At Bette Hochberger, CPA, CGMA, we’ve seen the transformative impact of fractional CFO firms on businesses of all sizes.

These specialized financial experts offer strategic guidance without the hefty price tag of a full-time executive.

Choosing the right fractional CFO firm can be a game-changer for your company’s financial health and growth potential.

This guide will walk you through the essential factors to consider when selecting a fractional CFO partner that aligns with your business goals.

What Does a Fractional CFO Do?

Strategic Financial Leadership

A fractional CFO provides high-level strategic guidance and financial management on a part-time or project basis. These professionals offer the expertise of a seasoned CFO without the full-time commitment or cost. They analyze financial data, identify improvement areas, and develop strategies to boost profitability and growth. For instance, a fractional CFO might implement a new budgeting system that cuts unnecessary expenses by 15% (directly improving your bottom line).

Cost-Effective Expertise

One of the main advantages of hiring a fractional CFO firm is cost-effectiveness. Small and medium-sized businesses can access top-tier financial expertise without breaking the bank. Outsourcing to fractional CFO services provides businesses with cost-effective financial leadership.

Flexibility and Scalability

Fractional CFOs offer flexibility in terms of engagement. You can scale their services up or down based on your business needs. This adaptability proves particularly valuable for seasonal businesses or those experiencing rapid growth. During a fundraising round, for example, you might increase your fractional CFO’s hours to prepare financial projections and pitch decks.

Industry-Specific Knowledge

Many fractional CFO firms specialize in specific industries, bringing targeted expertise to your business. This industry-specific knowledge can make a significant difference. A fractional CFO with experience in your sector can provide insights on industry benchmarks, regulatory compliance, and growth opportunities that a generalist might overlook.

Technology Integration

Fractional CFOs often bring expertise in financial technology, helping businesses streamline their financial processes. They can implement automation tools to improve accuracy and help drive growth. This tech-savvy approach leads to more accurate forecasting and faster decision-making.

The key difference between fractional and full-time CFOs lies in their engagement model. Fractional CFOs offer specialized expertise on a flexible, as-needed basis, making them an ideal solution for businesses that require high-level financial guidance but aren’t ready for the commitment of a full-time executive. As we move forward, let’s explore the key factors to consider when selecting a fractional CFO firm that aligns with your business goals.

Selecting the Right Fractional CFO Firm

Industry-Specific Expertise

A firm with a proven track record in your industry can make a significant difference. For example, a fractional CFO with experience in SaaS companies will understand the nuances of recurring revenue models and customer acquisition costs. They can benchmark your performance against industry standards and identify areas for improvement.

Comprehensive Service Offerings

The best fractional CFO firms offer a wide range of services tailored to your business needs. These services might include financial forecasting, cash flow management, fundraising support, and M&A advisory. Some firms provide services across multiple industries (such as SaaS, real estate, and manufacturing), which demonstrates their versatility.

Cutting-Edge Technology Integration

Your fractional CFO should excel in modern financial software and tools. They need to implement and leverage technologies like cloud-based accounting systems, data analytics platforms, and financial modeling software. This tech-savvy approach can lead to more accurate forecasting and faster decision-making.

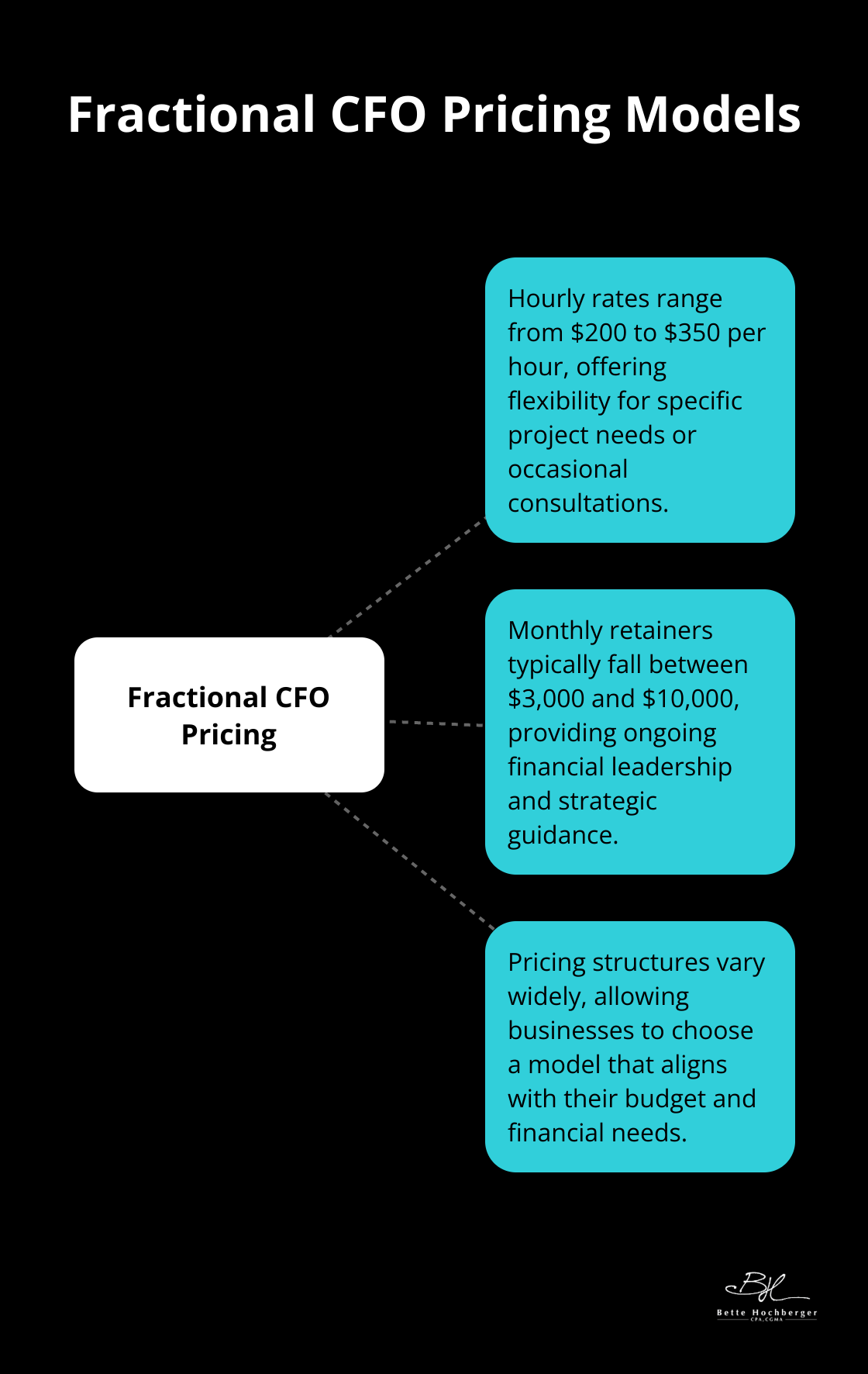

Flexible Pricing Models

Pricing structures for fractional CFO services vary widely. Some firms charge hourly rates ranging from $200 to $350, while others offer monthly retainers between $3,000 and $10,000. Try to find a firm that provides a pricing model aligned with your budget and needs. Transparency in pricing is essential – avoid firms that are vague about their fee structure.

Proven Track Record

Client testimonials and case studies are invaluable in assessing a fractional CFO firm’s effectiveness. Look for concrete examples of how they’ve helped businesses similar to yours. Has the firm helped a company in your industry increase its profit margins by a specific percentage? Or perhaps they’ve assisted in securing a significant round of funding?

The right fractional CFO firm should feel like a true partner in your business’s financial success. They should communicate complex financial concepts clearly, align their strategies with your business goals, and demonstrate a genuine interest in your company’s growth. These factors will equip you to choose a contract CFO that can propel your business to new heights of financial success. Now, let’s explore the essential questions you should ask potential fractional CFO firms to ensure they’re the right fit for your business.

Probing Questions for Potential Fractional CFO Firms

Financial Strategy Approach

Ask about their methodology for developing financial strategies. A top-tier fractional CFO firm should outline a clear process that includes thorough analysis of your current financial situation, identification of growth opportunities, and creation of actionable plans. They might discuss AI use cases for CFOs that are rapidly transforming the finance landscape, helping to streamline operations, make better decisions, and drive growth.

Communication and Reporting Practices

Effective communication is vital for a successful partnership. Inquire about their reporting frequency and methods. Do they provide weekly updates? Monthly financial reports? Real-time dashboard access? A study by McKinsey found that companies with strong financial communication practices are 2.5 times more likely to outperform their peers. Look for firms that offer clear, concise reports tailored to your business needs and decision-making processes.

Track Record of Success

Request specific examples of how they’ve helped businesses similar to yours. A reputable firm should provide case studies or testimonials demonstrating tangible results. They might share how they helped a SaaS company increase its valuation before a funding round or assisted a manufacturing business in reducing inventory costs through improved cash flow management.

Team Qualifications and Experience

Explore the backgrounds of the team members who will work with your company. Look for a mix of industry experience, relevant certifications (such as CPA or CMA), and a track record of success in roles similar to what your business needs. A survey by Robert Half found that 93% of CFOs say it’s challenging to find skilled financial professionals, so a firm with a strong, diverse team is a valuable asset.

Staying Current with Industry Trends

The financial landscape constantly evolves. Ask how the firm stays updated on industry trends, regulatory changes, and emerging technologies. Do they attend conferences? Participate in professional development programs? Subscribe to industry publications? A forward-thinking firm will have a clear strategy for staying ahead of the curve and bringing that knowledge to benefit your business.

Final Thoughts

Selecting the right fractional CFO firm will significantly impact your company’s financial health and growth trajectory. These specialized firms offer cost-effective financial leadership, industry-specific expertise, and cutting-edge technology integration. The ideal fractional CFO partner will feel like an extension of your team, providing strategic insights tailored to your unique business challenges.

Fractional CFO firms should demonstrate a genuine interest in your company’s growth and have a clear approach to developing financial strategies that drive success. You must prioritize industry experience, comprehensive service offerings, and a proven track record of success when evaluating potential partners. Look for firms that leverage advanced financial technologies and offer flexible pricing models that align with your business needs.

At Bette Hochberger, CPA, CGMA, we specialize in providing personalized financial services, including fractional CFO services. Our team aims to minimize tax liabilities, manage cash flow, and ensure profitability for businesses like yours. We strive to help companies navigate complex financial landscapes and achieve sustainable growth (through expert guidance and tailored strategies).