Strategic tax planning is the key to keeping more money in your pocket. At Bette Hochberger, CPA, CGMA, we know that smart tax strategies can lead to significant savings for individuals and businesses alike.

In this post, we’ll explore effective tax planning techniques and how they differ from simple tax preparation. We’ll also share practical strategies for various financial situations, helping you make the most of your hard-earned money.

What Is Strategic Tax Planning?

The Proactive Approach to Financial Management

Strategic tax planning transcends simple compliance. It’s a proactive approach to managing finances that focuses on making informed decisions throughout the year to minimize tax burdens and maximize savings. At its core, strategic tax planning involves the analysis of your financial situation, understanding of tax laws, and implementation of strategies to reduce your tax liability legally.

Year-Round Planning vs. Annual Preparation

Unlike tax preparation (which typically occurs once a year), strategic tax planning is an ongoing process. It demands foresight and regular adjustments to financial strategies. A study by the Government Accountability Office revealed that about 2 million taxpayers overpaid their taxes by not itemizing deductions when they should have. This statistic underscores the importance of continuous planning and analysis.

Quantifiable Benefits of Strategic Planning

The savings from strategic tax planning can be substantial. Tax planning can lead to reduced tax liability, improved cash flow management, and maximized tax deductions and credits. For individuals, the savings can be equally significant. Maximizing contributions to tax-advantaged retirement accounts (such as 401(k)s or IRAs) can lead to thousands of dollars in tax savings annually.

Customized Strategies for Optimal Results

Effective tax planning isn’t a one-size-fits-all solution. It requires a deep understanding of your unique financial situation. For business owners, this might mean selecting the right business structure. S corporations, for example, can offer benefits such as protected assets for shareholders and pass-through taxation. For individuals, it could involve the strategic timing of income and expenses. High-income earners can save thousands in taxes each year by harvesting tax losses in investment portfolios.

The Role of Professional Guidance

While many aspects of tax planning can be self-managed, the complexity of tax laws often necessitates professional guidance. Certified Public Accountants (CPAs) and tax professionals stay current with ever-changing tax regulations and can provide invaluable insights. They can identify opportunities for tax savings that you might overlook and help you avoid costly mistakes.

As we move forward, we’ll explore the essential components that make up an effective tax planning strategy. These elements will help you build a comprehensive approach to managing your taxes and maximizing your financial potential.

How to Optimize Your Tax Strategy

Strategic tax planning requires careful consideration of various financial aspects. We’ve identified key components that can significantly impact your tax savings.

Time Your Income and Expenses

One of the most powerful tools in tax planning is the strategic timing of income and expenses. If you expect a lower income year, it might benefit you to accelerate income into the current year and defer deductions to the following year. Conversely, in a high-income year, deferring income and accelerating deductions can lead to substantial tax savings.

This strategy proves particularly effective for self-employed individuals and small business owners who have more control over when they bill clients or make purchases.

Maximize Your Deductions

Optimizing deductions is essential for reducing your taxable income. Common deductions that people often overlook include charitable contributions, home office expenses for self-employed individuals, and educational expenses related to your current job.

For businesses, Section 179 of the Internal Revenue Code allows for immediate expensing of certain capital purchases. This can significantly reduce taxable income in the year of purchase, providing immediate tax relief and improving cash flow.

Implement Smart Investment Strategies

Investment decisions play a crucial role in your overall tax picture. Tax-efficient investing involves considering the tax implications of your investment choices. Key strategies include asset location, investment selection, and transaction timing. Tax-managed funds and municipal bonds can be effective tools for tax efficiency.

Additionally, tax-loss harvesting – selling investments at a loss to offset capital gains – can be an effective strategy.

Plan for Tax-Efficient Retirement

Retirement accounts offer excellent opportunities for tax-advantaged savings. Traditional 401(k)s and IRAs allow for tax-deferred growth, while Roth accounts offer tax-free withdrawals in retirement. The choice between these options depends on your current tax bracket and expectations for future income.

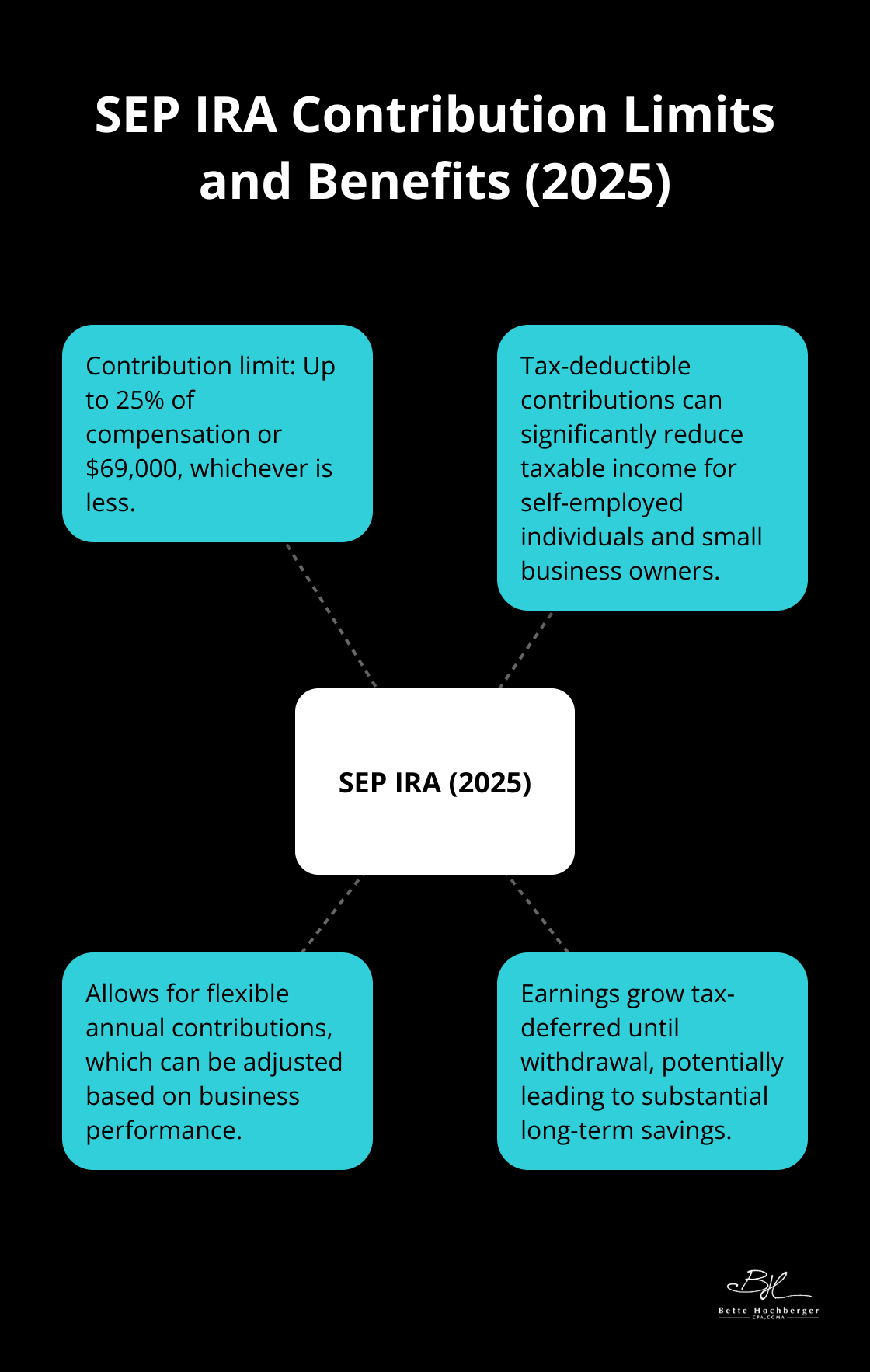

For small business owners, setting up a Simplified Employee Pension (SEP) IRA or a Solo 401(k) can allow for significant tax-deductible contributions. As of 2025, SEP IRAs allow contributions of up to 25% of compensation or $69,000, whichever is less.

Choose the Right Business Structure

For business owners, selecting the appropriate business structure is vital for tax optimization. Each structure – sole proprietorship, partnership, LLC, S corporation, or C corporation – has different tax implications.

For instance, S corporations can provide significant tax savings for some business owners by allowing them to pay themselves a reasonable salary and take additional income as distributions, potentially reducing self-employment taxes. However, this strategy requires careful planning and documentation to comply with IRS regulations.

Implementing these strategies requires a deep understanding of tax laws and your unique financial situation. While these components form the foundation of effective tax planning, the optimal approach varies for each individual and business. In the next section, we’ll explore practical tax planning strategies for different situations, helping you tailor your approach to your specific financial circumstances.

Tailored Tax Strategies for Every Financial Situation

Small Business Owners and Self-Employed Individuals

Small business owners and self-employed individuals can take advantage of unique opportunities for tax savings. One powerful strategy involves maximizing retirement contributions. In a one-participant 401(k) plan, self-employed individuals can contribute up to 25% of compensation as defined by the plan, or follow specific guidelines for self-employed individuals.

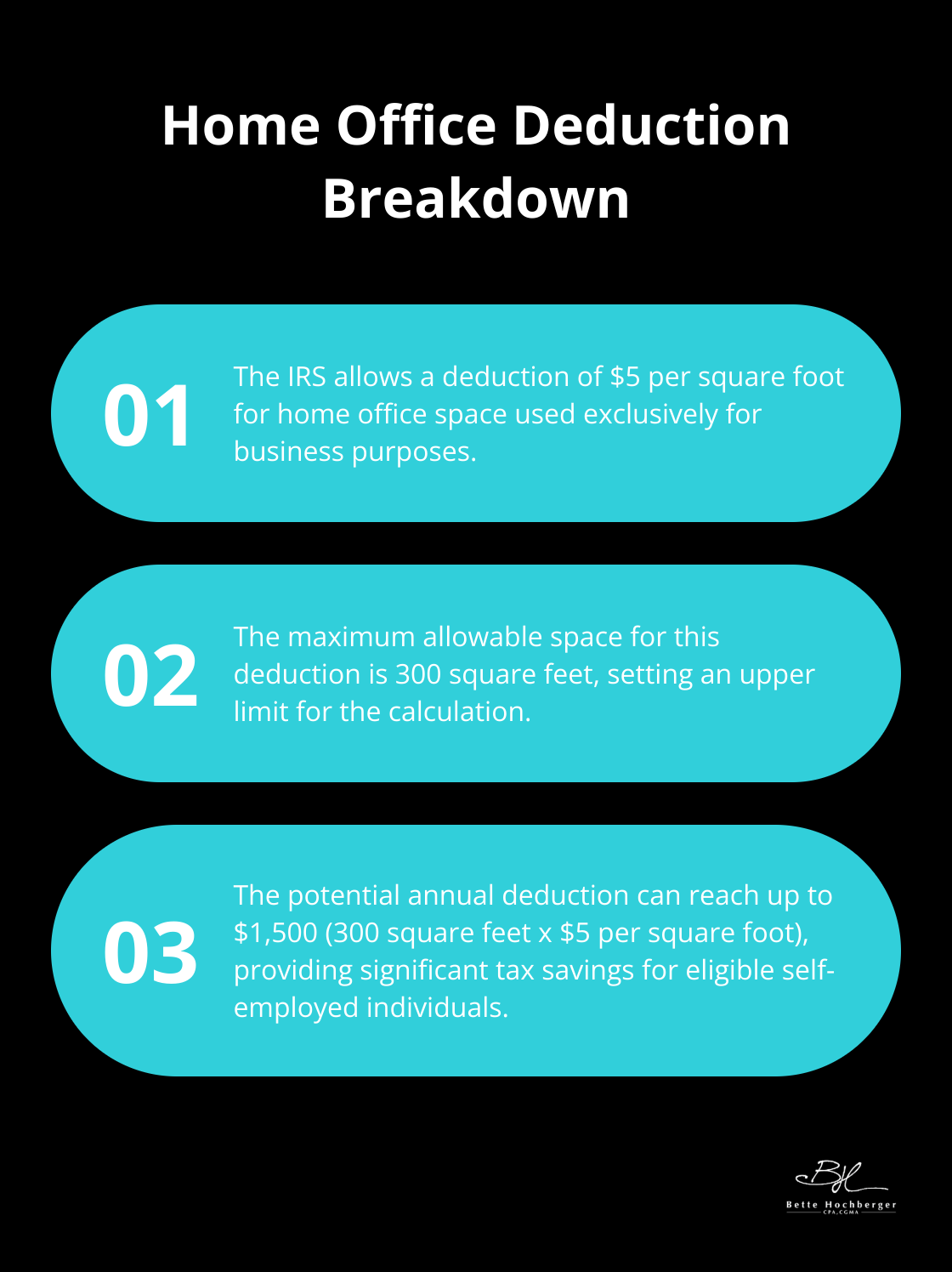

The home office deduction presents another effective strategy. The IRS allows a deduction of $5 per square foot of home office space (up to 300 square feet). This can result in a deduction of up to $1,500 annually.

Strategic timing of business expenses can lead to substantial savings. Purchasing necessary equipment or supplies before year-end increases deductions for the current tax year.

High-Income Earners

High-income earners face unique challenges in tax planning. One effective strategy involves maximizing contributions to tax-advantaged accounts. This includes maxing out 401(k) contributions, which for 2025 is $23,000 for those under 50 and $30,500 for those 50 and older.

Charitable giving provides significant tax benefits. Consider donating appreciated securities instead of cash. This strategy allows you to avoid capital gains tax on the appreciation while still claiming the full market value as a charitable deduction.

Tax-loss harvesting serves as another powerful tool. Selling investments that are underperforming and losing money can offset capital gains and potentially reduce your tax bill by up to $3,000 per year.

Real Estate Investors

Real estate investors have access to numerous tax advantages. One key strategy involves maximizing depreciation deductions. The cost recovery period for residential rental property is 27.5 years, which allows for significant annual deductions.

1031 exchanges offer a powerful tax deferral strategy. Reinvesting proceeds from the sale of an investment property into a like-kind property allows investors to defer capital gains taxes indefinitely.

Short-term rental owners can potentially qualify for the qualified business income (QBI) deduction, which allows for a deduction of up to 20% of net rental income.

Cryptocurrency Investors

Cryptocurrency investors face unique tax challenges. The IRS treats cryptocurrency as property (not currency) for tax purposes. This means each transaction, including purchases made with cryptocurrency, can trigger a taxable event.

One strategy to minimize taxes involves holding cryptocurrencies for more than a year before selling. This qualifies any gains for long-term capital gains rates, which are typically lower than short-term rates.

Using specific identification when selling cryptocurrencies can also lead to tax savings. This method allows you to choose which units of cryptocurrency to sell, potentially minimizing your tax liability.

Final Thoughts

Strategic tax planning empowers individuals and businesses to maximize their financial potential. This proactive approach to tax management can significantly reduce tax burdens and increase savings. Working with a qualified tax professional proves essential to navigate complex tax laws and regulations effectively.

Bette Hochberger, CPA, CGMA specializes in strategic tax planning and preparation for businesses and professionals. Our team utilizes advanced cloud technology to deliver personalized financial services. These services aim to minimize tax liabilities, manage cash flow, and ensure profitability.

Strategic tax planning requires regular review and adjustment to stay ahead of changing tax laws. We can help you develop a comprehensive tax strategy that aligns with your financial goals. Don’t leave money on the table – take control of your taxes and maximize your savings with strategic tax planning.