Content creation has become a booming industry, but with great success comes great responsibility – especially when it comes to taxes. At Bette Hochberger, CPA, CGMA & Associates PLLC, we understand the unique challenges content creators face when navigating the complex world of taxes.

In this post, we’ll break down the essentials of taxes for content creators, from understanding different income types to maximizing deductions and maintaining proper records. Whether you’re a seasoned influencer or just starting your content creation journey, these tips will help you stay compliant and financially savvy.

How Content Creators Pay Taxes

Content creation isn’t just about producing engaging videos or writing captivating posts. It also involves understanding the financial aspects of your work, especially taxes. Let’s break down the key components of taxes for content creators.

Income Types for Content Creators

Content creators earn money from various sources. These include:

- Ad revenue from platforms like YouTube

- Sponsorship deals

- Affiliate marketing commissions

- Merchandise sales

- Direct donations from fans

Each of these income streams is taxable, regardless of whether you receive a 1099 form or not. The IRS requires you to report all income if you earn $400 or more from self-employment.

The Basics of Self-Employment Tax

As a content creator, the IRS considers you self-employed. This status means you’re responsible for both the employer and employee portions of Social Security and Medicare taxes. As a self-employed content creator, you’re responsible for paying both the employer and employee portions of Social Security and Medicare taxes. However, you can deduct half of this tax on your income tax return, which helps offset the cost.

Estimated Tax Payments

Unlike traditional employees who have taxes withheld from each paycheck, self-employed content creators must make estimated tax payments throughout the year. By April 15, 2025, you need to make your first estimated quarterly tax payment for 2025 (covering income earned from January 1 – March 31, 2025). The amount you need to pay depends on your income, deductions, and credits.

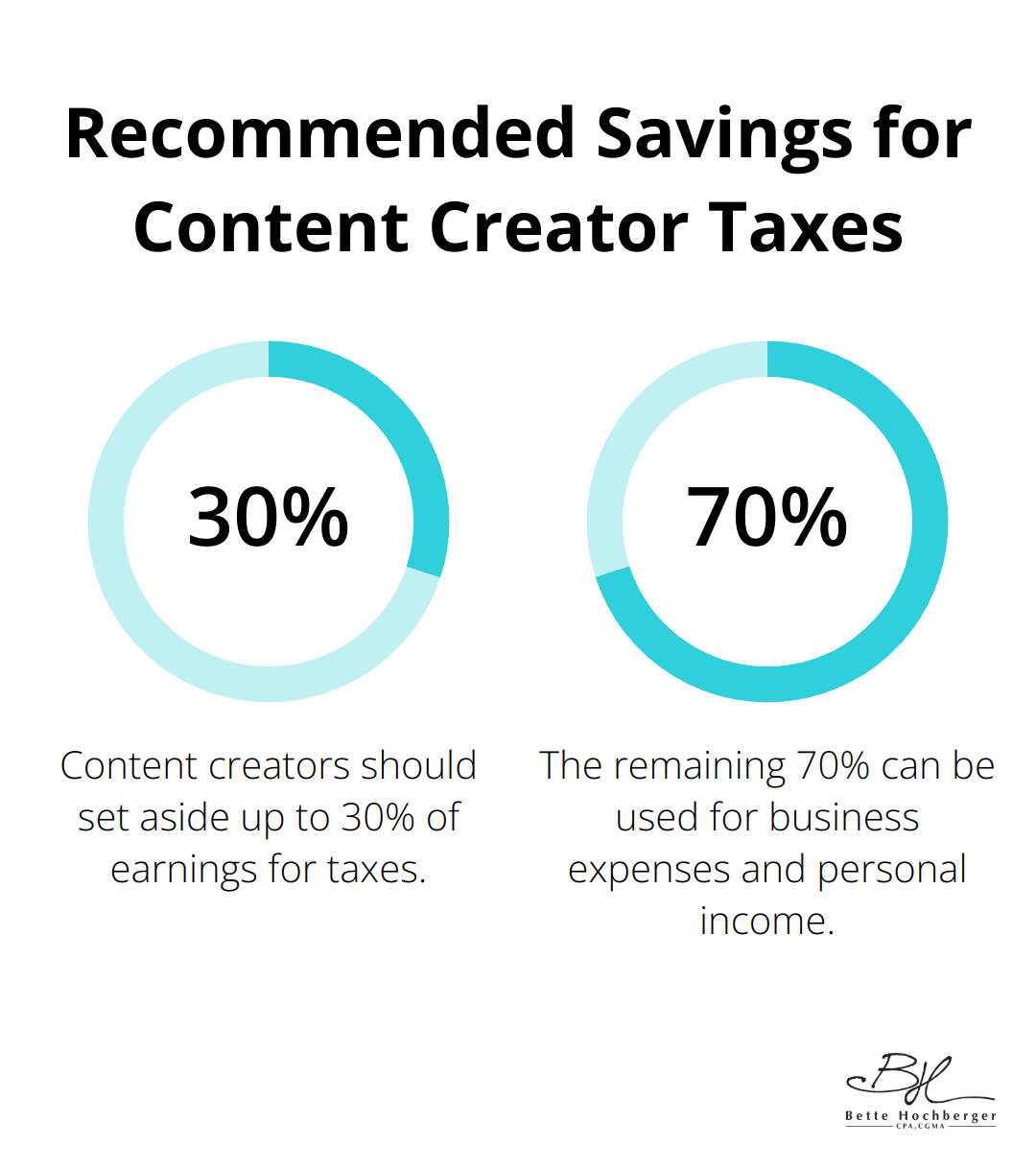

To avoid penalties, try to pay at least 90% of your current year’s tax liability or 100% of the previous year’s tax liability (whichever is lower). Many content creators find it helpful to set aside 25-30% of their earnings in a separate account for taxes. This practice can prevent financial stress when tax time arrives.

Tracking Income and Expenses

Accurate record-keeping is essential for content creators. Use accounting software or spreadsheets to track all income and expenses related to your content creation business. This includes everything from equipment purchases to travel costs for content-related events. Good records not only simplify tax filing but also help you identify potential deductions that can lower your tax bill.

As we move forward, let’s explore the various deductions and expenses that content creators can leverage to minimize their tax burden and maximize their profits.

How Content Creators Can Maximize Tax Deductions

Content creators have numerous opportunities to reduce their tax burden through strategic deductions. Let’s explore some key areas where content creators can find significant tax savings.

Home Office Deductions

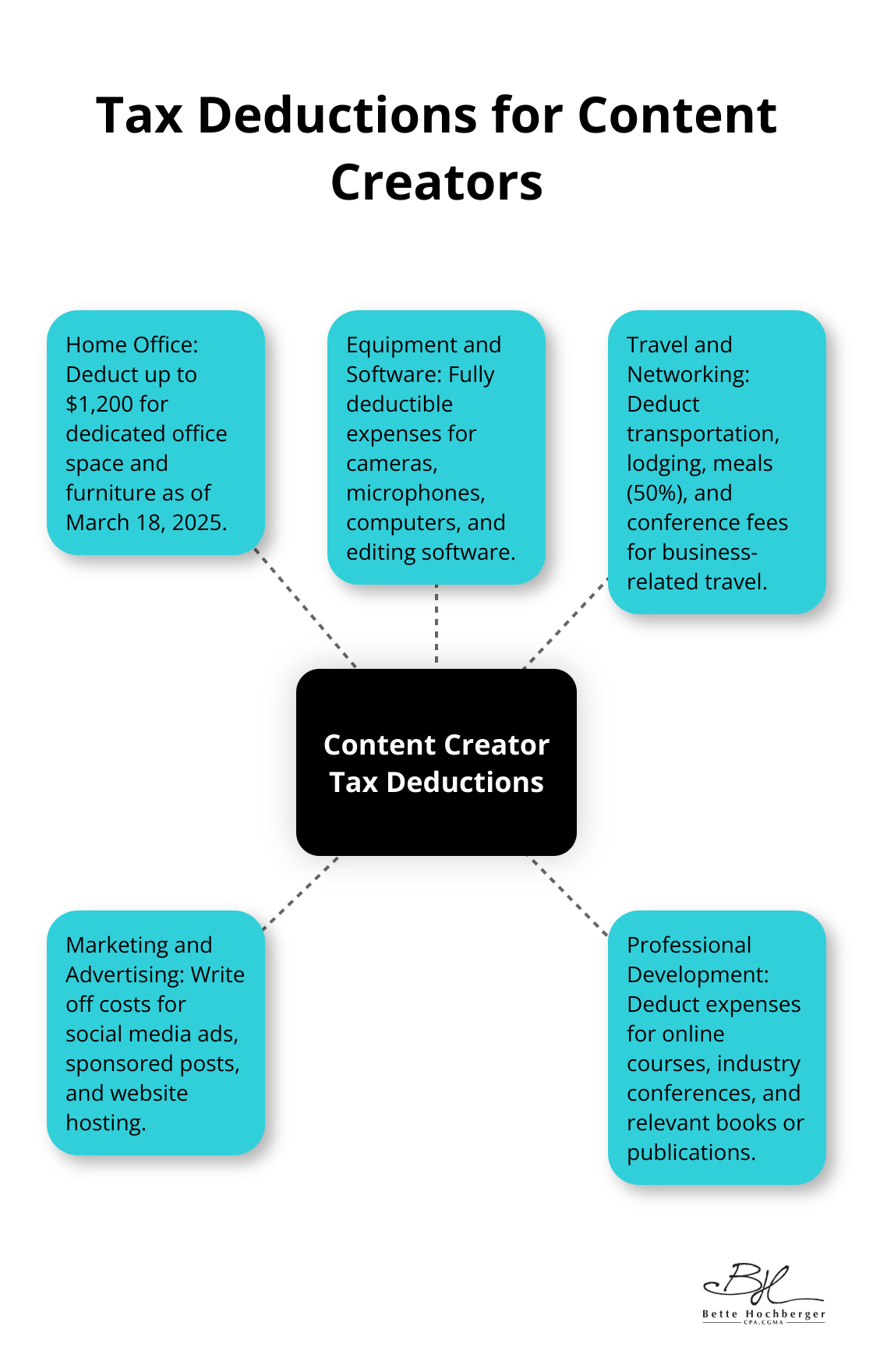

If you use a portion of your home exclusively for content creation, you may qualify for a home office deduction. The IRS uses specific criteria to determine if your content creation is a business eligible for this deduction. As of March 18, 2025, content creators can deduct up to $1,200 for dedicated office space and furniture.

Equipment and Software Expenses

High-quality equipment and software are essential for content creators. The good news is that these expenses are often fully deductible. Cameras, microphones, lighting equipment, computers, and editing software are all potential write-offs. Keep in mind that if an item serves both personal and business purposes, you can only deduct the percentage used for business (e.g., a laptop used 80% for content creation and 20% for personal use).

Travel and Networking Costs

Content creation often involves travel for shoots, conferences, or networking events. These expenses can add up quickly, but they’re also potentially deductible. Transportation costs, lodging, meals (50% deductible), and conference fees can all be written off if they’re directly related to your content creation business. Detailed records and receipts for all business-related travel expenses are essential for proper documentation.

Marketing and Advertising Expenses

Promoting your content is vital for growth, and these expenses are generally tax-deductible. This includes costs for social media ads, sponsored posts, website hosting, and even business cards. Don’t overlook subscriptions to industry-related publications or services that help you create or distribute your content.

Professional Development

Investing in your skills as a content creator can also lead to tax deductions. Enrolling in courses, joining mastermind groups, and listening to audiobooks are some examples of how you can grow as a creator-all of which you can write off. This includes online courses, industry conferences, and relevant books or publications.

While these deductions can significantly reduce your tax liability, it’s important to understand the specific rules for each deduction. Accurate record-keeping is key to maximizing your deductions while staying compliant with tax laws. In the next section, we’ll discuss best practices for record-keeping and filing taxes as a content creator.

Mastering Financial Management for Content Creators

Content creators face unique challenges in managing their finances and taxes. Proper record-keeping and strategic financial planning are essential for success in this dynamic field. This chapter provides key tips to help you stay organized and compliant.

Separate Your Finances

Content creators must establish clear boundaries between personal and business finances. Separate your finances to protect your hard-earned money, unlock tax benefits, boost your credibility, and set the foundation for scalable success. Open a dedicated business bank account and credit card for all your content creation activities. This separation simplifies bookkeeping, makes tax preparation easier, and provides a clearer picture of your business’s financial health.

Track Every Dollar

Accurate income and expense tracking is vital for content creators. Use accounting software designed for freelancers and small businesses to record all financial transactions. Popular options include QuickBooks Self-Employed, Wave, and FreshBooks. These tools can automatically categorize expenses, generate financial reports, and even help with invoicing.

Set aside time each week to review and categorize your transactions. This regular habit will save you hours of stress when tax season arrives.

Choose the Right Business Structure

As your content creation business grows, you may need to consider formalizing your business structure. While many creators start as sole proprietors, transitioning to an LLC or S-Corporation can offer tax benefits and personal liability protection.

An S-Corporation allows you to pay yourself a reasonable salary and take the rest of your profits as distributions (potentially reducing your self-employment tax burden). However, this structure also comes with additional paperwork and compliance requirements.

Consult with a tax professional to determine the best structure for your specific situation. The right choice depends on factors like your income level, growth projections, and personal financial goals.

When to Seek Professional Help

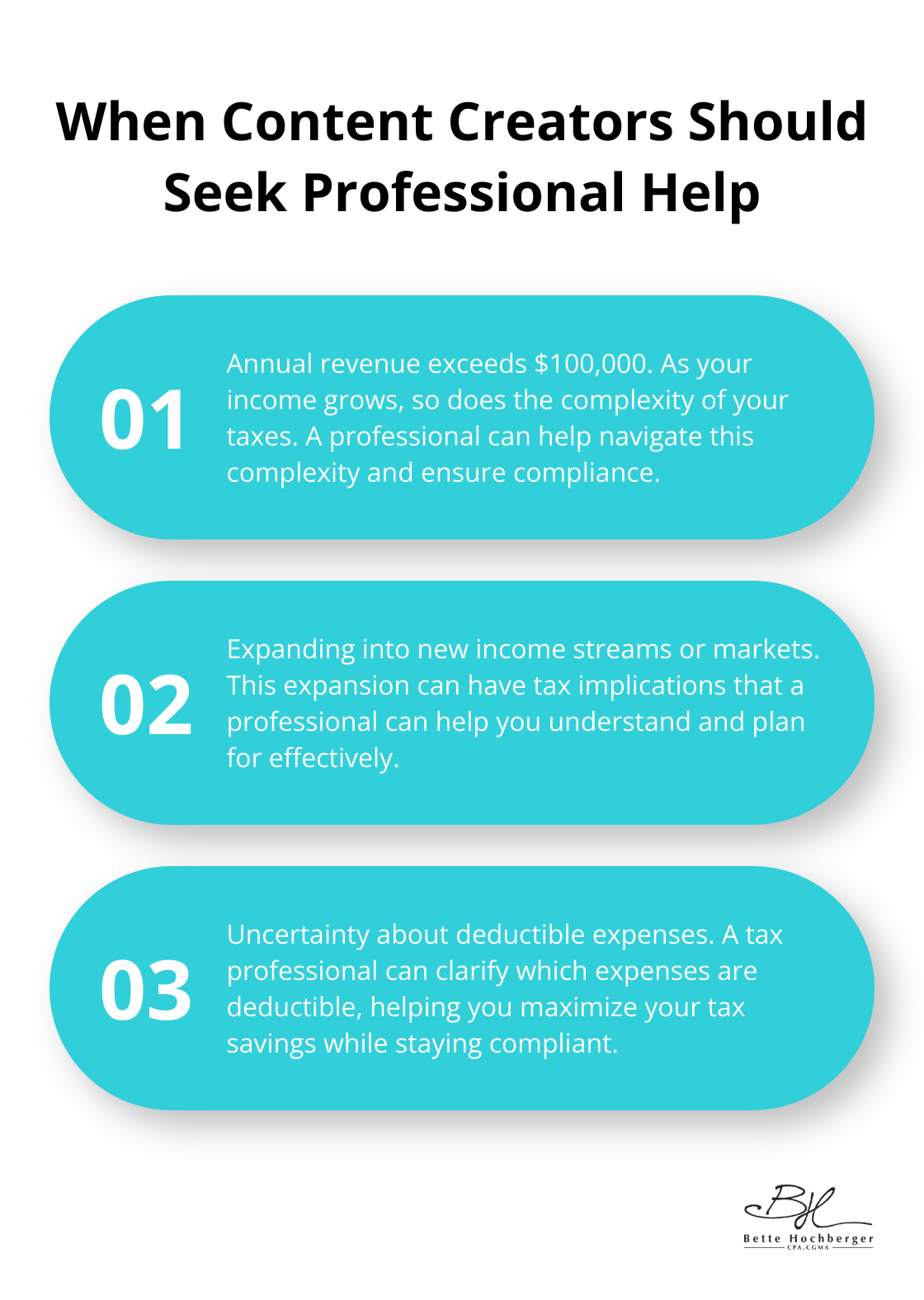

Many content creators start by managing their own finances, but there comes a point when professional help becomes invaluable. Consider hiring a tax professional or accountant if:

Your time as a content creator is best spent creating content and growing your audience. Outsourcing financial management to experts can free up your time and ensure you’re making the most of every tax-saving opportunity.

Final Thoughts

Taxes for content creators can be complex, but with the right knowledge and strategies, you can manage them effectively. We covered essential aspects of income reporting, self-employment taxes, and quarterly payments. We also explored valuable deductions that can reduce your tax burden, from home office expenses to equipment costs.

Proper financial management is key to success in the content creation world. You need to separate personal and business finances, maintain accurate records, and choose the right business structure. As your content creation business grows, professional help becomes increasingly valuable.

At our firm, we understand the unique challenges content creators face. Our team specializes in personalized financial services, including strategic tax planning and preparation (for content creators). We can help you minimize tax liabilities, manage cash flow, and ensure profitability.

I hope you learned something new today, and I’ll see you next time!