property. They must complete the entire exchange within 180 days. Failure to meet these deadlines results in immediate tax liability.

The Role of Qualified Intermediaries

A qualified intermediary (QI) must facilitate the exchange. This third party holds the sale proceeds from the relinquished property and uses them to purchase the replacement property. The investor never takes possession of the funds, which maintains the tax-deferred status of the transaction.

Eligible Property Types

The tax code uses the term “like-kind,” but it interprets this broadly for real estate. Nearly all real property held for investment or business use qualifies for exchange. For example, an investor can exchange an apartment building for raw land, or a retail space for an office building.

However, the IRS explicitly excludes certain types of property from 1031 exchanges. These include stocks, bonds, notes, and partnership interests. Additionally, property held primarily for resale (such as fix-and-flip properties) does not qualify.

As we move forward, we’ll explore the numerous benefits that 1031 exchanges offer to savvy real estate investors. These advantages extend far beyond simple tax deferral and can significantly impact an investor’s long-term wealth-building strategy.

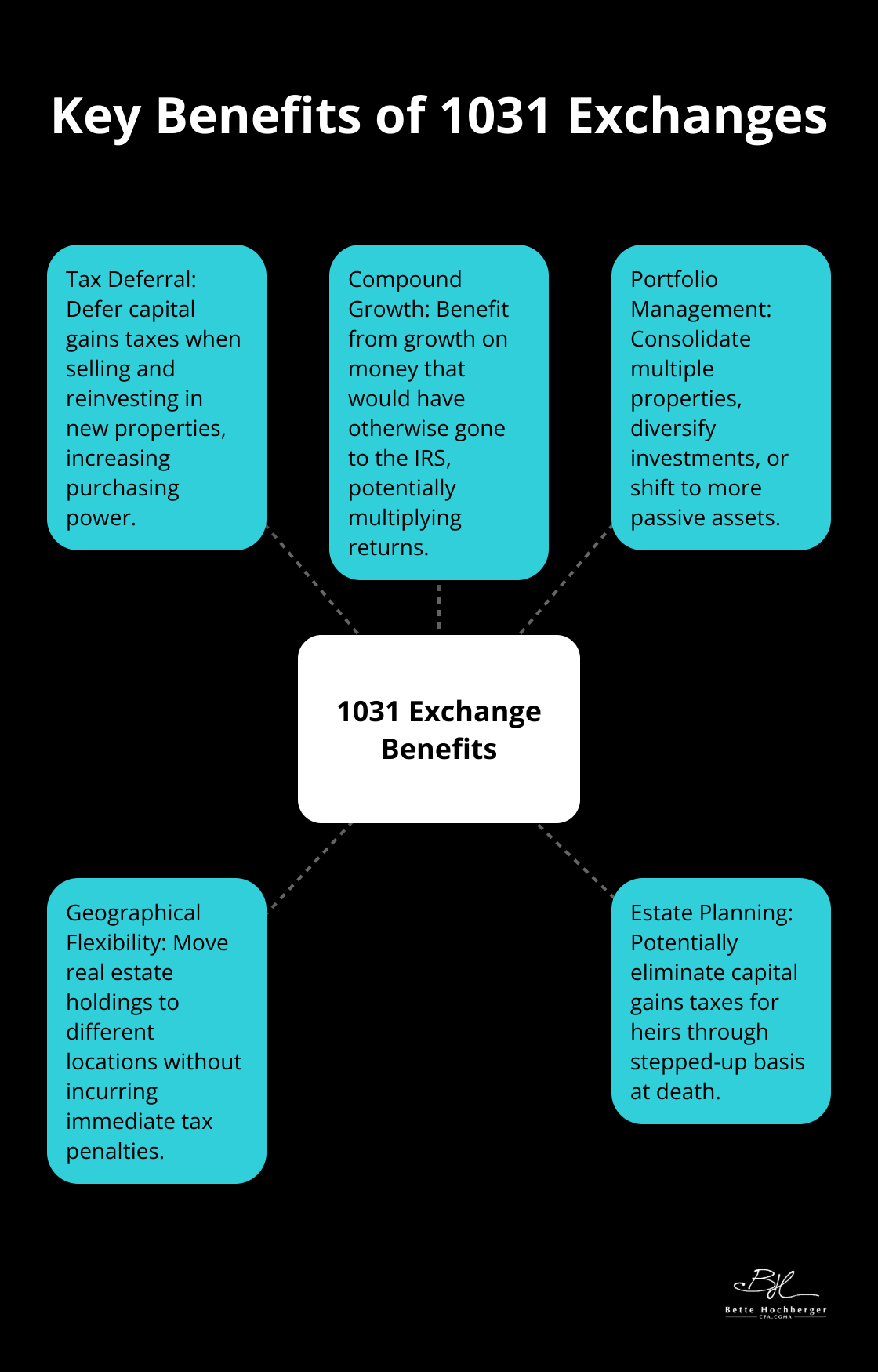

Why 1031 Exchanges Transform Real Estate Investing

Amplifying Investment Power

1031 exchanges offer real estate investors a powerful tool to build wealth and optimize their portfolios. The primary advantage lies in the ability to defer capital gains taxes. This deferral allows investors to reinvest the full proceeds from a property sale into a new investment. For instance, if you sell a property for $1 million with $300,000 in capital gains, you can reinvest the entire $1 million instead of just $700,000 after taxes. This increased purchasing power can lead to acquiring larger or more valuable properties (potentially generating higher returns).

Compound Growth Without Tax Burden

Tax deferral enables investors to benefit from compound growth on money that would have otherwise gone to the IRS. This growth potential multiplies when you reinvest all your gains into a new property in a high-growth market.

Strategic Portfolio Management

1031 exchanges provide flexibility in managing your real estate portfolio. You can use them to:

- Consolidate multiple properties into a single, more manageable asset

- Diversify from a single large property into multiple smaller ones

- Shift from high-maintenance properties to more passive investments

An investor with several small rental properties could exchange them for a larger apartment complex, simplifying management and potentially increasing cash flow.

Geographical Flexibility

These exchanges allow investors to move their real estate holdings to different locations without incurring immediate tax penalties. This flexibility proves particularly valuable for capitalizing on emerging markets or adjusting to changing personal circumstances. Emerging Trends in Real Estate® provides an outlook on real estate investment and development, presenting opportunities for strategic relocations.

Estate Planning Advantages

1031 exchanges can serve as a valuable tool in estate planning. If an investor holds a property acquired through a 1031 exchange until death, their heirs can receive a stepped-up basis, potentially eliminating capital gains taxes altogether. This strategy can significantly enhance the value of the estate passed on to future generations.

While 1031 exchanges offer substantial benefits, they also come with complex rules and potential pitfalls. Working with experienced professionals who can guide you through the process and help you maximize the advantages while avoiding common mistakes becomes essential. The next section will explore the specific rules and timelines that govern 1031 exchanges, providing a roadmap for successful implementation of this powerful investment strategy.

Navigating the 1031 Exchange Timeline

The 45-Day Identification Window

The 1031 exchange process starts when you sell your relinquished property. You have exactly 45 calendar days to identify potential replacement property(ies). This period includes weekends and holidays and cannot be extended. We suggest you start your property search before selling your original property to give yourself more time.

You can identify up to three properties of any value, or more if their total value doesn’t exceed 200% of the relinquished property’s value. Submit your identifications in writing to your qualified intermediary before the deadline expires.

Closing Within 180 Days

After identifying your replacement properties, you must close on one or more of them within 180 days after closing on your relinquished property. This timeline runs concurrently with the 45-day identification period (not consecutively). If your tax return is due before the 180-day period ends, you must complete the exchange by the earlier of the two dates.

The Critical Role of Qualified Intermediaries

A qualified intermediary (QI) is not just a legal requirement; they’re essential for a smooth exchange. The QI holds the proceeds from your property sale, preventing you from having actual or constructive receipt of the funds (which would disqualify the exchange).

Choose your QI carefully. Look for experience, financial stability, and a solid reputation. A good QI will help you navigate the complexities of the exchange, ensure all paperwork is completed correctly, and keep you on track with deadlines.

Understanding Boot and Its Tax Implications

Boot refers to any non-like-kind property received in the exchange, including cash. It’s taxable and can significantly impact the benefits of your 1031 exchange. Common sources of boot include:

- Cash proceeds not reinvested

- Reduction in mortgage debt on the replacement property

- Personal property received in the exchange

To maximize tax deferral, try to reinvest all equity and replace or exceed the debt from your relinquished property. If you receive boot, you’ll owe taxes on the lesser of the boot amount or your total gain on the sale.

Avoiding Common Pitfalls

Navigating these rules and timelines can be challenging. Here are some common pitfalls to avoid:

- Missing deadlines (45-day identification or 180-day closing)

- Incorrectly identifying replacement properties

- Receiving funds directly instead of through a QI

- Failing to reinvest all proceeds

Professional guidance can help you sidestep these issues and make the most of your 1031 exchange. While many firms offer 1031 exchange services, Bette Hochberger, CPA, CGMA stands out for its personalized approach and expertise in complex exchanges.

Final Thoughts

1031 exchanges provide real estate investors with a powerful tool to defer capital gains taxes and build wealth. Investors can leverage their full equity to acquire more valuable properties or diversify their portfolios by reinvesting proceeds from property sales into new investments. The tax deferral allows for compound growth on funds that would otherwise go to the IRS, which can potentially accelerate wealth accumulation over time.

The complexities of 1031 exchanges demand careful planning and attention to detail. Strict timelines for identifying and closing on replacement properties, along with nuanced rules surrounding qualified intermediaries and boot, can challenge uninitiated investors. Professional guidance becomes invaluable in navigating these intricacies and maximizing the benefits of 1031 exchanges.

Bette Hochberger, CPA, CGMA specializes in helping real estate investors optimize their 1031 exchanges. Our team of experts can guide you through every step of the process, from strategic tax planning to identifying suitable replacement properties (and ensuring compliance with IRS regulations). We use advanced cloud technology and personalized service to help our clients manage their real estate investments effectively.